An interesting week on the markets with the equities selling off mid week then bouncing back. Bond yields have fallen this week (bond prices up) while oil prices declined, and the Canadian dollar strengthened. For now, the trend in both the equity and fixed income markets are favouring investors. Commodities are mixed overall with no discernible (to me) trend.

| Index | Close Jan. 26th 2024 | Close Feb. 1st 2024 |

| S&P500 | 4,891 | 4,932 |

| TSX60 | 21,125 | 21,118 |

| Canada 10 yr. Bond Yield | 3.52% | 3.27% |

| US 10 yr. Treasury Yield | 4.16% | 3.88% |

| USD/CAD | $1.34500 | $1.33747 |

| Brent Crude | $82.95 | $78.86 |

| Gold | $2,018 | $2,056 |

| Bitcoin | $41,818 | $43,198 |

Source: Trading Economics & S&P Cap IQ

The message from central banks this week was more of the same. First out of the gate was the US Federal Reserve which held rates steady. They will continue with quantitative tightening (QT). More importantly, they are not in a rush to lower rates, with any prospect being pushed out to the second half of the year. The UK followed suit holding rates steady and maintaining a 2% inflation target. Inflation in the UK was at 4% in December. The Bank of England (BoE) expects it to fall further in Q1 but climb again in Q2 & Q3.

Here in Canada preliminary number indicate our GDP grew by 0.3% in December while November’s results were revised upwards. Q4 GDP growth is expected to be 1.2% (annualized) vs. Q3 which saw GDP contract by 1.2%. On the back of those number Bank of Canada governor Tiff Macklem spoke at the House of Commons Finance Committee today. While many of his comments were a repeat of the message he has delivered in the past few months, one comment did stand out. He posits that interest rates are not to blame for high housing costs. He points out that the cost of housing has remained elevated when rates have both declined and risen. He points the finger of blame at a lack of supply.

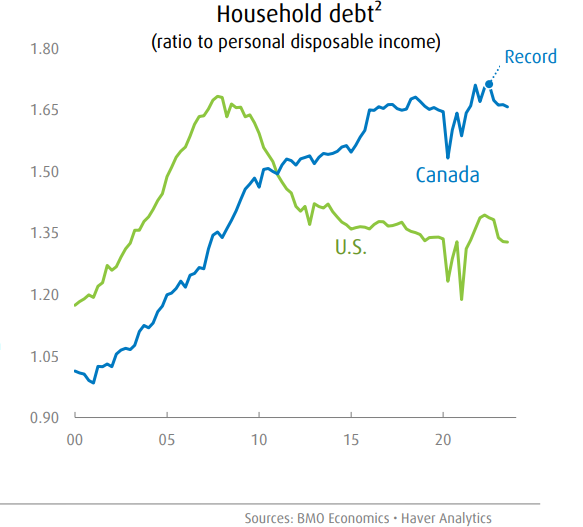

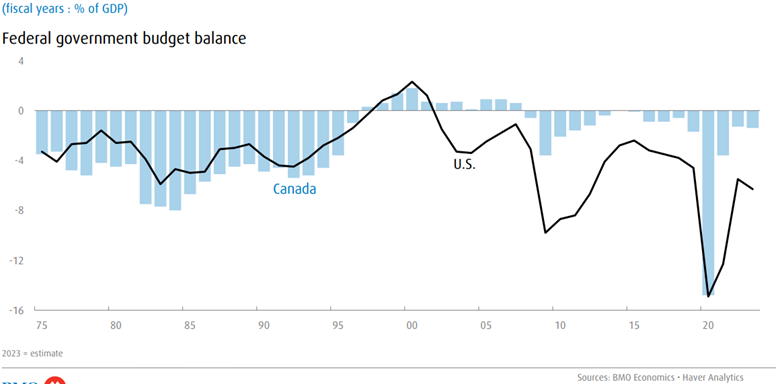

Last week I had the pleasure of attending the annual Forecast Dinner sponsored by the CFA Society. As usual it was a well attended and informative evening. The presenting forecasters were modestly upbeat pointing to resilient labour markets and a seemingly unstoppable US consumer. A couple of slides from BMO’s Chief Economist Doug Porter stood out to me. Both compare debt levels between Canada and the US. The comparison may or may not be fair as there are some structural differences in our economies, but we do like to make the comparison.

The first looked at the ratio of household debt to personable disposable income. It shows how we have swapped places with the US post the Financial Crisis. It’s hard to know where to put the blame, but US households got their affairs in order after the crisis of 2007-08.

The second graph compares our annual Federal Government deficits or surpluses as a % of GDP. Here we are in a better comparative position. We can do better but there is a reason we have a higher credit rating than our friends to the south.

This week Germany’s Chancellor Olaf Scholz called on the European Union to complete its creation of a banking and capital markets union. Not that dissimilar to Canada’s fragmentated capital markets with a multitude of regulators, the system creates inefficiencies for both issuers and investors. These federated systems are legacies of an earlier time of closed economies and poor (by today’s standards) communication networks.

The poster child for the troubled real estate sector in China, Evergrande, has been ordered to liquidate by a court in Hong Kong. There is a level of uncertainty around the winding-up process, and it is unclear which creditors will be left with unpaid debts. The company’s debt is estimated to be $340 billion. Along with banks and institutional lenders, there are a myriad of prospective buyers that have deposits on yet to be completed homes.

Elon Musk announced on X (Twitter) that his latest venture, Neuralink, had successfully implanted a wireless chip in a human brain. The goal is to connect human brains to computers to help tackle complex neurological conditions such as quadriplegia or ALS. There are obvious ethical questions around the procedure along with questions about non-medical uses. Queue the Matrix.

We’ll close off with one of the greats of Rock ‘n Roll doing his interpretation of Ravel’s Bolero…. Enjoy

Russ Lazaruk, RIAC, CIWM, CIM, FCSI

Managing Director & Portfolio Manager

Tel 250.999.3329.

![]()

www.ncpdfo.com