Markets were quiet this week. Equity markets advanced slightly, the Canada 10 yr. bond was unchanged, and the US 10 yr. Treasury yield dropped by 6bps. Market volatility has dropped precipitously since “Liquidation Day” in April. The VIX, which is a measure of volatility, has dropped from a high of 52.33 on April 8th to 15.39 at the close on Thursday. Summer doldrums indeed.

| Index | Close July 19th 2025 | Close July 24th 2025 |

| S&P500 | 6,306 | 6,379 |

| TSX60 | 27,387 | 27,411 |

| Canada 10 yr. Bond Yield | 3.57% | 3.57% |

| US 10 yr. Treasury Yield | 4.46% | 4.40% |

| USD/CAD | $1.37466 | $1.36329 |

| Brent Crude | $69.84 | $69.29 |

| Gold | $3,343 | $3,369 |

| Bitcoin | $119,840 | $118,878 |

Source: Trading Economics & Factset

It has been relatively quiet on the central bank front. The European Central Bank (ECB) chose to leave rates unchanged this week. Other major central banks are also expected to hold rates steady for now. The only item of interest was Donald Trump’s tour of the Federal Reserve’s renovation project which is over-budget. Trump did manage some digs on interest rates in but got fact-checked on the cost over-runs.

Canadian retail sales for June were better than expected, rising 1.6% over the prior month. It was still a slow quarter for retailers as Canadian Consumers continue their path of caution. The underlying numbers were decidedly mixed with auto sales suffering the most.

The Prime Minister and Premiers met for 3 days this week in Ontario’s cottage country. The closed-door talks ranged from bail reform, to pipelines, to tariffs. All the First Ministers agreed that the August 1st deadline for US trade talks may not be met and that it was more important to get the best deal possible rather than meeting an artificial deadline.

There appears to be a bit more certainty emerging around tariffs. This week a deal was announced with Japan that set a 15% import tariff. To get the deal Japan promised to invest $550 billion in the US. What form that investment takes remains to be seen. Expectations are the European Union will get a similar deal.

North American car manufacturers were not happy with the Japan deal as the 15% tariff rate puts their North American operations at a disadvantage. Car makers are already feeling the pinch. Both GM and Stellantis (Chrysler/Fiat) had big drops in Q2 profits due to the tariffs. To date both companies have absorbed the higher costs, but at some point, they will be passed on to consumers.

Leaders of the European Union and China met in Beijing this week. While the gathering wasn’t a disaster, it wasn’t an overwhelming success either. The event, which was to mark 50 years of diplomatic ties was cut short. Tension over trade and China’s ongoing trade/support of Russia in its war against Ukraine remain. The area of agreement and co-operation was climate change.

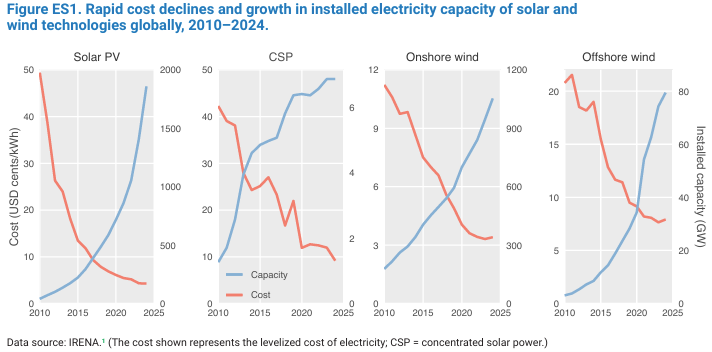

According to a recent U.N. report, renewable or green energy has passed a positive tipping point. The report found that 74% of the growth in electricity generated worldwide last year was from wind, solar, and other green sources. Meanwhile sales of electric vehicles have grown from 500,000 in 2015 to more than 17 million in 2024. Solar is now 41% and wind power 53% cheaper than the lowest cost fossil fuel. The charts below are not that different from any new technology as it reaches mass adaptation. You can access the entire report here.

We’ll close off the week with our own bit of solar energy, reminding us to Keep on the Sunny Side… Have a great summer weekend,

Russ Lazaruk, RIAC, CIWM, CIM, FCSI

Managing Director & Portfolio Manager

![]()