It was a mixed week on the markets with bond yields slightly higher (prices lower) and equity markets higher. There was a lot of noise throughout the week as investors waited for results from Nvidia and digested the probability of rate cuts starting in the US sooner rather than later. The weaker US dollar has translated to a stronger Canadian dollar and higher gold prices.

| Index | Close Aug 22nd 2024 | Close Aug 29th 2024 |

| S&P500 | 5,576 | 5,603 |

| TSX60 | 23,037 | 23,227 |

| Canada 10 yr. Bond Yield | 3.09% | 3.16% |

| US 10 yr. Treasury Yield | 3.87% | 3.87% |

| USD/CAD | $1.35996 | $1.34857 |

| Brent Crude | $77.06 | $79.97 |

| Gold | $2,484 | $2,519 |

| Bitcoin | $60,336 | $59,468 |

Source: Trading Economics & Factset

It is quiet on the central bank front this week as everyone enjoys the last few days of August before the post-Labour Day return to reality. Inflation does continue to fall though, with Germany’s rate dropping to 2% in August. That was lower than the estimates of 2.3% and July’s rate of 2.6%.

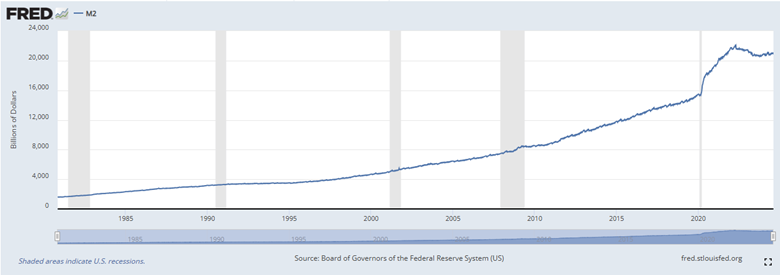

While the short-term interest rate receives the most attention in the inflation battle, some economists would argue the M2 money supply is equally or more important. If price inflation is the result of too much money in the system, then any shrinkage should bring down inflation. The chart below shows both the sudden increase in M2 at the start of the pandemic and the decrease starting in the spring of 2022. The moves in the M2 can be partially (mostly) explained by the US Fed’s quantitative easing and tightening which allows then to increase or decrease the amount of cash in circulation. (It’s not quite that simple but will do for now).

The market was eagerly nervously waiting for the latest results from Nvidia this week. The chip maker has been the poster child of the AI frenzy. The results came in ahead of estimates but did not meet the markets heady expectations. NVDA sold off after the announcement, but the true believers quickly moved in the buy the dip. We (I) personally think the sector (and market) is over valued and we did take some money off the table in the past few weeks. We will see what September brings but right now the mid-cap space is offering better value.

Oil has been volatile lately. An expected increase in OPEC production was offset by a shutdown of Libyan oil fields. Also playing into the mix is the ongoing war in the middle east and a soft Chinese economy. No predictions here except for continued volatility.

Staying on the energy file but much closer to home, the Malahat First Nation (51%) and their partner Energy Plug Technologies (49%) have broken ground on a 56,000 sq. ft. gigafactory that will produce batteries for residential, commercial, and industrial applications. The plant will be in the Malahat Nations business park located in Mill Bay on Vancouver Island. The price tag for the entire project is ~$75 million.

Warren Buffet is undoubtedly the GOAT of investing. This week Berkshire Hathaway surpassed the $1 trillion mark in market capitalization. Buffet acquired Berkshire (BRK) in 1965 when it was a failing textile company. Under his (and Charlie Munger’s) leadership the shares have gained more than 5,600,000%. That is about 20% annually, nearly double the return of the S&P500. All this with no outsized bets on technology.

The federal government made several policy announcements after their cabinet retreat this week. They include a 100% tariff on China built EVs. This is in line with US and European moves and is a move to protect our domestic industry from heavily subsidized cars from China. The other was a two-pronged attempt to address housing affordability. The first is an attempt to reduce demand by scaling back immigration, especially temporary foreign workers. The second is an attempt to increase supply by leasing (not selling) federal lands for housing development.

My reading list this summer included Ray Dalio’s “Principles for Dealing with the Changing World Order”. Dalio’s general premise is that empires rise and fall with a common rhythm, and we are now seeing the decline of the American Empire and the rise of a new global hegemon, China. He builds a compelling argument, but I am not 100% convinced. Maybe it’s my naïve belief that democracy is adaptable enough to bend and adapt whereas autocratic regimes tend to be rigid and suffer from their own personality disorders.

If you are a fan of 1990’s Britpop, you’ll be happy to know that Oasis is getting back together. So we’ll leave you “Don’t Look Back in Anger”, which could be the motto of their reunion tour. Have a great long weekend….

Russ Lazaruk, RIAC, CIWM, CIM, FCSI

Managing Director & Portfolio Manager

![]()