The Week That Was

Both equity and bond markets had a good week as investors saw glimmers of hope in US inflation data. As we’ve written several times in the past, inflation drives interest rates, which determine the discount rate applied to the valuation multiples on all asset classes. Lower inflation = lower interest rates = expanded multiples = higher asset prices. The market could very well be ahead of itself (it often is) as we haven’t seen the effect of high interest rates on earnings yet.

Market Close July 7th 2023 Latest July 14th 2023S&P500 4,399 4,524S&P TSX 60 Comp. 19,831 20,263Canada 10 yr Bond 3.57% 3.38%US 10 yr Treasury 4.05% 3.79%Canadian Dollar $1.32710 $1.31851Brent Crude Oil $78.47 $79.93Gold $1,924 $1,958Bitcoin $30,266 $31,322Source S&P Capital IQ & Trading Economics

The Bank of Canada raised its key lending rate by 25-bps this week in the midst of mixed economic indicators. In its statement it acknowledged that global inflation was easing but pointed to a still robust labour market and persistent inflationary pressure in services. Canada created 60,000 new jobs in June. The jump was offset by more people entering the workforce which pushed the unemployment rate up to 5.4%. Wage growth did moderate a bit with average wages climbing 4.2% from a year ago vs. 5.2% in May.

Inflation numbers in the US gave markets something cheer about. Headline annualized CPI eased off to 3% for June down from 4% in June. Core CPI was a bit stickier at 4.8%. It’s this core rate that may keep the Fed in a tightening frame of mind. On the other hand (there are no one handed economists, sorry Mr. Truman) the Producer Price Index (PPI) came in lower than expected as well, rising a negligible 0.1% year over year in June. Barring any supply chain disruptions, this drop in PPI should make itself felt at the consumer level before too long.

The contrarian in all of this is China where CPI & PPI numbers are teetering on the brink of deflation. After an initial burst post-COVID lockdowns, China’s economy has slowed. The country’s PPI declined by 5.4% from a year ago while CPI was flat year over year. Deflation can be a more intractable problem than inflation, so watch this space closely.

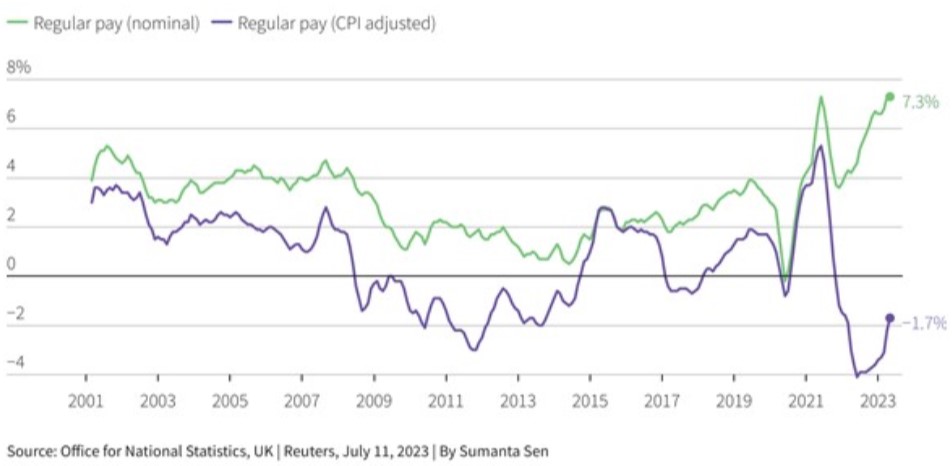

If you wonder why central banks (amongst others) worry so much about inflation, this chart shows what it does to the purchasing power of the average wage earner, who is still getting hefty nominal wage increases. Taken from UK data, it clearly shows the pernicious effects of inflation on living standards.

The NATO Summit in Vilnius wrapped up this week. Ukraine gained more security guarantees and promises of money and equipment. They didn’t get a firm timeline for NATO membership but do have a clear path to it. Turkey dropped its objection to Sweden’s membership in exchange for F-16 jets. The loser was of course Russia, who faces an increasingly united and determined NATO alliance.

Corporate Canada is seeing further consolidation in both the financial and energy sectors. Laurentian Bank announced that was up for sale after receiving an unsolicited takeover offer. This follows the acquisition of HSBC Canada by RBC. Laurentian is not seen to have the same value and has struggled over the past number of years. TransAlta Renewables is being folded back into its parent company TransAlta. A 40% share had been floated to the public in 2013. The offer price for the shares is $13, a decent premium over its pre-announcement price of $10.99.

My granddaughter Chloe rides rodeo and is getting very good at it, so this weeks song is dedicated to her…. Enjoy.

Have a great weekend, stay safe, stay healthy,

Russ Lazaruk, RIAC, CIWM, CIM, FCSI

Managing Director & Portfolio Manager

Tel 250.999.3329.

![]()

Copyright © 2023, All rights reserved.

The information transmitted herein by NCP Investment Management is intended only for the person or entity to which it is addressed and may contain confidential and/or privileged material. It is for discussion purposes only and NOT a recommendation to buy or sell securities. Any review, re-transmission, dissemination or other use of , or taking any action in reliance upon this information by persons or entities other than the intended recipient is prohibited. If you received this in error, please contact the sender and delete the material from any computer.