A mixed week where US equities and crypto currencies hit new all-time highs before pulling back. The TSX sustained its momentum throughout the week hitting new highs again at Thursday’s close. 10yr. bond yields are rising again as inflation worries continue to percolate amongst bond traders. Gold has also come off its highs as higher interest rates will raise the cost of carry.

| Index | Close Nov. 8th 2024 | Close Nov. 14th 2024 |

| S&P500 | 5,995 | 5,947 |

| TSX60 | 24,759 | 25,050 |

| Canada 10 yr. Bond Yield | 3.18% | 3.31% |

| US 10 yr. Treasury Yield | 4.31% | 4.46% |

| USD/CAD | $1.39066 | $1.40348 |

| Brent Crude | $73.87 | $72.50 |

| Gold | $2,685 | $2,568 |

| Bitcoin | $76,482 | $87,256 |

Source: Trading Economics & Factset

Tired of hearing/reading about the US election and Donald Trump? Yeah, me too. Unfortunately, it is something we must deal with and factor into investment decisions. There is a wide range of opinions, from the cheering Trump fans, to some rather sanguine commentary from the investment world, to others that are lighting their hair on fire. We’ll continue to try and navigate it all focused on the empirical evidence before us rather than opinion and conjecture.

CPI (inflation) in the US ticked up a bit to 2.6% for October, meeting expectations. Core inflation also ticked up a bit to 3.3%, throwing some doubt on how aggressive the Fed will be in lowering rates. Shelter costs, which account for 1/3 of the index, are proving to be problematic.

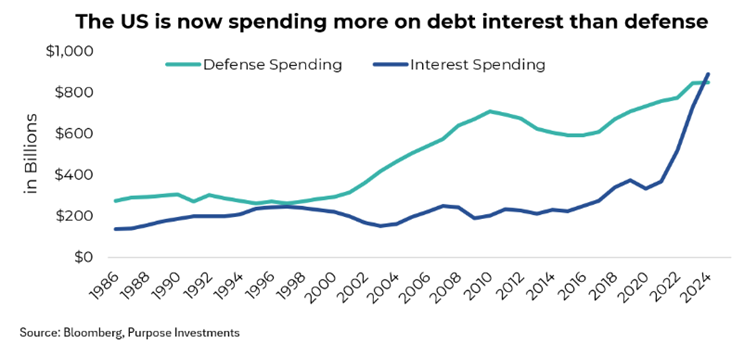

The amount the US pays in interest on its Federal debt now exceeds the amount spent on defence. With the deficit expected to increase under the Trump presidency, this will start to crowd out other government expenditures. We will have to wait and see if the new joint heads of the “Department of Government Efficiency” or DOGE (Elon Musk & Vivek Ramaswamy) will be able to materially reduce the cost of government.

Back home north of the 49th parallel, the Federal Government has moved to end the strikes & lockouts at the ports in BC and Montreal. Labour Minister Steve McKinnon ordered all sides back to the bargaining table for binding arbitration. The BC union has said it will challenge the ruling in court.

Overseas, Germany will be going to the polls early next year after the ruling coalition collapsed. The expected election date is February 23rd. In a sign of unusual political civility, Chancellor Olaf Scholz met with the Opposition Leader, Friederich Merz, to agree on a date to hold a (no)confidence vote and subsequent election date. The coalition’s collapse was triggered by withdrawal of the centrist FDP. The centre-right CDU currently leads in the polls.

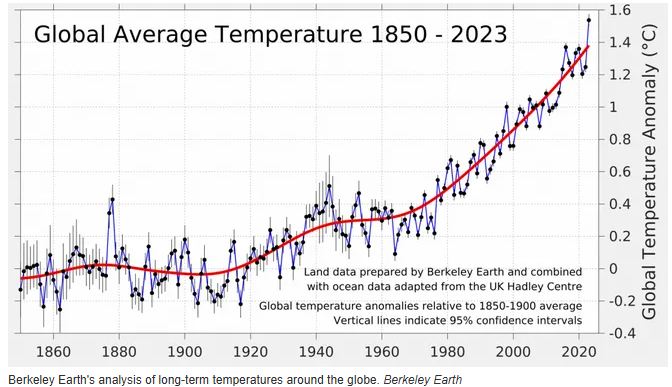

Climate action is struggling at the moment, and it is showing at the latest COP29 conference being held in Baku, Azerbaijan. Both France and Argentina have withdrawn their top negotiators. In reality, people, aka voters, have higher priorities right now than something most do not think will affect them. Many expect the Trump administration to withdraw from the Paris accord. The tragic reality is that global temperatures have been rising since the industrial revolution and the rise has been accelerating this century.

In related corporate news, Volkswagen is partnering with EV maker and Tesla rival Rivian. VW will invest $5.8 billion in a joint venture. This is a marriage of necessity. Rivian has been haemorrhaging cash while VW has struggled with coming to market with a winning EV. New cars are as much software platforms as they are self-propelled boxes on wheels. It is the software that VW has struggled with, and that Rivian excels at.

Did you know that we produce webcasts as well as publishing this weekly missive? You can find them on our Insights Channel here. Our two latest include one on manager selection (kind of like Moneyball) and a macro-economic discussion with economist Chantelle Schieven. If there are any topics you would be interested in let us know.

November is here, and the snowbirds are taking flight to warmer climes. As they pass through the deserts on their way south, they will rest at the modern-day equivalent of a caravanserai. So with that in mind (yes, it’s a bit of a stretch), I’ll leave you with this piece from Loreena McKennit….. enjoy

Russ Lazaruk, RIAC, CIWM, CIM, FCSI

Managing Director & Portfolio Manager

![]()