It was a generally positive week on the markets with both the TSX and S&P500 in positive territory. Yields have retreated a bit in Canada giving a lift to bond prices while yields on the US 10 yr. Treasury have remained essentially flat. Looking at the recent lower CPI (inflation) numbers and stronger retail sales, I’m left musing that we may be in a Goldilocks phase right now. I hope I didn’t just jinx that by saying it out loud. The best markets do climb a wall of worry though, and there is still plenty to worry about.

| Index | Close Oct. 10th 2024 | Close Oct. 17th 2024 |

| S&P500 | 5,785 | 5,851 |

| TSX60 | 24,302 | 24,690 |

| Canada 10 yr. Bond Yield | 3.25% | 3.18% |

| US 10 yr. Treasury Yield | 4.07% | 4.10% |

| USD/CAD | $1.37413 | $1.37993 |

| Brent Crude | $79.19 | $74.58 |

| Gold | $2,627 | $2,693 |

| Bitcoin | $60,162 | $67,370 |

Source: Trading Economics & Factset

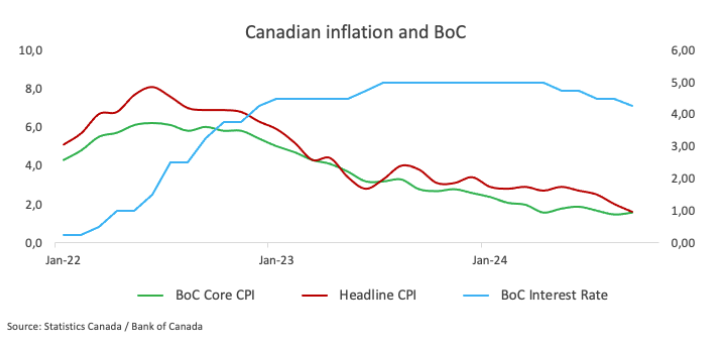

Inflation in Canada surprised to the downside for September with a mere 1.6% rise in the Consumer Price index. This beat expectations of 1.9% and well below August’s 2% number. (not to mention the 8.1% peak in June 2022). Core was also well below the Banks 2% target. This bodes well for more aggressive rate cuts in the coming months. The casualty in this is the Loonie which is weakening in the face of a widening spread between short-term interest rates between Canada and the US.

Chart Courtesy FXStreet

Inflation also fell in the UK and European Union to 1.7% in both cases. The European Central Bank dropped rates by 25bps in response to 3.25%. Unless we get an unexpected spike in prices (unlikely), Central Banks may be worrying about deflation in the next few months.

Retail sales in the US were surprisingly strong last month, rising 0.4%. The labour market was a bit mixed with initial unemployment claims falling by 19,000 but continuing claims rising by 9,000. There is a lot of noise in the employment numbers due to hurricanes and strikes. Overall, the employment picture in the US remains strong.

Talking of strikes, Boeing is working to raise up to $35 billion. The financing will be a combination of equity, debt, and bank financing. The company’s credit rating is currently 1 notch above junk. 33,000 Boeing’s workers started striking in September. This is on top of a myriad of quality control and safety issues they have had to deal with over the past 5 years. We’ll not be buyers of the debt nor the equity.

Big tech has an almost insatiable appetite for electricity. The move to “cloud” based computing and data centres was the real start. Since then, the AI frenzy has added almost exponential growth in demand. It is not just the power needed to run the servers. The data centers also need to be cooled. The big companies also have ambitious “net-zero” goals. While wind and solar are part of the mix, Amazon, Microsoft, Google, and Open AI are all inking contracts for nuclear power. Most of the deals are from small modular reactors (SMRs) but Microsoft has contracted with Constellation Energy to resurrect part of Three Mile Island.

More years ago, than I care to admit, my regiment was divided into 2 music camps. On one side were the Disco / Northern Soul fans. Standing firm on the other side were the fans (including me) of Hard Rock. This was the 1970s so it was Led Zepplin, the Stones, Ten Years After, and….., So with that bit of history, we’ll sign off with this live performance at Woodstock of “I’m Going Home” by Ten Years After. Now turn up the volume and blow off the roof 😉

Russ Lazaruk, RIAC, CIWM, CIM, FCSI

Managing Director & Portfolio Manager

![]()