Hello, Mean Reversion, my Old Friend

Mean reversion is the financial concept that asset prices tend to return to their historical average over time. It’s a reminder that, amidst the market’s constant fluctuations and speculative frenzies, there is an underlying truth—the mean. This mean represents a sense of equilibrium and rationality in a world often dominated by emotion and short-term thinking. In this way, mean reversion offers a framework to understand the market decline since June & July’s statistically unusual pace of advance.

“The Sound of Silence” by Simon & Garfunkel and the concept of mean reversion in option-based investment strategies may seem like an unlikely pair, but beneath the surface, they share a profound similarity in their message.

In the song, “The Sound of Silence,” the lyrics speak to the idea that amidst the noise and superficiality of the world, true understanding and wisdom can be found in moments of silence. The song suggests that by listening to the silence, one can gain insights that are often drowned out by the cacophony of modern life.

As in the song, financial markets are accompanied by an ever-present siren song that distracts investors away from the simple truth that in any 10-year period they only ever have a less than 50% probability of achieving a return that is equal to or greater than the roughly 10% long-term average. And therein lies the rationale for why SDA+ is constructed to ignore noise in favour of systematic attention to probability maximization and mean reversion. If, in so doing, investors can have an 85% probability of achieving the long-term average, as they can, why should they accept less than 50%?

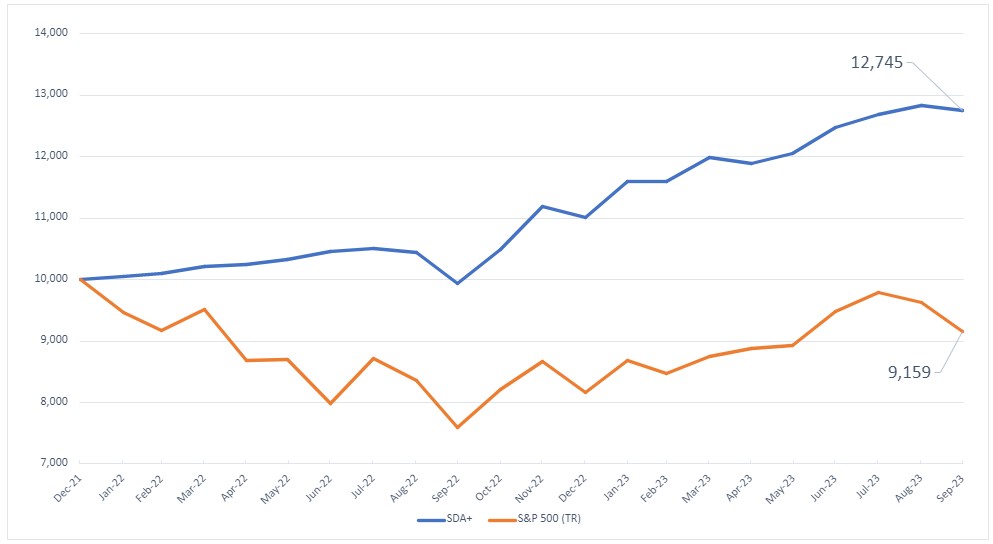

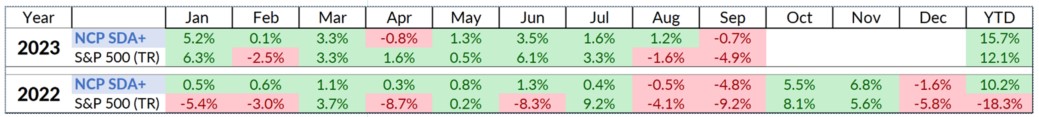

While it’s entirely possible that the almost 10% advance of the S&P from May to July 31 could persist, it is undeniably more probable that a >40% annualized rate of advance will mean revert. SDA+ does not know nor speculate on whether any particular advance will sustain but it does monetize periods of statistically unsustainable movement so that the probability of achieving at least the 10% long-term average is achieved. In practical terms that meant most of our stock positions were “called away” because we had sold call options with higher strike prices that were only 15% likely to be achieved. When these outlier prices were eclipsed SDA+ became an automatic profit taker. For a brief time, it appeared SDA+ had left money on the table; that is until mean reversion, our old friend, showed up.

This is a great reminder that unrealized gains are just that, not real yet. Since July as mean reversion set in, SDA+ not only held up very nicely because it had largely rotated to cash, but it is also ideally positioned to monetize any excessive negative market move by selling put options that again provide it with an 85% probability of a return that is equal to or greater than the 10% long-term average.

In the same way that “The Sound of Silence” encourages us to find meaning in introspection, mean reversion guides investors to make informed decisions by focusing on the long-term fundamentals rather than getting carried away by short-term market noise. It’s good to see you again mean reversion my old friend.

Click here to book a Discovery Call to learn more about how SDA+ works

Grant Colby

Managing Director Wealth Management & CEO

This is not an offering of investment advice or solicitation and should not be used as a basis for making investment decisions. It is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be prohibited by law or regulation or which would subject NCP to a registration requirement within such jurisdiction or country. We do not guarantee accuracy or completeness, although we attempt to update information on a timely basis. Neither NCP Capital Partners nor any of its directors, officers, employees or agents shall have any liability, howsoever arising, for any error or incompleteness of fact or opinion in it or lack of care in its preparation or publication; provided that this shall not exclude liability to the extent that this is impermissible under securities laws. All statements and opinions are liable to change without notice.