It was another mixed week on the markets. The S&P500 advanced after last week’s sell-off. Canada didn’t fare quite so well. Low oil prices earlier in the week and higher inflation had investors hitting the pause button. Gold gave up some of its recent gains but renewed geo-political tensions brought back the bid.

| Index | Close Oct 16th 2025 | Close Oct. 23rd 2025 |

| S&P500 | 6,622 | 6,741 |

| TSX60 | 30,459 | 30,186 |

| Canada 10 yr. Bond Yield | 3.08% | 3.09% |

| US 10 yr. Treasury Yield | 3.98% | 4.01% |

| USD/CAD | $1.40504 | $1.39864 |

| Brent Crude | $60.92 | $65.89 |

| Gold | $4,324 | $4,109 |

| Bitcoin | $107,835 | $109,999 |

Source: Trading Economics & Factset

We’ll start with inflation in Canada which came in at 2.4% for September, up from August’s 1.9% reading. The increase was primarily the result of higher fuel prices though rent, and groceries also played a role. Core CPI remained stable at 2.4%. There is a divergence of opinion on another rate cut next week. The odds have dropped from 80% to 65%. Those arguing for a rate cut point to a slowing economy, job losses, and tariffs.

On the other side of the Atlantic, the UK’s inflation rate cooled a bit coming down to 3.8%. Markets had been expecting a 4% reading. The better-than-expected number may not be enough to warrant another rate cut from the Bank of England (BOE). Again, the biggest contributor to inflation was fuel (petrol in the local lingo). The BOE has a 2% inflation target, but the UK economy has been struggling for a while with Q2 GDP growth at 0.3%. Again, one can argue for a rate cut based on anemic growth but the UK risks entrenching higher inflation if the BOE is too quick to cut rates.

There are cracks showing in the US consumer with private lenders starting to run into trouble. Two lenders (First Brands & Tricolor) in the auto sector declared bankruptcy. Then Zions Bancorporation announced it had taken a $50 million loss on two loans. The auto related losses were tied to sub-prime borrowers with low or no credit scores. While this does not appear to be a 2008 scenario, Jamie Dimon did remind us that there is never just one cockroach.

China’s leadership held a 4-day closed session (plenum) to map out the country’s future and the next 5-year plan. The resultant communique was short on details but long on ambitions. The theme was enhancing China’s self-reliance through technology and advanced manufacturing. There were no real surprises in the communique, and it really builds on previous 5-year plans. What did catch watchers by surprise was the purge of 11 senior members of the Central Committee.

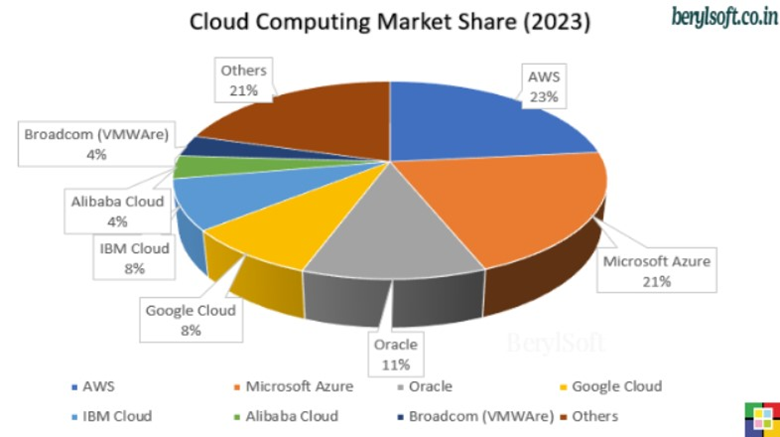

Cloud computing runs the internet and most enterprise level software / applications. The sector is dominated by a few companies and if one has an issue the effect can be felt around the globe. This week Amazon Web Services had an outage at its data centre in Virginia. The cause is reported to be an update that went wrong and brought the system down. What it showed is that the modern technology infrastructure is not as resilient as it should be and needs more (costly) redundancy. Just to re-enforce the importance of that statement, most governments rely on private sector providers of cloud computing services.

Critical minerals were back in the news this week as the US and Australia signed a deal to boost supplies of rare earths and critical minerals. Included in the agreement is investment by both countries in Australia’s mining sector. This includes $1 billion to be deployed in the next 6 months.

Oil has popped up in the last 2 days after the White House imposed tougher sanctions on Russia’s leading producers Rosneft and Lukoil. This is after a planned meeting between Putin and Trump was cancelled. A call between Secretary of State Marco Rubio and Russian Foreign Minister Sergei Lavrov earlier made it clear that Russia would not shift its position on the Ukraine War. Just to make a point, Russia then held nuclear readiness drills.

But what about those Blue Jays!! In a 7-game payoff round the Jays are off to the World Series with the hopes and pride of the nation along for the ride. We’re all Jays fans now!!

Hil & I leave Montpellier this Friday. We expect to be home by Nov. 1, after stops in Agen and Brussels. It has been a fun trip, and we have thoroughly enjoyed Montpellier the second time round. Since the first part of our journey home will be via the train – I’ll leave you with this from Marc Lavoine…. Enjoy

Russ Lazaruk, RIAC, CIWM, CIM, FCSI

Managing Director & Portfolio Manager

![]()