It was a glorious week for equity investors as the markets reached new highs. Spurred on by the hopes of lower taxes and less regulation, investors piled in after the Trump victory. Bond markets and gold took the opposite stance, selling off sharply before recovering later in the week. The big winner was Bitcoin, which also reached new highs.

| Index | Close Oct. 31st 2024 | Close Nov. 8th 2024 |

| S&P500 | 5,705 | 5,979 |

| TSX60 | 24,157 | 24,846 |

| Canada 10 yr. Bond Yield | 3.25% | 3.24% |

| US 10 yr. Treasury Yield | 4.29% | 4.34% |

| USD/CAD | $1.39203 | $1.38623 |

| Brent Crude | $74.07 | $75.57 |

| Gold | $2,744 | $2,704 |

| Bitcoin | $70,235 | $75,796 |

Source: Trading Economics & Factset

Opinions on the President Elect are strongly held on both sides of the political spectrum. We’ll leave the political analysis and prognostications to others. What we need to deal with going forward is the reality of a second Trump Presidency and how the policies of the incoming administration will play out in the markets. There is no doubt that Wall Street liked a lot (but not all) of the policies touted by the Trump campaign, in particular lower taxes and fewer regulations. These two items accounted for most of the euphoria.

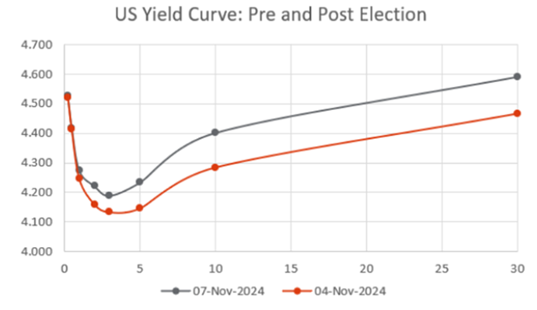

But there are dangers lurking in the policies. The most important one from an investing perspective is inflation. There is no clear plan on how to pay for the tax cuts other than an ever-growing deficit. The proposed tariffs will not close the gap. While not in full vigilante mode, the bond market is paying attention to the inflationary impact of tariffs and government borrowing. As the chart below shows, yields across the curve jumped indicating the nervousness of the bond market.

Chart Courtesy Richardson Wealth

While most were digesting the results of the US election, central banks were lowering rates. The US Federal Reserve shaved 25-bps off the overnight rate as expected. In the post meeting press conference, Jerome Powell was less than clear about future rate cuts. The Fed remains data dependent. When asked if he would resign if Trump asked told him to, he replied with an emphatic no. That’s as clear an answer as you will ever get from a central banker.

Not to be left out of the fun, The Bank of England also cut rates by 25-bps. The move was also widely expected. The Bank made it clear though that the rate of change would be cautious as the recent UK Budget could add inflationary pressures. The Budget increased the minimum wage, increased employer contributions to National Insurance, and increased Government borrowing. The Budget also included a sharp increase to the Capital Gains Tax rate.

It’s a small country with a population of only 3 million, but Moldova is strategically important, lying along Ukraine’s western border. Despite blatant election interference by Russia, the country re-elected its pro-western President Maia Sandu. Earlier, a referendum on pursuing membership in the European Union also passed. Again, despite heavy handed interference by Russia.

One labour dispute ends and another starts. Boeing’s ongoing labour dispute has come to an end with the union membership voting in favour of the latest contract offer. The 7-week strike won the workers a 38% pay increase over the next 4 years. Meanwhile, here on the west coast of Canada, employers locked out more than 700 foremen at the BC ports. The ports handle ~$800 million of goods every day and a lengthy dispute will have a major impact on goods flowing in both directions. Grain and cruise ship operations will not be affected though.

Last Monday I was in Vancouver attending a Family Office conference organized by DC Finance. The company does these conferences around the world, and they are very much focused on the ultra-wealthy. The presentations were interesting but like most conferences much of the value comes from the conversations you have with the other attendees during the breaks. The number one concern of the families in attendance? Will my kids be OK. Not so much different than you and I.

While not necessarily known as a foodie nation, Canada has had its fair share of culinary inventions. Some, I had no idea were invented here and other I just assumed had always been around. So, for your next trivia quiz here is a list of Canadian “inventions.

Monday is Remembrance Day. I am of the generation where my father, father-in-law, and all of my uncles served in WW2. My Dad, Hil’s Dad, and some of my uncles went on to have full careers in the military. With them and my own comrades-in-arms in mind we’ll close of with this balled from Terry Kelly. ( yes, that’s me in the picture)

Russ Lazaruk, RIAC, CIWM, CIM, FCSI

Managing Director & Portfolio Manager

![]()