Sustainable Dividend Achievers+

Investment Objective

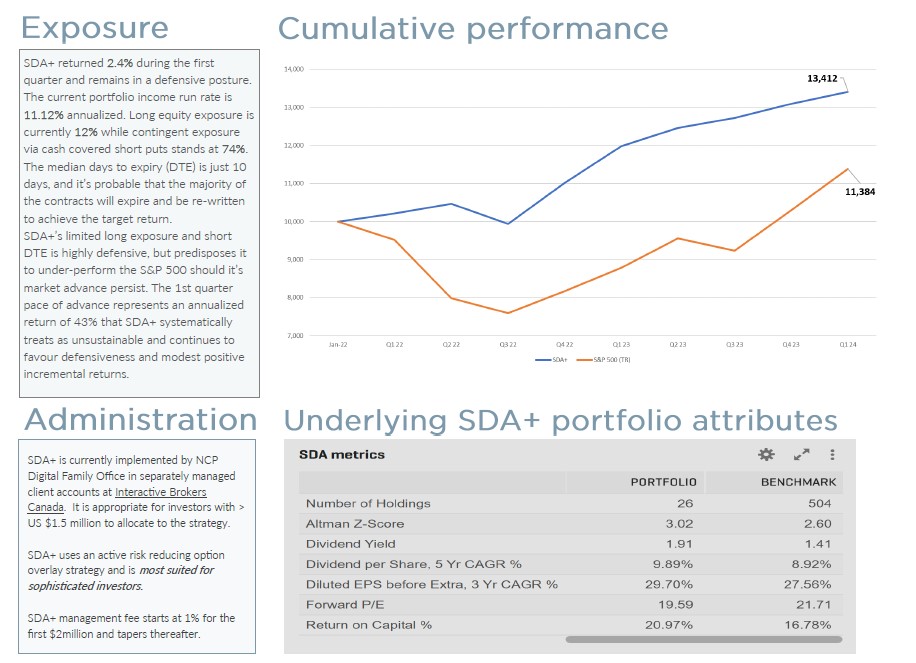

Sustainable Dividend Achievers+ (SDA+) is a target return strategy with a 7-10% income objective.

It’s actively managed using a long equity (income & growth style) and short volatility approach.

SDA+ is systematic and evidenced-based to maximize the probability of achieving three clear objectives.

- Preservation of capital over two market cycles

- Generate sustainable annual portfolio income of > 7%

- Realize growth comparable to S&P 500 long-term average (10%) but with lower volatility

Methodology

SDA+ is a two stage process, not a product.

Long equity process

Uses a proprietary quantamental screening process to create an underlying long equity portfolio with measurably superior growth and sustainability attributes.

The potential underlying long equity exposure is derived from an equally weighted list of the top 20 companies that have passed the multi-factor quantamental screening process. The top 20 list is dynamic and regenerated quarterly.

This dynamic sub-set of highest rated companies only serves to identify potential exposure. Actual exposure to the underlying is only ever realized, or disposed of, via the application of a systematic, revenue generating, short-option buy/sell discipline.

Consequently there is no fixed minimum equity exposure for SDA+. Permitted range is from 0% to 100% long-equity.

Short volatility process

Applies a short option overlay process to, serve as a buy/sell discipline, mitigate long-only risk, and enhance yield.

The investment objectives of risk mitigation and yield enhancement are met by selling market volatility against the potential underlying long equity exposure identified above.

Cash covered put options are sold to capture excess negative volatility and serve as a buy discipline that always acquires potential long exposure at a discount, and generates yield.

Conversely, covered call options are sold to capture excess positive volatility, generating yield and automating profit taking when the rate of growth is statistically unsustainable.

*Options are only used in SDA+ for risk reduction & yield enhancement, not speculative purposes.

This is not an offering of investment advice or solicitation and should not be used as a basis for making investment decisions. It is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be prohibited by law or regulation or which would subject NCP to a registration requirement within such jurisdiction or country. We do not guarantee accuracy or completeness, although we attempt to update information on a timely basis. Neither NCP Capital Partners nor any of its directors, officers, employees or agents shall have any liability, howsoever arising, for any error or incompleteness of fact or opinion in it or lack of care in its preparation or publication; provided that this shall not exclude liability to the extent that this is impermissible under securities laws. All statements and opinions are liable to change without notice.