It was a quiet week on the markets with closures in Canada on Monday and Thursday in the US to celebrate our respective national holidays. Equity markets put in a positive week while the bond market saw a slight rise in rates. The loser for the past few weeks has been Bitcoin. It has been negatively corelated to the traditional asset classes for most of the past year.

| Index | Close June 27th 2024 | Close July 4th 2024 |

| S&P500 | 5,488 | 5,532 |

| TSX60 | 22,942 | 22,244 |

| Canada 10 yr. Bond Yield | 3.50% | 3.63% |

| US 10 yr. Treasury Yield | 4.29% | 4.36% |

| USD/CAD | $1.36945 | $1.36125 |

| Brent Crude | $86.28 | $87.41 |

| Gold | $2,328 | $2,351 |

| Bitcoin | $61,442 | $58,190

|

Source: Trading Economics & Factset

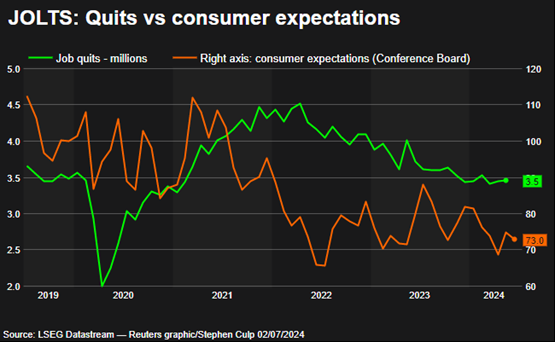

This weeks Jobs Openings & Labour Turnover Survey (JOLTS) from the US was a bit mixed but still trending towards a more normalized labour market. Job openings were up a bit with most of the demand coming from small and medium sized business. The propensity of people to quit or change jobs has been on a steady decline, which may be connected, at least in part, to falling consumer confidence. Correlation does not equal causation and there are other factors involved. Nevertheless, the chart below should give policy makers more reason to think about rate cuts.

Chart courtesy Reuters

While it has been a quiet week on the markets, it has been anything but in the world of politics. Here in Canada a recent by-election loss in a traditionally safe Liberal riding has sparked the first rumblings within the party for a new leader. It is a tough call as a party or leader. Do you hand over the reigns now and doom your successor to a probable defeat (a la Brian Mulroney to Kim Campbell)? Or do you go down to defeat then leave and allow the party to rebuild under a new leader with a fresh mandate?

In Canada, the question and debate are only (mildly) existential to the Liberal party. In the US though, a disastrous performance from Joe Biden in the recent debate with Donald Trump could be existential for the country. Now, late in the game, calls have come for Joe Biden to cede to fight to a younger candidate for the Democratic Party. My political-junkie wife refused to watch the debate (perhaps knowing the outcome) but I did. From what I saw, President Biden has aged a lot in the last year and needs to bow out gracefully now. Donald Trump spouted his usual line of BS and bluster.

Overseas, there were election in the UK where Labour trounced the governing Conservatives. The results were widely expected and end 14 years of Tory government. British “political commentator” Jonathan Pie summed up why the electorate decided it was time for a change. In France, Emmanuel Macron had rolled the dice and called a snap parliamentary election for that country with the first round of voting already done. In the French system, there are 2 rounds of voting with a final ballot coming on Monday. Marine Le Pen’s hard right National Rally is leading in the first round of voting but not expected to garner a majority of the seats in the second round. This is a parliamentary election only and Macron still has 2 years left in his term as President.

Staying political for a bit more, there were 2 decisions from the US Supreme Court this week that will be consequential. The first, and most widely reported on, is the ruling that a President has legal immunity for “official acts”. The ruling goes further saying evidence that pertains to an unofficial or private act cannot be introduced if it comes from official records. This has obvious implications for accountability and democratic norms.

The second ruling is also consequential but in a different way. The new ruling essentially overturns the “Chevron Doctrine” which had delegated the enforcement and interpretation of rules to Federal agencies and regulatory bodies. If you tend to being libertarian, you will see this as a roll back of government overreach. If you tend to the left of the political spectrum, you will see this as a license for corporations to do as they please with no accountability. I suspect, because the ruling moves the interpretation from the agencies back to the courts, that it will slow decision making as cases wend their way through the court system. Not a win for anyone right now.

There was good news this week on the Alzheimer’s front. Eli Lilly received FDA approval for its new drug Kinsula. Kinsula has proven effective at slowing the progression of the disease in the early stages by removing beta amyloid which is a direct cause of the disease. The drug is expensive at $32,000 for a year’s treatment. The advantage of this treatment is that early trials show treatment can be stopped once all the plaques have been removed.

It’s summer, so we will close with Bryan Adam’s memories of the summer of ’69…. enjoy

Russ Lazaruk, RIAC, CIWM, CIM, FCSI

Managing Director & Portfolio Manager

![]()