Another interesting week on the markets. The US was closed for Martin Luther King Day which resulted in lower volumes everywhere else. The S&P500 traded down for a few days before rebounding to finish flat. The TSX didn’t fare as well, losing 200+ points. The bond market re-enforced the call of higher for longer with both US & Canada 10 yr. yields climbing again. More on that below.

|

Index |

Close Jan. 12th 2024 | Close Jan. 18th 2024 |

| S&P500 | 4,784 | 4,782 |

| TSX60 | 20,990 | 20,758 |

| Canada 10 yr. Bond Yield | 3.22% | 3.49% |

| US 10 yr. Treasury Yield | 3.95% | 4.14% |

| USD/CAD | $1.34080 | $1.35010 |

| Brent Crude | $78.29 | $79.07 |

| Gold | $2,049 | $2,023 |

| Bitcoin | $43,416 | $40944 |

Source: Trading Economics & S&P Cap IQ

Underlying the call for higher (rates) for longer were reports from both sides of the 49th parallel. Canadian inflation (CPI) ticked higher in December to 3.4%. As usual there was a lot of noise in the number, including higher fuel prices and the “base effect”. The Bank of Canada’s favoured measures of inflation were also higher than expected, dashing hopes for early interest rate relief.

In the US, the December non-farm payrolls were higher than expected, adding 216,000 jobs. Last week’s new unemployment claims dropped by 16,000 to 187,000, a 16 month low. These, coupled with 3rd quarter GDP growth of 4.9% (annualized) will give the Federal Reserve reason to hold rates steady. Headline CPI was at 3.4% in December and core CPI at 3.9%. It seems getting rid of that last bit of inflation is just as hard as losing that last 5 lbs. of weight.

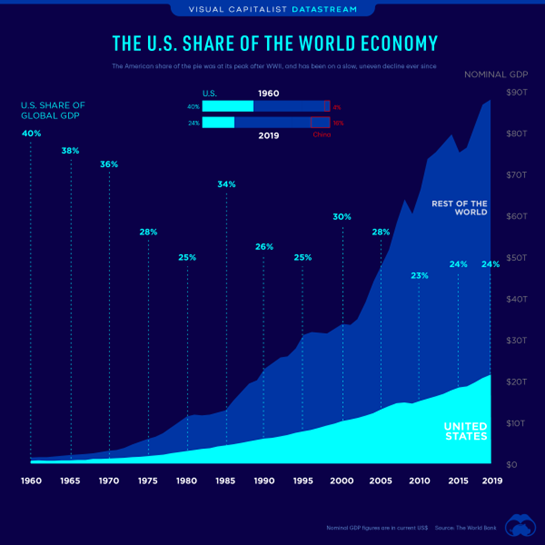

One of the many interesting conversations at NCP happened earlier this week. One of the measures we use to measure the under/over valuation of the S&P500 is to compare it to the US GDP. I put forth the argument the comparison is no longer relevant for 2 reasons. First, before the globalization of the past 20+ years most of the S&P500 companies concentrated on their home (US) market, so the measure made sense. Today the leaders in the index are truly global in scope. Compounding this is the “cap weighting” methodology of the index itself (larger companies have a higher weighting). Second, the US share of global GDP has shrunk from 40% in 1960 to 24% in 2019.

Source: Visual Capitalist & Datastream

That trend may reverse itself if the recent moves to re-shoring and de-globalization continue but the largest companies will continue to be global in nature and scope.

China is shrinking. 2022 saw a population decline of 850,000 people. That decline accelerated in 2023 to 2.08 million. These are the first years since the “Great Famine” in the early 1960s that China’s population has declined. The situation shows no sign of improvement. The working age population continues to shrink and those over 60 now represent 21.1% of the population. A shrinking work-force, higher social costs for pensions & elder-care, and financial struggles in the real estate and local government sectors all point to the potential for stagnation.

Blackberry co-founder Jim Balsillie wrote an interesting op-ed in the National Post this week. In it he argues that the Canada’s innovation and productivity policies (both government & corporate) are missing the boat. Focused, as they are on incremental productivity improvements through capital investment, they are missing the change in the global economy, where intellectual property (IP) and its ownership rights are the generators of wealth. Read the article and let us know what you think. I’m still digesting it.

Segueing a bit, Microsoft surpassed Apple as the largest company in the world this week. Both companies own vast quantities of IP and guard it zealously. Microsoft’s focus on artificial intelligence (AI) is one of the main drivers in its market dominance. (more IP) According to a recent IMF report, AI is also projected to disrupt up to 40% of the world’s jobs. It will complement some by making workers more productive. Others will be eliminated. I think Mr. Balsillie has a point.

Maybe it’s the gray weather (but not the snow) that made me think of this song. Most of my trips through London, seem to have been in the “rainy season”. Nevertheless, I have fond memories of driving down Baker Street listening to this piece by Gerry Rafferty when it was #1 on the charts…. enjoy.

Russ Lazaruk, RIAC, CIWM, CIM, FCSI

Managing Director & Portfolio Manager

Tel 250.999.3329.

![]()

www.ncpdfo.com