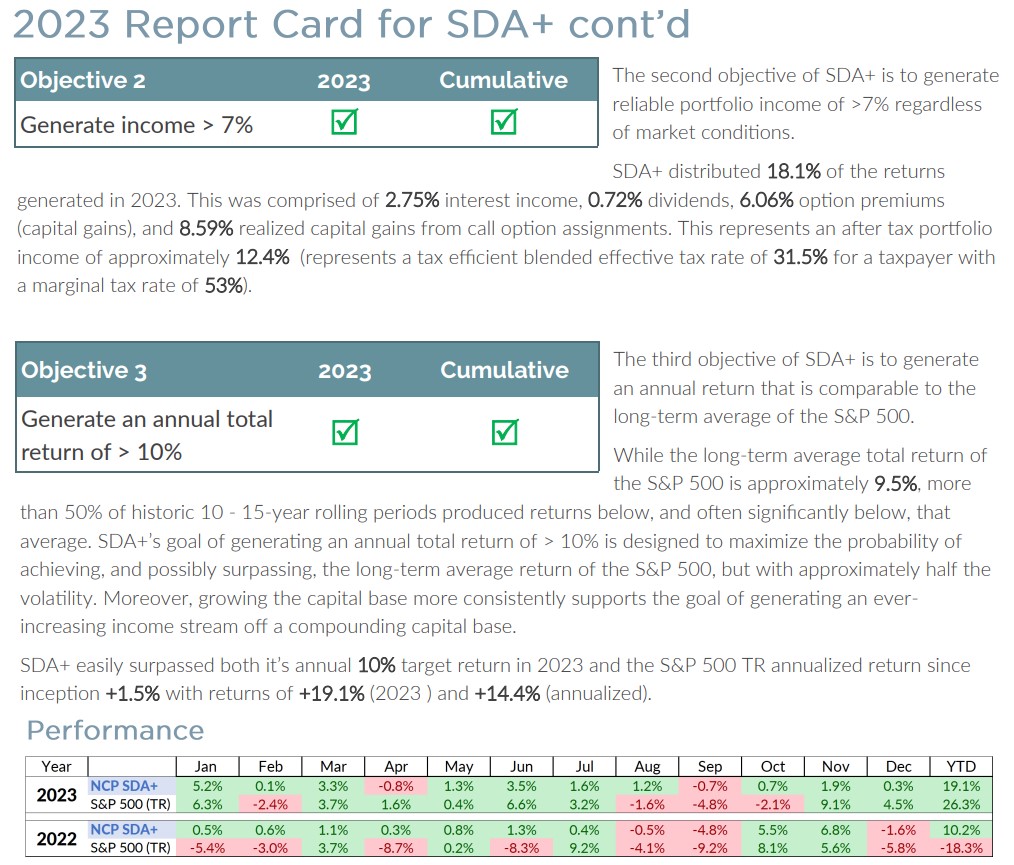

The table above reports the USD net of fees performance of the SDA+ Reference account. Reporting is independently calculated by SOC 2 Type 1 certified NDEX Systems. The strategy is applied consistently to all client accounts, but readers should anticipate performance dispersion because implementation occurs in separately managed accounts with different start dates resulting in different exposure. The strategy objective is to achieve an absolute return therefore the S&P 500 is not a relative or relevant benchmark. However, because the candidates for the potential underlying long equity portfolio are predominantly S&P 500 constituents , S&P 500 performance is presented to provide context.

2023 Year In Review

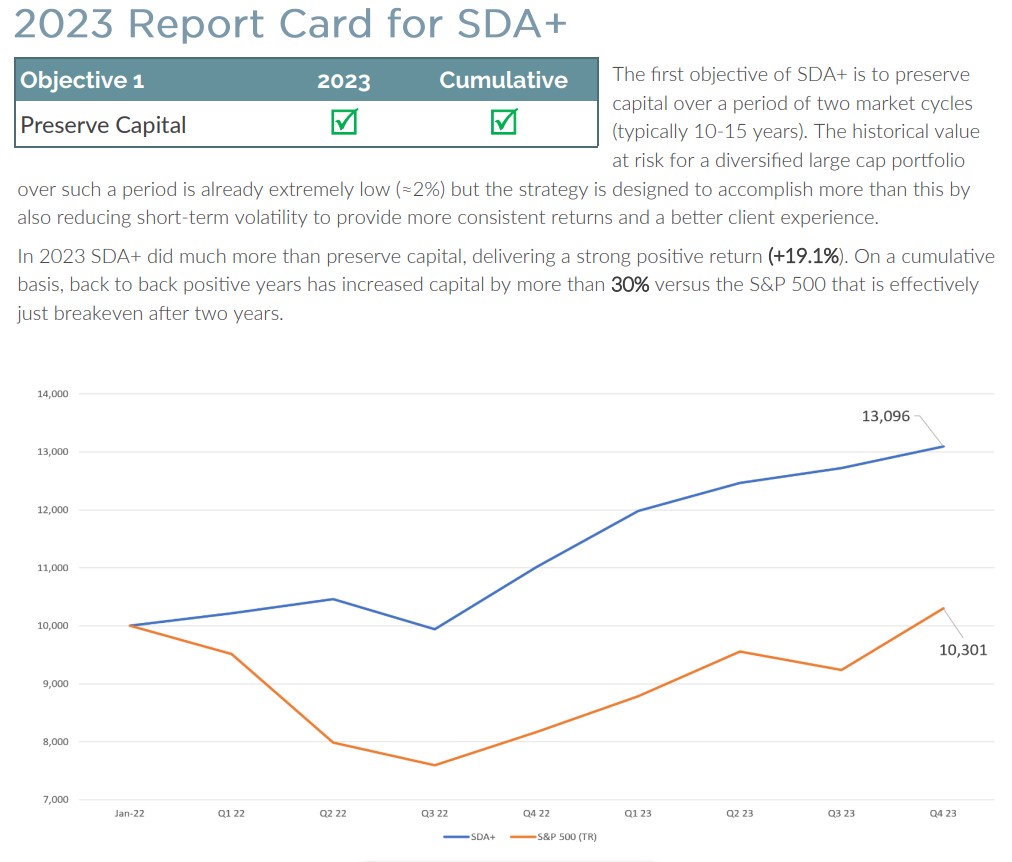

Despite the S&P 500 experiencing levels of extreme greed psychology on three separate occasions (February, July & Present), SDA+ comfortably exceeded its 7-10% income objective for the year. While buoyant market conditions depress put option prices and make it more challenging to meet the target income objective, these periods of exuberance also provided opportunities to realize capital gains that enabled SDA+ to comfortably exceed its third objective of delivering a total return that is comparable to the long-term return of the S&P 500 of 10%, by realizing a total return of 19.1% in 2023.

Conversely, instances of extreme fear occurred only twice (March & October) yet, in both cases, the market drawdown remained below the 10% threshold typically necessary for SDA+ to materially increase equity risk exposure resulting in us to having less equity exposure in the final quarter which limited returns somewhat.

The strategy’s systematic prioritization of risk mitigation over returns is reflected in the current equity risk exposure sitting at only 5%. Despite this low equity exposure SDA+ remains ideally positioned to achieve its three investment objectives in 2024, but is prone to underperform the S&P 500 if the statistically unsustainable current advance persists.

While we are committed ‘non-forecasters’, SDA+ is designed to treat periods of extreme optimism, such as the present one, as statistically prone to mean reversion. Even with the dampening effect of current exuberance on put prices, the combination of available premiums (6%) and the yield on cash (4.5%) allows us to continue achieving the portfolio income objective going forward, while maintaining a defensive posture.

As we look back on 2023, we are grateful for the trust you’ve placed in us for your core equity income and growth objectives. We look forward to our continued mutual success and collegiality in 2024.

Management Team

This is not an offering of investment advice or solicitation and should not be used as a basis for making investment decisions. It is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be prohibited by law or regulation or which would subject NCP to a registration requirement within such jurisdiction or country. We do not guarantee accuracy or completeness, although we attempt to update information on a timely basis. Neither NCP Capital Partners nor any of its directors, officers, employees or agents shall have any liability, howsoever arising, for any error or incompleteness of fact or opinion in it or lack of care in its preparation or publication; provided that this shall not exclude liability to the extent that this is impermissible under securities laws. All statements and opinions are liable to change without notice.