Russ has headed to London for the week, so I (Sam Coby) am stepping in this week for quick summary of the week that was.

This week, equity markets have been dynamic, influenced by movements in bond yields, with the 10-year Treasury yield briefly touching a 14-month high at 4.8% before retreating. Despite these pressures, overall market sentiment remains cautiously optimistic, supported by solid earnings results, particularly from banks. In the crypto market, Bitcoin and Ethereum showed strong performance, with Bitcoin nearing an all-time high

| Index | Close Jan. 16th 2025 | Close Jan. 23rd 2025 |

| S&P500 | 5,963 | 6,118 |

| TSX60 | 24,810 | 25,434 |

| Canada 10 yr. Bond Yield | 3.45% | 3.32% |

| US 10 yr. Treasury Yield | 4.66% | 4.65% |

| USD/CAD | $1.43966 | $ 1.4382 |

| Brent Crude | $81.43 | $77.88 |

| Gold | $2,716 | $2,755 |

| Bitcoin | $100,245 | $103,910 |

Source: Trading Economics & Factset

US equities have soared to their most expensive level relative to government bonds since the dot com era. US equities hit a record high on Wednesday, pushing the forward earnings yield on the S&P 500 down to 3.9%, according to Bloomberg. Meanwhile, a sell-off in Treasuries has driven 10-year bond yields up to 4.65%. Which means the extra risk an investor takes on when owning a stock, has fallen into negative territory and reached a level last seen in 2002.

The big news this week is that, after too short of a pause, the circus is back in town, and Trump has taken office once again. On his first day, he issued executive orders to review existing trade deals and reiterated his intention to impose import duties on Canada, Mexico, and the European Union. He halted funding for renewable infrastructure, ended the 50% electric car goal, and aims to expand resource development in Alaska. He also gave TikTok a 75-day extension in the U.S., requiring a deal that gives the U.S. a 50% stake, along with a myriad of other executive orders.

Outgoing Canadian Prime Minister Justin Trudeau responded Thursday to Trumps threats of tariffs stating , “American consumers will pay more whenever President Donald Trump decides to apply sweeping tariffs on Canadian products.”

The Bank of Canada is weighing its first move of 2025. The domestic economy has shown minimal growth, and the Canadian dollar is struggling. However, a robust jobs report for December has sparked some optimism about potential growth. Meanwhile, the looming threat of punitive tariffs from Trump on Canadian exports adds to the uncertainty. With some analysts such as Scotiabank’s vice-president and head of capital markets economics, urging Canada’s central bank to “take a breather and hold next week,” to give policymakers time to digest possible U.S tariffs.

Google announced a fresh $1 billion investment in Anthropic, a startup renowned for its Claude generative-AI models. Claude generative – AI assists with tasks like generating text and code, analyzing images, and translating languages, using generative pre-trained transformers trained on large datasets and fine-tuned with reinforcement learning from human feedback.

Over in the UK where Russ is spending some time, the European Union has agreed to allow London to continue clearing the bloc’s trades until 2028, a departure from its previous vow that the post-Brexit arrangement would end this summer. While the EU aims to reduce its reliance on London for clearing euro derivatives, this extension allows more time to develop and strengthen its own clearing infrastructure within the EU, and also means that EU regulators will continue to have oversight over clearing activities in London, which is crucial for maintaining financial stability and managing systemic risks.

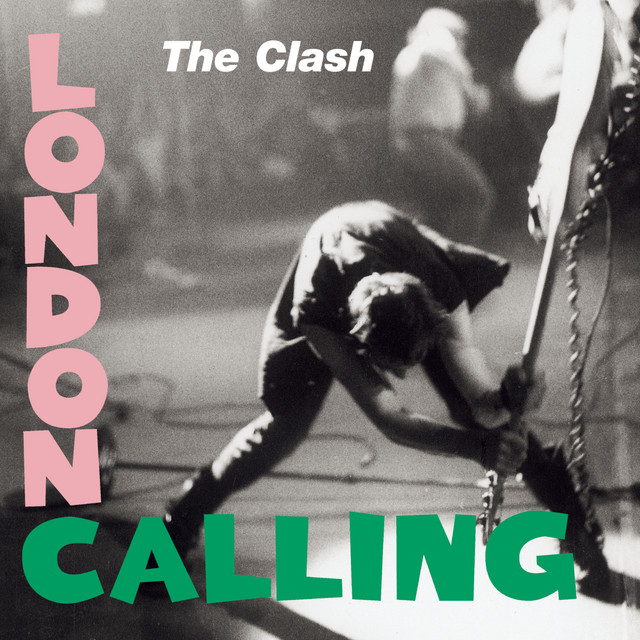

Staying on the theme of London, I will leave you with The Clash to kick off your weekend

Sam Colby,

Associate

![]()