We’re back after a 2-week hiatus. Between conferences (me) and holidays (Sam) it has been a busy 2 weeks. Turning to the markets it was a relatively positive week with equity markets & Bitcoin up and bond markets essentially flat. Oil is also on an upswing thanks to increasing worries over Iran and a weakening US dollar.

| Index | Close June 5th 2025 | Close June 12th 2025 |

| S&P500 | 5,939 | 6,039 |

| TSX60 | 26,342 | 26,616 |

| Canada 10 yr. Bond Yield | 3.25% | 3.33% |

| US 10 yr. Treasury Yield | 4.39% | 4.37% |

| USD/CAD | $1.36752 | $1.36054 |

| Brent Crude | $65.34 | $70.20 |

| Gold | $3,353 | $3,386 |

| Bitcoin | $101,554 | $105,872 |

Source: Trading Economics & Factset

We’ll kick-off as usual with a look at interest rates and in this case the non-move by the Bank of Canada. In their press release the Bank referenced tariff uncertainty, some weakness in the labour market, but core inflation that was bit higher after stripping out the effects of the carbon tax cancellation.

In the US, consumer inflation rose marginally in May to 2.4%. Although the rise was lower than expectations (2.5%) it is still above the Federal Reserve’s target. Producer Price Inflation (PPI) rose 2.6%, which was in line with expectations. The Federal Reserve is expected to hold rates steady at their meeting next week in light of these reports. What is noticeable is that the effects of tariffs have not worked their way through the system yet.

Oil has moved up this week on fears that Israel will launch an attack on Iran’s nuclear facilities. According to reports, Israel does not have the support of the US administration for any attack. The US is currently in negotiations with Iran to prevent any further enrichment of uranium by Iran. The yet to be agreed upon deal would be similar to the treaty Donald Trump abrogated in his first term.

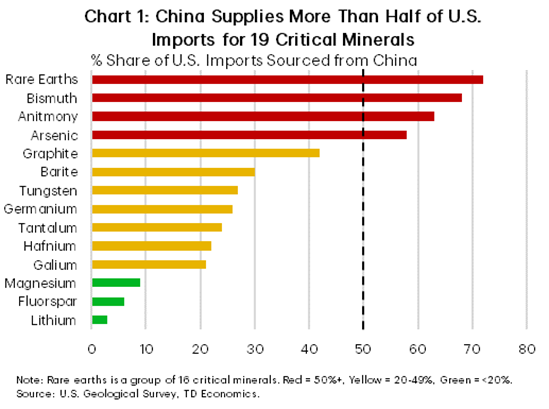

After their tariff tiff, Donald Trump and Xi Jinping thought it might be a bit smarter to sit down and negotiate. Word is out that there is the framework of a deal between the world’s 2 largest economies. Both sides were motivated to bring the temperature down. China by an economy that is built on exports and a weak domestic economy. The US by the fact China has a stranglehold on critical metals. It is the latter point that has put the US in a position of relative weakness. The minerals are used in everything from the auto sector to the defence industry.

Source: TD Economics / US Geological Survey

Critical minerals and rare earths were a topic of conversation at the Responsible Investment Association’s conference last week. Many of them are needed for the energy transition and Canada is seen as an untapped resource. Support for the development of the deposits came not just from the institutional investment crowd but the First Nation’s leaders in attendance as well. For many of the remote First Nations, the development, if done responsibly, is seen as a pathway to prosperity. Not just in terms of jobs, but as co-owners of the projects as well.

Another take away from the conference is that responsible investing and ESG are not dead. They are just being quiet. Investment managers are still pressing corporations on their ESG practices and corporations are still quietly implementing many of the policies as they just make good business sense. We’ve gone from green washing to green hushing.

The G7 summit starts in Kananaskis next week. Canada has played host to the summit 7 times, the last in 2018 in Charlevoix. In addition to the leaders of the G7 countries, there will be a plethora of other world leaders in attendance this year including Volodymyr Zelenskyy (Ukraine), Ursula von der Leyen (EU), Claudia Sheinbaum (Mexico), and Narendra Modi (India). Expectations of any breakthroughs are muted, and observers will be focused on the various leaders’ interactions with Donald Trump.

Buried in Donald Trump’s “Big Beautiful Tax Bill” is a measure that really makes no sense. Section 899 and the potential activation of Section 891 of the Internal Revenue Code will act as a disincentive to foreign investors in allocating to US investments. The proposal would add a cumulative 5% tax every year for 4 years on interest, dividends, or business profits earned by foreign investors. This is in addition to current withholding rates and may not be eligible for an offsetting deduction against your Canadian taxes as it will fall outside existing tax treaties. At the end of 4 years the potential tax on US investment income could be as high as 50% for non-US persons.

This week we lost another icon of the Rock & Roll era, Brian Wilson of the Beach Boys. With summer almost here we’ll close with memories of sun, sea, and sand, after all, life should be a beach… enjoy

Russ Lazaruk, RIAC, CIWM, CIM, FCSI

Managing Director & Portfolio Manager

![]()