We are back after our Christmas Holiday hiatus. Our Christmas was quiet with lots of family time. The rest of the world seemed to be filled with angst, thanks to DJT and his various hangers on. Equity markets eked out a small gain since we last wrote but it has not been without volatility. Bond markets have been just ugly with 10 yr. yields rising sharply around the world. But before we all light our hair on fire over the headlines, remember the market has a very narrow focus with earnings, inflation, and interest rates topping the list. The rest is noise.

| Index | Close Dec. 19th 2024 | Close Jan. 9th 2025 |

| S&P500 | 5,869 | 5,919 |

| TSX60 | 24,414 | 25,088 |

| Canada 10 yr. Bond Yield | 3.37% | 3.37% |

| US 10 yr. Treasury Yield | 4.57% | 4.69% |

| USD/CAD | $1.43894 | $1.43773 |

| Brent Crude | $72.58 | $77.20 |

| Gold | $2,597 | $2,669 |

| Bitcoin | $96,492 | $91,832 |

Source: Trading Economics & Factset

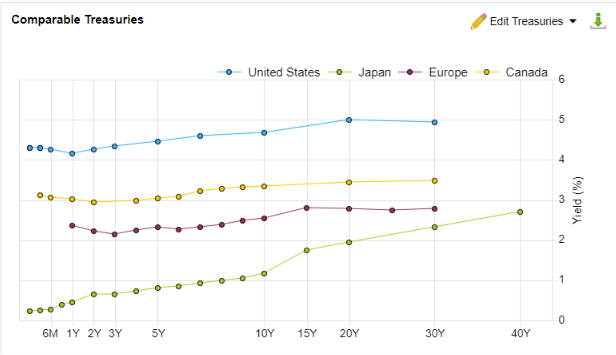

We’ll start with a quick look at inflation and interest rates. Inflation in the US is still above the Federal Reserves 2% target at 2.7% (November). Canada’s November reading was 1.9%. That goes a long way in explain the difference in US & Canadian interest rates. It also explains a large part of the strength in the US dollar vs. the rest of the world. The chart below shows the spread in rates between the US, Canada, Europe, & Japan.

Chart Courtesy: Factset

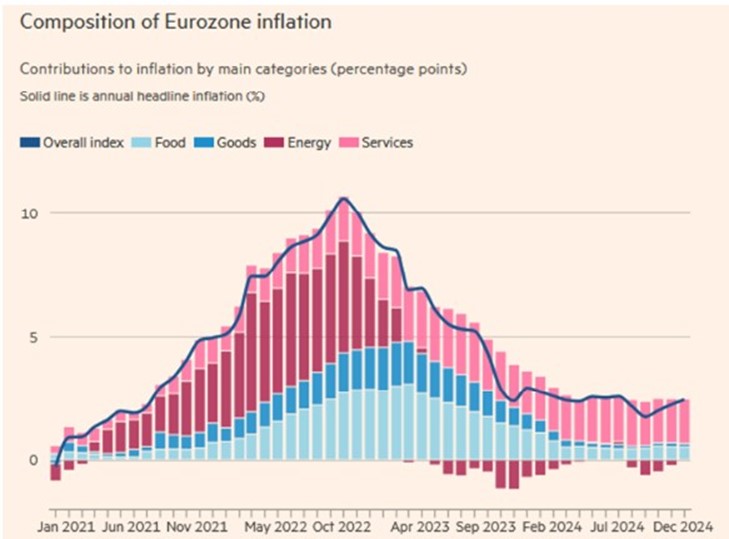

Inflation in the Eurozone ticked up to 2.4% in December (2.2% in November). The rise was uneven across the 19 member countries ranging from lows of 1% in Ireland to 4.5% in Croatia. Services were the biggest contributor with a 4% rise. Note that energy has been deflationary for the past few months. Markets still expect cuts from the central bank (ECB) with another 25-bps cut expected this month.

Chart Courtesy of Financial Times

The relatively new Labour government in the UK is facing pressure from the Bond Vigilantes. The 30 yr. gilt (bond) yield reached 5.35% on Wednesday surpassing the previous high in August of 1998. The increase in borrowing costs is putting pressure on the national budget as debt servicing ratios climb past the 7% of total spending that had been forecast. Shades of George Soros and the Bank of England in 1992.

The big news in Canada has been the announcement that PM Justin Trudeau will resign once the Liberal Party has chosen a new leader. At the same time parliament was prorogued. We’ll leave the politics aside but look at some of the near-term ramifications. Prorogation kills any bills still on the order table in Parliament. This includes the increase in the capital gains inclusion rate. But, and it’s an important but, CRA will continue to collect and/or assess based on the legislation that was before the house before prorogation. Government will continue to function as normal with the executive council (Prime Minister and cabinet) still maintaining their full range of authority and responsibilities.

If you missed topping up your charitable donations last year, you still have a chance to do it now and claim the tax credits for 2024. The CRA has extended the giving deadline to the end of February thanks to the postal strike. If you are over 71 and can no longer contribute to an RRSP, charitable giving can give some tax relief while doing some good in the world.

The world lost a great humanitarian at the end of December. Jimmy Carter, the 39th President of the United States passed away at the age of 100. One of his many accomplishments was in Canada. As a young US Naval Officer and engineer, he was sent to assist in the shutdown of the Chalk River reactor which had suffered a partial meltdown. During the operation he was lowered into the reactor to help with the disassembly. Through his work with Habitat for Humanity he helped build thousands of homes. His Carter Center has worked to eliminate the parasitic guinea worm which causes dracunculiasis. The number of cases dropped from 3.5 million per year in the mid-1980s to 25 in 2023.

We may not get classic Canadian winters here on Vancouver Island, but they can be worth celebrating. Whether it is those clear crisp prairie days, or the Quebec Winter Carnival, it does have a special beauty. On that note, I’ll leave you with this 1941 piece from Peggy Lee and the Benny Goodman Orchestra….. enjoy!

Russ Lazaruk, RIAC, CIWM, CIM, FCSI

Managing Director & Portfolio Manager

![]()