Equity markets were basically flat for the week while the bond market experienced some volatility. Bond yields hit near term lows last Friday, with Canada 10 yr. bonds dipping below 3%. US CPI (inflation) and employment numbers pointed to sticky inflation which had traders bidding up yields as the week wore on. The market breadth in the US is narrowing a bit with the heavy lifting still being done by the technology giants.

| Index | Close Dec. 5th 2024 | Close Dec. 13th 2024 |

| S&P500 | 6,074 | 6,047 |

| TSX60 | 25,680 | 25,411 |

| Canada 10 yr. Bond Yield | 3.10% | 3.17% |

| US 10 yr. Treasury Yield | 4.18% | 4.34% |

| USD/CAD | $1.40235 | $1.42065 |

| Brent Crude | $72.18 | $73.50 |

| Gold | $2,632 | $2,680 |

| Bitcoin | $99,215 | $99,952 |

Source: Trading Economics & Factset

Canadian borrowers got some more relief this week with a 50-bps cut in the Bank of Canada interest rate. The rate cut is a bit of a good news / bad news story. It shows the Bank has confidence that inflation is being contained around the 2% level. On the other hand, it also points to a sluggish economy, which is one of the reasons inflation has fallen. The rate cut has also undercut the Loonie. Good for exporters, not so good for snowbirds.

Joining the rate cut gang were both the European Central Bank (ECB) which cut by 25-bps and the Swiss National Bank (SNB) which cut by 50-bps. In both cases the story was similar to Canada’s, a sluggish economy and disinflation. Again, like the Loonie, both the Euro and Swiss Franc took a hit after the cuts.

Offsetting Europe and Canada has been the economic performance in the US. November’s employment report saw 227,000 new jobs added. The unemployment rate did tick up to 4.2% from 4.1% though as new workers entered the labour market. Along with this comes fears that inflation may not come down to the Fed’s 2% target. The latest CPI number was 2.7% (core 3.3). While meeting expectations, it doesn’t show any signs of falling to where the Fed wants it. On Thursday morning the Producer Price Index (PPI) was released and came in above expectations at 3%. The highest since February 2023. Markets are still pricing in a 25-bps rate cut by the Fed next week, but expectations are growing that the Fed will not be as aggressive in cutting rates next year.

Canadian business news has been (rightfully) obsessed with the potential tariffs and trade war with the US after January 20th. The Trump public rationale for the tariffs focus on fentanyl and illegal migration into the US from Canada (and Mexico). The reality is that those issues at the US/Canada border are almost insignificant compared to the southern border. The Federal Government has already pledged to spend a billion dollars to enhance security at the border.

But pundits are starting to believe that the tariffs are seen as a way to offset tax cuts and an out-of-control deficit in the US. This becomes a completely different problem. Which may explain Ontario Premier Doug Ford’s tough talk about cutting off energy (electricity and oil/gas) to the US if the tariffs are enacted. Of course it isn’t as simple as that. Electricity flows both ways across the border depending on fluctuating generation capacity. BC is an exporter most years but was a net importer in 2023 due to low water levels at the dams. Werner Antweiler does a good job of dissecting the flows and trends here.

Alphabet (Google) announced a major breakthrough in quantum computing this week. The company announced that its Willow quantum chip had solved a problem in 5 minutes that would have taken the world’s fastest supercomputer ten septillion years to complete. This is still early days, and any practical or commercial application is still at least a decade away. Wikipedia gives an explanation of quantum computing here. Spoiler alert – it’s like Schrödinger’s cat.

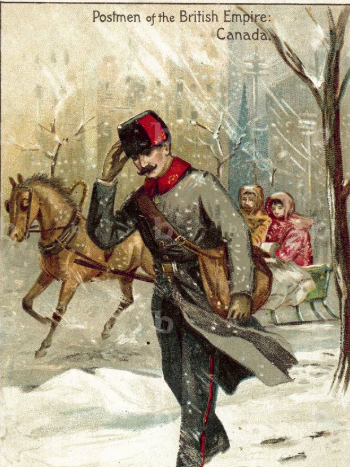

With the postal strike now into its 4th week we’ll close off with this piece from the Marvelettes… have a great weekend

Russ Lazaruk, RIAC, CIWM, CIM, FCSI

Managing Director & Portfolio Manager

![]()