The Week That Was

Equity markets are finishing what has been a mixed week on a positive note. PCE core inflation came in lower than expected, bringing hope to investors. 10 yr. Treasuries continue to flirt with a 4% yield but have not made a commitment yet.

The US Federal Reserve did raise the overnight rate by an expected 25-bps this week. In comments after the announcement, Fed Chair Jay Powell left the door open to more hikes. While core inflation did come in lower than expected, at 4.1% it is still well above the Fed’s 2% target. Amongst all the noise, traders are placing bets on an end to rate hikes.

In Canada we had solid evidence that the rise in interest rates is starting to cool the economy. Preliminary numbers indicate the economy shrunk by 0.2% in June while Q2 GDP grew by a measly 1%. This after a strong May which had prompted the Bank of Canada to raise rates. Most of the weakness came from the manufacturing and wholesale sectors. Job vacancies also ticked down to 759,000 openings. Still a tight labour market but there are signs of softness.

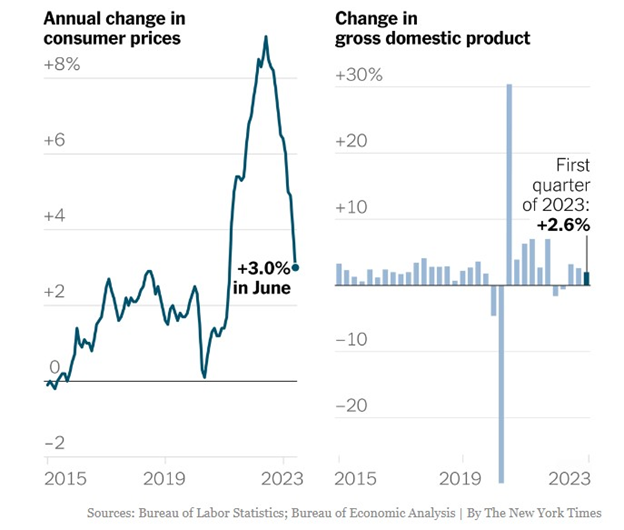

The trade off between controlling inflation and maintaining economic strength is not easy as this chart shows.

Canadians love to talk about the weather, mainly because we have such a wide range of conditions. Here in Montreal, where we are visiting for a few weeks, it will be a humid 28c today. Which is a change from the -30c I’ve experienced in winter visits. This year though, the weather is no joke. From forest fires raging across the country to floods in the Maritimes it has been one of the worst summers on record.

It is not just Canada that is experiencing the heat. According to scientists, July will be Earth’s hottest month on record and estimated to be the hottest month in 120,000 years. The cause is a combination of GHG related climate change and the onset of El Nino in the Pacific Ocean. For investors it brings a new set of challenges. We need to assess not only a company’s climate impact (carbon emissions) but their resilience and adaptability to climate change. Like all change, this brings both risks and opportunities.

In corporate news, we had some good earnings reports with Meta (Facebook), Alphabet (Google), and Microsoft all reporting strong results. Microsoft did warn that earnings would dip as they ramp up capital investment in AI. General Motors also reported a strong 2nd quarter with profits up 59%. Investors were looking forward, as they should, to possible labour strife when the current contract with the UAW expires in September.

“A rose by any other name would smell just as sweet”. Would Juliet’s words to Romeo apply to Twitter which is now called X? Elon Musk has decided to rebrand the ubiquitous bird app to X. It is part of his plan to turn the app into an everything platform. In this he will be competing head-to-head with Facebook, Amazon, and others. If nothing else, this move will spawn countless business case studies for decades to come, whether it succeeds or fails.

Hil & I went on a date last night to see the Barbie movie. It is funny, a bit of a morality tale, allows Mattel to poke fun at itself, and is definitely about girl power. If you want some light summer entertainment in pink it fills the bill. With that in mind we’ll close off with this classic from Cyndi Lauper….. enjoy

Russ Lazaruk, RIAC, CIWM, CIM, FCSI

Managing Director & Portfolio Manager

Tel 250.999.3329.

![]()