A relatively quiet week on the markets with the equity markets essentially flat and a slight drop in bond yields (prices higher). Gold has pulled back below $3,300 and oil is up a couple of dollars. The US dollar is stronger against the Loonie again as tariff negotiations intensify.

| Index | Close July 24th 2025 | Close July 31st 2025 |

| S&P500 | 6,379 | 6,343 |

| TSX60 | 27,411 | 27,260 |

| Canada 10 yr. Bond Yield | 3.57% | 3.46% |

| US 10 yr. Treasury Yield | 4.40% | 4.38% |

| USD/CAD | $1.36329 | $1.38556 |

| Brent Crude | $69.29 | $71.90 |

| Gold | $3,369 | $3,293 |

| Bitcoin | $118,878 | $116,608 |

Source: Trading Economics & Factset

Both the Bank of Canada (BoC) and the US Federal Reserve left interest rates unchanged this week. In both cases they cited uncertainty over the level of and longer-term effects of tariffs. In its post announcement press release, the BoC cited not only the questions around tariffs but the current resilience of the global economy. The Bank is prepared to cut rates if the economy shows signs of weakening.

In its post announcement press release the Federal Reserve also cited uncertainty around the effects of tariffs. The tariff effect will be more directly felt in the US. It also pointed to a resilient economy, inflation that is still above target and healthy labour markets. While the majority of voting members were in favour of standing firm, there were 2 dissenting votes that called for a 25bps rate cut. Surprisingly, Donald Trump did not erupt and call for Jerome Powell’s head to be delivered to him on a platter.

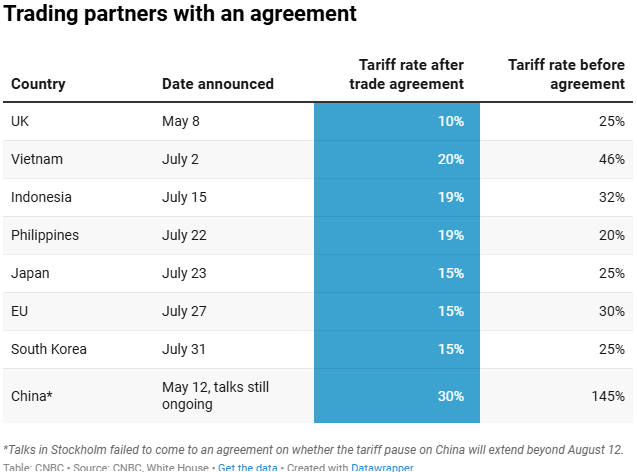

The headline stories in the financial press have been all about tariffs. There is a pattern emerging of baseline tariffs of ~15% plus a promise of the various countries to invest X billion dollars in the US and/or commit to buying X billion dollars of US energy. Despite claiming that they could conclude 90 deals in 90 days, the Trump administration will have only 8 “deals” finished by their August 1st deadline. Let’s be clear about these deals – at the moment they are agreements in principle, not formal trade agreements or treaties. They could all fall apart with the next social media posting.

Source:CNBC

For those countries without a tariff deal, they will have tariffs arbitrarily imposed on August 1st. Mexico has received a 90-day exemption. Canada is still in intense negotiations, and it is not expected to have a signed deal by August 1st. While the prospect of a higher tariff in the short-term is not welcome, a lot of our trade with the US will not be affected as it falls under CUSMA (NAFTA v.3), mitigating the impact.

Housing affordability is not just a Canadian issue. (For an informed debate on Canadian Housing Policy, tune into this podcast with host David Herle) It has been an issue around the world including the US. According to this US study, the main reason is high mortgage rates. Donald Trump would like the Federal Reserve to drop rates to solve the problem. Unfortunately, it’s not that simple. Most US mortgages are linked to the bond market which the Federal Reserve has little sway over. (Lowering short-term rates often pushes long-term rates up as the bond market prices in higher inflation) This week the US Senate passed a bi-partisan bill to re-invigorate the US housing market with an intent to make it more affordable. The bill is wide ranging and includes things like manufactured housing, the appraisal process, and making small mortgages available.

There was some news in the Canadian wealth management industry this week. Leading independent dealer Richardsons has been acquired by the Canadian insurance and wealth management giant iA Financial. The $597 million deal won’t affect advisors or clients for now as iA will continue to run Richardson’s as a separate entity.

This week and next we are hosting one of our grandsons, Alex, while he takes sailing lessons at the Royal Victoria Yacht Club. The lessons have been a hit, and who know, maybe it will inspire him to go to sea one day. With that in mind we’ll leave you with this from Stan Rogers…. Have a great long weekend.

Russ Lazaruk, RIAC, CIWM, CIM, FCSI

Managing Director & Portfolio Manager

![]()