Equity markets were dominated by one name this week, Nvidia. The stock sold off in advance of earnings, bringing the index down with it, before rebounding post-earnings release. More than anything else, this is an indication of a very narrow advance by the S&P, led by the Magnificent 7. More on that below. Other asset classes were relatively quiet, though I will note that Bitcoin has had a strong run up since October.

| Index | Close Feb. 15th 2024 | Close Feb. 22nd 2024 |

| S&P500 | 5,030 | 5,081 |

| TSX60 | 21,223 | 21,328 |

| Canada 10 yr. Bond Yield | 3.54% | 3.54% |

| US 10 yr. Treasury Yield | 4.24% | 4.33% |

| USD/CAD | $1.34630 | $1.34800 |

| Brent Crude | $82.86 | $83.35 |

| Gold | $2,004 | $2,023 |

| Bitcoin | $51,368 | $51,459 |

Source: Trading Economics & S&P Cap IQ

A few weeks ago, we wrote about knowing what was in an index and whether it was an appropriate benchmark or investment. (You can invest in most indices through an ETF of fund). I am old enough to remember the “Nortel effect” in Canada where 1 stock accounted for 33.47% of the S&P/TSE(X)300 and 44% of the S&P/TSE(X)60. While not quite in the same league, the Magnificent 7, all technology companies with exposure to AI, represent over 25% of the S&P500. Despite the promise of broad diversification, the S&P500 (and others) has become a more focused bet on one sector.

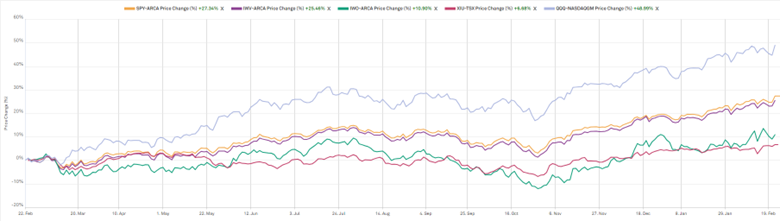

Chart Courtesy S&P Capital IQ

The chart above compares the NASDAQ (QQQ) which is very tech heavy to the S&P 500, Russell 3000 (broad US market), Russell 2000 (US small & mid-cap) and the TSX Composite. Each with a descending exposure to technology.

Before we leave the tech sector completely, Amazon has been added to the Dow 30, replacing Walgreens. And those Nvidia earnings? They blew past analysts’ expectations with strong forward guidance. There is a lot of good news baked in here, so we are very cognizant of falling victim to FOMO.

There was good news on the inflation front in Canada this week with headline CPI dropping to 2.9% in January. Core and Trim inflation also dropped, albeit by not as much. While this new print is within the Bank of Canada’s target range, policy makers will want to see it sustained for a few more months before making any changes to monetary policy (interest rates).

In other corporate news, two credit card giants are merging. US based Capital One is buying Discover in a $35 billion all stock deal. Discover was created by Sears in 1985 as part of their push in financial services which included Dean Witter Reynolds (brokerage) and Caldwell Banker & Company (real estate). The card company remained part of Dean Witter, then Morgan Stanley until it went independent in 2007. It has about 8% of the credit cards in circulation in the US behind Visa (48%) and Mastercard (36%). The laggard is American Express with a 7.5% market share.

The Japanese stock market has been one of the best performers this year. Improved corporate governance, exposure to the semi-conductor industry, a weaker yen (helping exports), and an influx of investors fleeing China have all helped the Nikkei reach a new all-time high, finally passing the previous high made 34 years ago.

The US made its first moon landing in 50 years this week. The unmanned spacecraft built by Texas based Intuitive Machines touched down on the lunar surface on Thursday. The craft is carrying a variety of scientific instruments on behalf of NASA.

On that note we’ll close of with this classic from Frank Sinatra…. Enjoy

Russ Lazaruk, RIAC, CIWM, CIM, FCSI

Managing Director & Portfolio Manager

Tel 250.999.3329.

![]()

www.ncpdfo.com