We will look back at this November with fond memories as both equity markets and bond markets put in strong results. Yields pulled back from their October highs lifting the prices of bonds, while equities benefited from a modest multiple expansion, again fueled by falling yields. The Canadian dollar also strengthened. Oil bucked the trend and has been declining haphazardly since mid-September.

| Index | Close Nov. 24th 2023 | Close Nov. 30th 2023 |

| S&P500 | 4,559 | 4,564 |

| TSX60 | 20,103 | 20,236 |

| Canada 10 yr. Bond Yield | 3.72 | 3.55 |

| US 10 yr. Treasury Yield | 4.48% | 4.33% |

| USD/CAD | $1.36350 | $1.35620 |

| Brent Crude | $80.48 | $80.51 |

| Gold | $2,002 | $2,038 |

| Bitcoin | $37,738 | $37,653 |

Source: Trading Economics & S&P CapIQ

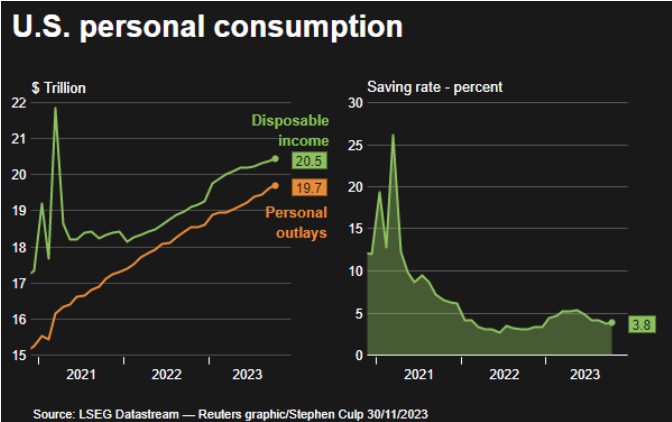

Central banker’s will be in a good mood right now as indications point to lower inflation but no recession (yet). This week, the European Union’s November inflation rate dropped to 2.4% from 2.8% in October. Markets have now priced in a rate CUT as early as April 2024. Adding to the good news was a moderating PCE (Personal Consumption Expenditures) Price Index in the US coupled with a softening labour market. Interestingly, the personal savings rate also ticked up.

If you had asked many prognosticators at the beginning of 2023 what their outlook would be, a significant number would have said stagflation, when the economy stagnates but inflation continues to rise. Now, that seems to be off the table. Despite falling inflation, the US posted GDP growth of 5.2% in the third quarter. Unfortunately, Canada’s GDP sank 0.3% in Q3 thanks to lower consumer spending and exports. Some of Canada’s poor showing can be attributed to this summer’s fires which curtailed production in large parts of the resource industries. Not to mention strikes at west coast ports and the St. Lawrence Seaway.

OPEC+ met this week and agreed to cut another 1 million barrels per day (bpd) of production. But the cut isn’t binding, and the voluntary cuts will mostly be borne by Saudi Arabia. Oil prices declined a bit on the news. Factoring into OPEC+’s decision was China’s stagnant economy, increased US production, and some internal dissent.

The public equity markets serve 2 main purposes. They are an avenue for companies to raise capital efficiently with access to a deep pool of potential investors. They also democratize capitalism by opening the opportunity to invest to virtually every adult through a liquid open market. But what happens when those publicly traded companies go private? That is a question that we need to ask. The TSX & TSX Venture have lost 19 publicly listed companies this year worth $12.5 billion. So far this year there have been 13 initial public offerings (IPOs) valued at $114 million. Canada is not alone in this phenomenon. The US markets saw 58 companies worth a total $120 billion taken private.

Electric and hybrid vehicles are gaining market share. Sales of fully-electric, hybrid, and plug-in hybrid vehicles captured 18% of total sales in Q3. The adoption rate is accelerating, powered in part by falling prices. Range anxiety does remain a concern amongst consumers, but as more charging stations and new battery technology come in to play this will dissipate. Most new technologies are on the path to dominance once they exceed a 10% adoption rate. Bain & Company have an in-depth study on it here.

The world lost 2 giants this week. Controversial, divisive, but probably the most consequential diplomat in history, Henry Kissinger passed away at the age of 100. The world of finance lost one of its icons, Charlie Munger, who was a few weeks shy of his 100th birthday. Munger was Warren Buffett’s business partner and best friend. Together they built Berkshire Hathaway into what it is today.

The Christmas season has started, so head on down to your local five and dime for some bargains, with this from Nancy Griffiths to keep you going. You might find more than just a bargain…. enjoy

Russ Lazaruk, RIAC, CIWM, CIM, FCSI

Managing Director & Portfolio Manager

Tel 250.999.3329.

![]()

www.ncpdfo.com