It’s been a mildly positive week on most markets. The lone exception was the bond market which saw yields rise slightly (prices down). The Loonie has shown some strength in this month but could face some headwinds if the US pauses its interest rate cuts. Meanwhile gold has retained its lustre, trading at all time highs as investors seek a safe haven.

| Index | Close Feb. 6th 2025 | Close Feb. 13th 2025 |

| S&P500 | 6,075 | 6,116 |

| TSX60 | 25,522 | 25,699 |

| Canada 10 yr. Bond Yield | 2.98% | 3.14% |

| US 10 yr. Treasury Yield | 4.44% | 4.54% |

| USD/CAD | $1.43175 | $1.41925 |

| Brent Crude | $74.25 | $75.23 |

| Gold | $2,856 | $2,929 |

| Bitcoin | $96,798 | $96,461 |

Source: Trading Economics & Factset

US inflation was on the rise in January with both the Consumer Price Index (CPI) and Producer Price Index (PPI) coming in higher than expected. Both headline and core CPI numbers were up which means the US Federal Reserve will hold off on interest rate cuts for now. Jerome Powell made the same observation in his testimony to the Senate Banking Committee this week. Powell, wisely, did not allow himself to be dragged into a debate on tariffs or the closure of the Consumer Financial Protection Bureau. He left those fights to the politicians.

Inflation and economic activity are also affected by sentiment. US Inflation expectations are fairly stable for now with 3% being the median for 1, 3, and 5 years. This is pretty much in line with January’s 3% headline CPI rate. Canadian inflation expectations have been dropping (along with inflation) for a year. Overall consumer sentiment in Canada has been improving since the end of 2023.

Canada added 76,000 jobs in January beating expectations. The unemployment rate ticked down to 6.6% from a November high of 6.9%. The manufacturing sector added the most jobs (33,000) with most of those in Ontario. All the job gains were in the private sector as the public sector shed 8,400 jobs last month. In the US job creation fell short of expectations with 143,000 new jobs vs. expectations of 170,000. These gains are in jeopardy if a full-blown tariff/trade war breaks out.

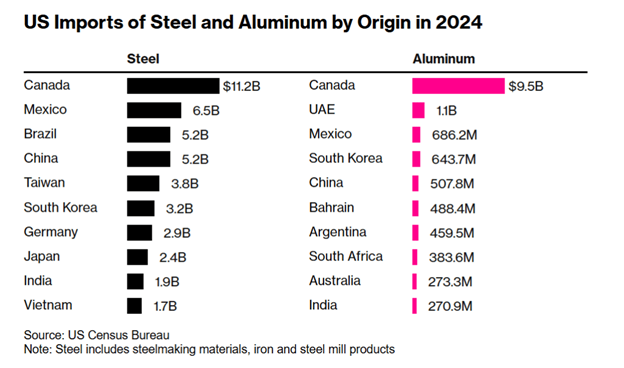

And speaking of tariffs…. Donald Trump has announced a 25% tariff on all steel and aluminum imports. The affects every country, not just Canada. The irony is the US does not have the industrial capacity to replace the imports, so prices will rise by 25% for American importers/consumers. In the case of aluminum, the US does not have the electricity generation capacity to expand domestic production if they wanted to.

In response to the recent tariff announcement, Ford Motors CEO, Jim Farley, has warned Congress that the tariffs will blow a hole in the US auto industry. The cross-border trade in the metals and auto parts supports more than 17 million jobs (US, Canada & Mexico). The Brookings Institute estimates that the 25% tariff will eliminate 177,000 jobs in the US alone. Canada is the largest exporter of steel and aluminum to the US so is at most risk, but the costs will also be borne by US manufacturers.

Gold has been on a tear for the past 2+ years. The move plus the threat of tariffs on the precious metal have created a dislocation in the market. Dealers are rushing to ship bullion from their vaults in London (the world’s largest trading centre) to New York as investors demand more of the metal to hedge their portfolios and get ahead of any potential tariffs. The price difference is usually around $2 and recently spiked to $50, creating an interesting arbitrage opportunity.

In corporate news, Elon Musk offered to buy Open AI for $97 billion. The offer was immediately rejected by Open AI founder Sam Altman. At the same time Musk is suing OpenAI over its plans to change from a non-profit to a for-profit entity. Here in Canada, TD bank is selling its stake in US discount broker Schwab for $20 billion. TD will use $8 billion for share buybacks and re-invest the remainder in its Canadian operations.

There has been no shortage of news and noise for the past few months, and we expect it to continue for the next 4 years. We will work hard to filter out the noise and concentrate on what matters, providing the best financial planning and investment management services we can by providing solutions tailored to your goals. Not the whims of the market or social media.

It is Valentines Day, so we will close off with this love song from Canada’s immortal bard, Stan Rogers, to his wife… enjoy

Russ Lazaruk, RIAC, CIWM, CIM, FCSI

Managing Director & Portfolio Manager

![]()