It was another wild ride on the equity markets, driven by the stream of consciousness coming from the Whitehouse. Despite that, we have finished the week in positive territory. Gold hit a new all-time high earlier in the week before pulling back a bit. Bonds yields are up marginally in Canada and down 2bps in the US. Bitcoin showed some spark climbing back over $90K again.

| Index | Close Apr. 17th 2025 | Close Apr. 25th 2025 |

| S&P500 | 5,295 | 5,496 |

| TSX60 | 24,193 | 24,728 |

| Canada 10 yr. Bond Yield | 3.14% | 3.21% |

| US 10 yr. Treasury Yield | 4.33% | 4.31% |

| USD/CAD | $1.38399 | $1.38548 |

| Brent Crude | $67.67 | $66.45 |

| Gold | $3,319 | $3,340 |

| Bitcoin | $84,960 | $93,567 |

Source: Trading Economics & Factset

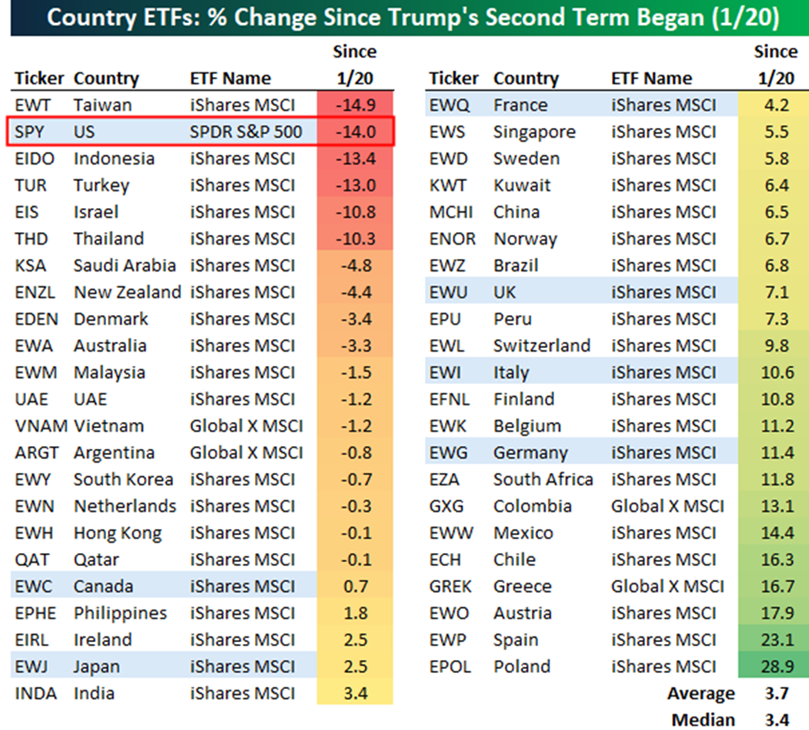

One of the primary tenants of investing and risk management is to diversify your bets. The table below shows the performance of various country specific equity ETFs. It is why we build portfolios with exposure to global, not just Canadian or US equities. It is also a reminder that past performance does not foretell future returns.

To be honest, I would like to write this weekly piece without having to mention or think about Donald Trump, but that is well nigh impossible. In the past week he mused (tweeted) about firing Federal Reserve Chair Jerome Powell. The markets swooned and bond yields spiked. It was only after he walked back those comments that we saw a recovery. The markets take Central Bank independence seriously. Any attempt to undermine that will have serious repercussions for a country’s currency and capital markets.

The turmoil and uncertainty have not been kind to the US dollar. Like S&P500 post the Trump inauguration, the green back has seen a steady decline. This has both good and bad implications for the US economy. On one hand it makes US exports more competitive. On the other hand, it makes imports more expensive (on top of tariffs) which is inflationary. More damaging is that it can raise the cost of capital. The chart below is interesting. It shows the markets positive expectations after the election that were dashed post-inauguration. Buy on mystery, sell on history.

It seems the adult in the room right now is Treasury Secretary Scott Bessent. It was he that got Trump to walk back his comments about Jerome Powell (markets quickly recovered immediately after). Then, he lowered the temperature on tariffs. Again, the markets reacted positively. His calm and professional approach is not universally liked though as he and Elon Musk have butted heads on more than one occasion. Maybe not a bad thing.

Elon’s days as the head of DOGE may be numbered. Musk has said he will step back from his DOGE role next month to pull Tesla out of the ditch. The car company’s sales have plummeted. While some would put the blame on his controversial role with DOGE, the real issue is increasing competition that is leap-frogging Tesla’s technology.

The 51st state has risen its ugly head again. According to White House press Secretary Karoline Leavitt, Donald Trump has not changed his mind on this issue, even if he has been rather quiet about it since the start of our election.

A lot of that competition Tesla is facing is in/from China. BYD has been leading the way in China where “new energy vehicles” (NEV) have garnered over 50% market share. NEVs include hybrids and battery electric vehicles (BEVs).

Google (Alphabet) has been branded a monopolist by a US federal judge for the second time in a year over its advertising business. No penalties have been imposed yet, but they could include the forced sale of certain business lines or technologies. The company will appeal. So far their defense seems to be – “Sorry, but we can’t help being the best there is”. Or something like that.

There was a half-marathon in Beijing last weekend with 12,000 human runners and 20 humanoid robots. The good news is that the robots finished last. The first robot crossed the finish line in 2 hr. 40 min. This compares to the human world record of 56:42 minutes. Nonetheless, it was a technological feat to have them complete the winding 21 KM course.

Pope Francis passed away this week from a stroke. Known as a fighter for the poor and downtrodden, he was respected around the world for his piety and social conscience. We’ll leave you with Mozart’s Requiem as a final tribute…. Have a great weekend

Russ Lazaruk, RIAC, CIWM, CIM, FCSI

Managing Director & Portfolio Manager

![]()