This week, Russ is enjoying some well-deserved time off, so I, Sam Colby, have the pleasure of stepping in as your guest writer to recap the week that was.

The stock market closed with mixed results on Thursday following a challenging week for the S&P 500. Earlier in the week, selloffs of major tech companies led to the S&P 500 experiencing its worst session in months, as disappointing earnings reports from market heavyweights Tesla and Alphabet failed to meet investor expectations. The Dow ended in positive territory, while the S&P 500 and the Nasdaq Composite struggled to rebound into the green after their earlier declines this week. Bond yields trended upwards, pushing the 10-year Canadian benchmark yield to 3.41% and prices down. In contrast, Bitcoin demonstrated impressive gains this week.

| Index | Close June 18th 2024 | Close July 25th, 2024

|

| S&P500 | 5,551 | 5,399 |

| TSX60 | 22,674 | 22,608 |

| Canada 10 yr. Bond Yield | 3.34% | 3.41% |

| US 10 yr. Treasury Yield | 4.22% | 4.247% |

| USD/CAD | $1.36330 | $1.3780 |

| Brent Crude | $87.41 | $82.43 |

| Gold | $2,416 | $2,351 |

| Bitcoin | $63,974.07 | $65,777 |

Source: Trading Economics & Factset

The market’s drop this week is largely attributed to concerns over the tech sector and the recent selloff of its shares, driven largely by disappointing returns on investments in artificial intelligence (AI). Despite substantial investments made by major tech companies, the expected returns have not yet materialized, leading investors to reassess the value and potential returns from these significant AI investments. The market sentiment towards tech earnings seems to support the article Russ shared last week from Goldman Sachs, which questioned whether the investment in AI was justified by the returns.

The Bank of Canada dropped overnight rates another 25 basis point. The rate cuts aim to address sluggish growth and stalled labor markets in Canada. Many predicted the rate cut as inflation was stable at 2.7%, but while inflation trends have been encouraging, some categories remain stubbornly elevated, such as housing, food, and energy. The cuts should provide some relief to borrowers. The Bank of Canada’s governor, Tiff Macklem, stated, “With the target in sight and more excess supply in the economy, the downside risks are taking on increased weight in our monetary policy deliberations.”

Meanwhile, in the US, Waller says the Fed is “getting closer to cutting rates, but they are not there quite yet.” Last week the European Central Bank also left their target rate unchanged, with their President Christine Lagarde stating, They will take their time to make sure stubborn inflation is firmly under control before lowering rates again.”

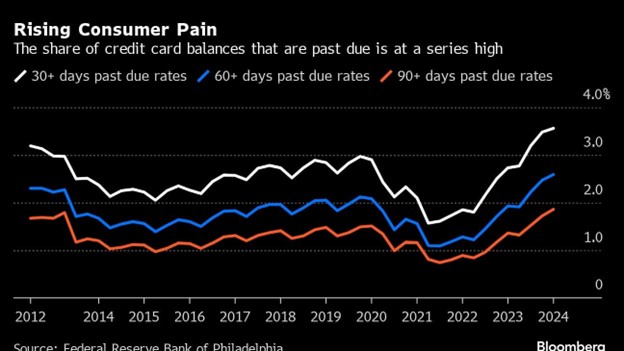

On Thursday, the U.S. GDP and initial jobless claims were released. The U.S. saw an expansion of GDP at a rate of 2.8% in the April to June period, a 1.4% increase from last year. Despite high interest rates, the American economy has been resilient, and the decreasing number of jobless claims has allowed consumers to keep spending. However, some are not as quick to rejoice, as household debt has climbed to its highest point since 2012.

The trend of increasing household debt indicates that many Americans have exhausted the excess savings accumulated during the pandemic and are now relying on debt to make purchases they may not be able to afford at current high interest rates. To support their spending, Americans are spending more of their paychecks, saving about 3.8% of their monthly income, well below the average 7%. As the Federal Reserve maintains elevated interest rates to curb inflation, consumers will bear the financial burden.

Graph courtesy of BNN Bloomberg

What has been described as the largest IT outage in history not only caused chaos last week with software glitches occurring worldwide, canceled flights, and hospital disruptions, but it has also cost companies billions globally. CrowdStrike Holdings Inc., the cybersecurity company at the center of these massive global IT outages, said that a bug in a safety mechanism allowed flawed data to go out to customers in a botched update, causing last week’s meltdown. Insurance analysts estimate that the botched update will cost Fortune 500 companies alone more than $5 billion in direct losses, with the healthcare and banking sectors being hit the hardest. This incident reveals the world’s overwhelming dependence on a key cybersecurity company and the risks associated with such concentration.

The big news that disrupted most Sunday brunches was Joe Biden’s announcement that he is withdrawing his bid for re-election and his endorsement of Kamala Harris as his successor. With the support of top Democrats like the Obamas, the Clintons, and Nancy Pelosi, to name a few, all signs are pointing to Kamala Harris being on the ticket for the 2024 presidential election. Kamala is gaining on Trump in polls and raised a record-breaking 100 million dollars in less than 48 hours. The question remains: what will the rest of the democratic ticket look like in November?

Staying on the topic of American politics, Trump has announced his vice president choice, J.D. Vance. The Ohio Senator is being flagged as a liability for the Republicans by many. While he may appeal to Trump’s existing base, his extreme conservative views, especially when it comes to women’s rights, pose a risk for Republicans that they could lose swing voters or independents, especially women.

If you’re still reading, thank you for letting me take over this week. If you are still craving some weekly insights from Russ, give NCP’s latest interview video series a listen. In this episode, Russ talks to Kevin Frankowski and Jordan Lehmann, from Ox + Plow Agriculture Inc., about farmland as a unique asset class.

The Olympics kicked off this week in Paris. Sprinter André De Grasse and weightlifter Maude Charron, both gold medalists at the Tokyo Olympics, led the Canadian athletes in the first-ever outdoor opening ceremonies in Paris, which took place on the Seine River. Rumors are swirling that Canada’s very own Celine Dion is set to make her comeback performance at the Olympic opening ceremonies since she took time off due to her illness, Stiff Person Syndrome. In the spirit of the Canadian athletes and Celine Dion, I will leave you with her 1996 performance at the opening ceremonies of the Atlanta Olympics.

Samantha Colby