We’re back after last week’s absence when we were in planning and strategy sessions for 2 days. We got some good work done and now it’s time to move forward. Which is not how the markets are acting this past week. Both equity and bond markets are down thanks to geo-political turmoil, recalcitrant inflation, and some profit taking. Commodities were mixed with energy and soft (agricultural) down and metals up.

| Index | Close Apr. 11th 2024 | Close Apr. 18t 2024 |

| S&P500 | 5,199 | 5,010 |

| TSX60 | 22,110 | 21,708 |

| Canada 10 yr. Bond Yield | 3.77% | 3.79% |

| US 10 yr. Treasury Yield | 4.58% | 4.64% |

| USD/CAD | $1.36869 | $1.37676 |

| Brent Crude | $89.74 | $87.01 |

| Gold | $2,344 | $2,380 |

| Bitcoin | $70,061 | $63,418 |

Source: Trading Economics & S&P Cap IQ

Inflation in both the US and Canada ticked a little bit higher in March. In the US, the rise to 3.5% from 3.2% in February will undoubtedly delay any rate cutes by the US Federal Reserve. Fuel, housing, and clothing all contributed to the rise in prices. Core inflation, which strips out food and energy, stayed steady at 3.8%. The Fed clearly has their work cut out for them. Canada’s inflation rate also ticked up in March to 2.9% vs. February’s 2.8%. Again, the cost of fuel and energy with the main culprits. The Bank of Canada’s preferred measures of inflation, CPI Trim and Median, both came in below expectations. A June cut in interest rates is still in the cards for the Bank of Canada. With both Canada and Europe likely to cut rates before the US, watch for a strengthening US dollar.

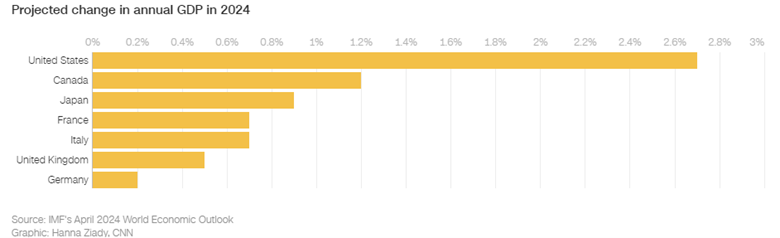

The US economy continues to outperform. Recent GDP growth projection from the IMF were raised to 2.7% for this year from 2.1%. This far outstrips the rest of the G7 nations, where Canada is #2 with an anemic 1.2% expected growth in 2024 GDP. The emerging markets have the highest growth prospects (4.2%), though a strong US dollar could hamper that. This reinforces the probable delay in any move by the Federal Reserve to cut rates.

The Federal Government tabled the Budget this week and 2 things stuck out: A change in the capital gains inclusion rate (how much of your gain is taxed) & a deficit of $39.8 billion. Housing was the main beneficiary of the new initiatives. Though the capital gains changes do not affect most people, they have gained the most press and will affect financial plans of business owners and incorporated professionals.

The capital gains changes take effect on June 25th. For individuals any capital gain over $250,000 will have a 66.6% inclusion rate vs. the current 50%. This is calculated on an annual basis. The amount below $250,000 will still have a 50% inclusion rate. Corporations and trusts will have a 66.6% inclusion rate from dollar 1 of capital gains. The table below illustrates the changes using a hypothetical capital gain of $300,000.

| Individual Before June 25 | Individual After June 25 | Corp. or Trust Before June 25 | Corp. or Trust After June 25 | |

| Capital Gain Amount | $ 300,000.00 | $ 300,000.00 | $ 300,000.00 | $ 300,000.00 |

| Taxable Amount of 1st $250K | $ 125,000.00 | $ 125,000.00 | $ 125,000.00 | $ 166,500.00 |

| Taxable Amount of Remainder | $ 25,000.00 | $ 33,300.00 | $ 25,000.00 | $ 33,300.00 |

| Taxable Gain | $ 150,000.00 | $ 158,300.00 | $ 150,000.00 | $ 199,800.00 |

| Taxes owing @ 53.5% / 50.7% | $ 80,250.00 | $ 84,690.50 | $ 76,050.00 | $ 101,298.60 |

| Effective tax rate on gain | 26.8% | 28.2% | 25.4% | 33.8% |

| 53.5% top marginal tax rate in BC for individuals | ||||

| 50.7% rate for corp. passive income |

This will affect business owners and incorporated professionals who hold investments inside their corporations. I’ll leave the arguments as to whether these investments should have ever been inside a corporation to the accountants.

There are some ways to avoid the higher tax rates, including paying salary rather than dividends and creating room for an Individual Pension Plan (IPP). We would be happy to explore these concepts with you.

But it is not all bad news for business owners. The lifetime capital gains exemption (LCGE) is being increased to $1.25 million (per person) which will be indexed to inflation starting in 2026. There will also be a “Canadian Entrepreneur’s Incentive” which will apply to the sale of shares in a qualifying business by an eligible shareholder (essentially the founders). This will maintain the 50% inclusion rate for $2 million of capital gain over the LCGE exemption. This will be phased in starting this year in $200,000 increments and reaching the $2,000,000 mark in 2034.

Housing got a boost with the First Time Home Buyer’s Plan (RRSP withdrawal) limit raised from $35,000 to $60,000. The grace period to start repayment has been extended to 5 years. The repayment period is 15 years (+ the 5 yr. grace). Note: this is separate from the First Home Savings Account (FHSA).

Other housing measures include accelerated capital cost allowance (depreciation) on purpose built rental housing, and the re-purposing of federal lands for housing.

Like all budgets, there is something to like and something to hate. To be fair, incorporated professionals have come out worse for wear in this one.

We’ll close off here with this piece from Slim Gaillard singing the Taxpayer Blues…. Have a great weekend and get those taxes filed 😉

Russ Lazaruk, RIAC, CIWM, CIM, FCSI

Managing Director & Portfolio Manager

![]()