Sustainable Dividend Achievers+

Portfolio Vitals

Our profit-taking discipline, specifically through call assignments, successfully achieved its intended purpose in late Q2. As a result, the portfolio’s long equity exposure decreased to just 27% (long equity, short calls), while the potential long exposure stands at 42% (long cash, short puts).

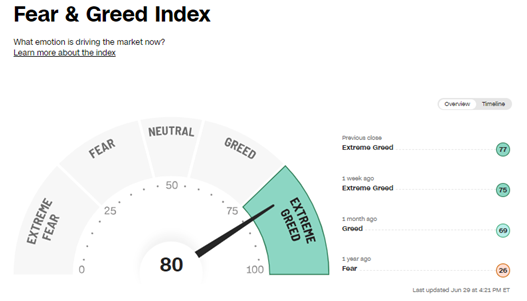

Currently, 31% of the portfolio is held in cash with no option exposure, as we anticipate a busy earnings calendar in late July. Having already surpassed the annual target return of 10% with a notable 13.3% YTD gain, and considering the signs of excessive market optimism, we are comfortable maintaining a defensive posture for the time being. In practical terms, this means we will hold off on further put exposure until the market has absorbed the earnings cycle in July. Subsequently, we’ll prioritize acquiring greater downside risk mitigation, even if it entails accepting lower put option premiums.

The average days to expiry (DTE) for the 42% potential long exposure is currently 23 days, providing average downside risk mitigation of 13.3% (as of Jun 28, 2023).

We are pleased to have achieved the annual target return in the first half of the year, and we are content with the defensive stance of the portfolio as we enter the traditional summer doldrums. Our mindset is to patiently await opportunities that arise when the winds of change and volatility inevitably sweep through the market.

Macro Picture: A Deceptive Gust of Euphoria

Sentiment inevitably manifests as market volatility and disruption when it undergoes a shift. Our SDA+ strategy capitalizes on sentiment extremes and latent volatility, aiming to maximize the likelihood of surpassing long-term market returns. As mentioned in the Portfolio Vitals commentary (left), we utilize such periods—where statistically unsustainable returns are implied—as an opportunity to systematically take profits.

For our current long positions, this approach allowed us to earn option premium at more than 8% annualized while accepting a limitation on future 54-day returns of over 11%. Achieving such a substantial return within this short timeframe translates to over 77% annualized. Although returns of this magnitude are possible on occasion, they remain highly improbable from a systematic standpoint.

Regarding recently exited positions, the average outcome resulted in gains of similar proportions, providing us with an opportunity to pause or re-enter the market when optimism is less pronounced, and reflected in lower prices. In some instances, we’ve witnessed prices continuing to rise after taking profits; however, certain stocks like QUALCOMM (see following page) have already exhibited a modest mean reversion, validating our profit-taking methods.

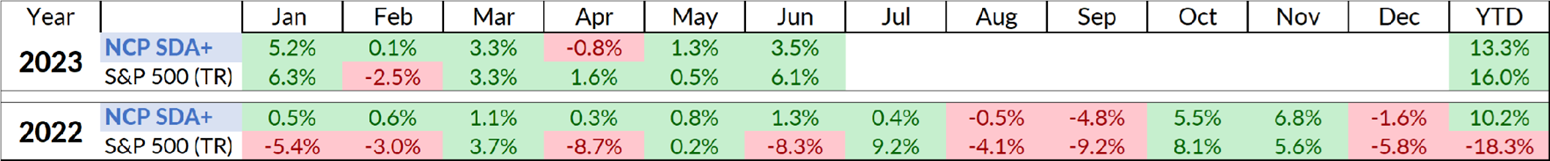

Performance

The strategy is applied consistently to all client accounts, but readers should anticipate performance dispersion because implementation occurs in separately managed accounts with different start dates resulting in different exposure. The strategy objective is to achieve an absolute return therefore the S&P 500 is not a benchmark. However, because the candidates for the potential underlying long equity portfolio are predominantly S&P 500 constituents , S&P 500 performance is presented to provide context.

Qualcomm Exemplar: Mitigating Risk & Enhancing Returns with Options

Qualcomm, like all portfolio candidates, successfully passed our rigorous quantamental screening process which identifies and ranks the top 20 companies worldwide. However, meeting this screening criterion merely made it a potential holding. To actually purchase it, the stock would need to experience a significant decline in price.

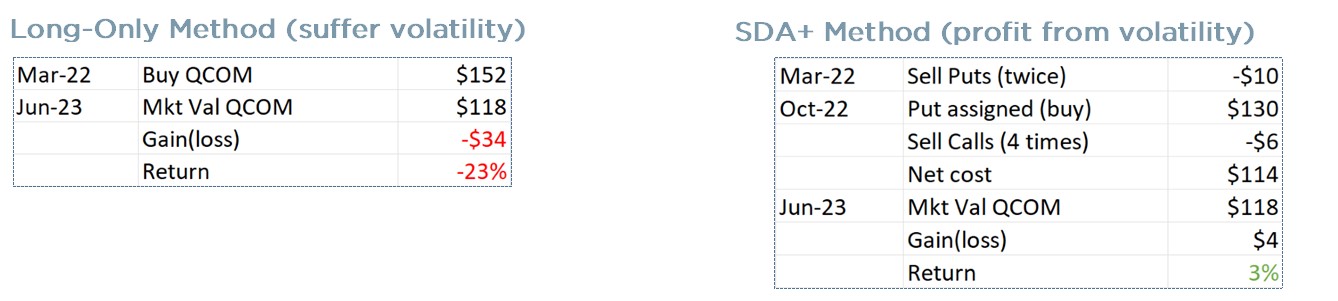

The tables below illustrate the difference between a typical buy-and-hold strategy, which relies on hope, and the active risk mitigation approach employed by SDA+ through options.

No portfolio, including SDA+, can completely avoid losing trades. However, by systematically capitalizing on volatility-based option premiums, we are able to significantly mitigate losses. There’s a well-known adage in portfolio management that winning is achieved by minimizing losses, and our experience with Qualcomm serves as a textbook example of how options can effectively reduce the impact of trades that would otherwise result in losses.

Since we entered into our first Put contract on March 21, 2022, buy-and-hold investors in Qualcomm have experienced a negative return of -23%. In contrast, SDA+ has managed to achieve a positive 3% return on Qualcomm over the same period. This was made possible by the initial two put options, which mitigated the first -14% of downside, and cumulative option premiums of 12% that more than offset the next -9% of Qualcomm’s decline (-14% + -9% = -23%).

Following a recent call option exercise that modestly improved SDA+ return compared to the previous scenario, we have once again sold a put option with the intention of re-purchasing Qualcomm at an even lower price ($108). We trust that sharing this example helps readers better comprehend the role of options and the SDA+ methodology to manage risk and enhance returns.

Management

Management

This is not an offering of investment advice or solicitation and should not be used as a basis for making investment decisions. It is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be prohibited by law or regulation or which would subject NCP to a registration requirement within such jurisdiction or country. We do not guarantee accuracy or completeness, although we attempt to update information on a timely basis. Neither NCP Capital Partners nor any of its directors, officers, employees or agents shall have any liability, howsoever arising, for any error or incompleteness of fact or opinion in it or lack of care in its preparation or publication; provided that this shall not exclude liability to the extent that this is impermissible under securities laws. All statements and opinions are liable to change without notice.