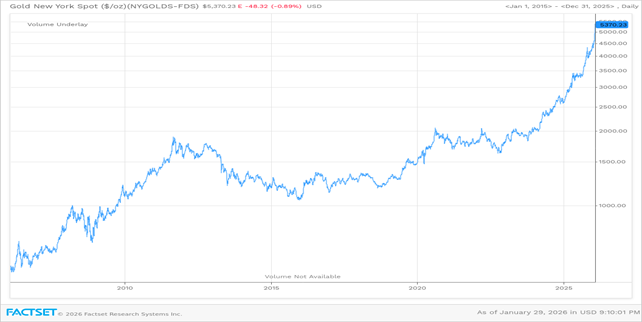

Despite a steep morning sell off on Thursday (thanks to colly wobbles over the AI trade) equity markets have closed out relatively flat. The commodity space was where the action was with gold making new all-time highs, oil jumping over US threats to Iran, and copper reacting to supply constraints. The Canadian dollar is ratcheting higher, but this is probably more a story of weakness in the US dollar.

| Index | Close Jan 22nd 2026 | Close Jan 29th 2026 |

| S&P500 | 6,911 | 6,971 |

| TSX60 | 33,069 | 33,025 |

| Canada 10 yr. Bond Yield | 3.40% | 3.43% |

| US 10 yr. Treasury Yield | 4.25% | 4.24% |

| USD/CAD | $1.37878 | $1.34977 |

| Brent Crude | $64.65 | $70.81 |

| Gold | $4,947 | $5,371 |

| Bitcoin | $89,095 | $84,206 |

Source: Trading Economics & Factset

It was steady as she goes on the central bank front this week. Both the US Federal Reserve and the Bank of Canada (BoC) decided on no changes to their rate policy this week. In its post announcement press release, the BoC said the outlook was little changed from October but is vulnerable to US trade policies and geopolitical risk. The Bank projects growth of 1.1% in 2026 and 1.5% in 2027.

Despite pressure from the Whitehouse, 10 out of 12 voting members of the FOMC opted to hold rates steady. They cited a stabilizing labour market, continued economic growth, and inflation that is still above target. To date, the Federal Reserve has preserved its independence. While Jerome Powell will be replaced in a few months after his term expires, the majority of voting members are still data driven. Much to the market’s relief.

Another source of angst has been shelved for now. Thursday’s auction of 40 yr. bonds in Japan was well received with the yield easing to 3.87%. The yield is still 122-bps higher than this time last year. While long duration bonds from Japan may sound esoteric, a crack in this market would be felt around the globe.

Gold has been on a tear for the past year but has gone parabolic in the last few weeks. There are several reasons for its return to glory including a sliding US dollar, increased buying by central banks, and the return of retail investors via ETFs. Our friends at Capitalight Research have estimated the relative contribution of the drivers as:

– Safe-haven demand / geopolitical risk: ~25%

– Monetary policy expectations / real rates: ~25%

– US dollar dynamics: ~20%

– Central-bank demand: ~20%

– Technical & positioning effects: ~10%

You can subscribe to Capitalight’s excellent coverage of this sector at Home | Capitalight Research

In the past I have tended to agree with Lord Keynes that gold is a barbarous relic. This view was re-enforced during the Asian crisis of 1997/8 when the flight to safety was not to gold but rather US Treasuries. However, that began to change in 2024 when bullion started to pick itself up off the mat. The use of sanctions, increasing indebtedness of the US, and the lack of other credible reserve currencies have given gold back its lustre. The trade is not without risk though. Higher interest rates will take some of the shine off as they raise the cost of carry.

Free trade is not dead. This week, the European Union and India signed a comprehensive trade agreement. The deal covers 25% of the world’s economy and 2 billion consumers. Talks first started in 2007 but stalled 9 years ago. The capriciousness of US tariff policy acted as the catalyst to conclude the agreement. This deal comes on the heels of the EU / Mercosur (Latin America) trade agreement signed earlier this month. This agreement was also 20+ years in the making.

Closer to home, Canada’s First Ministers have been meeting in Ottawa this week. The focus was, of course, the ongoing trade disputes with the US. There appeared to be consensus and a feel of Team Canada coming out of the meetings. If there was a disappointment, it was the lack of progress on eliminating inter-provincial trade barriers. According to a recent IMF study, eliminating the barriers would increase Canada’s GDP by 7% or $210 billion. You can find the IMF report here.

Electric Vehicles outsold internal combustion vehicles for the first time in Europe. While sales still lag hybrid vehicles the move toward EVs is relentless in Europe and Asia. December saw 300,000 EVs sold in Europe capping a 50% rise in sales for 2025.

Although you wouldn’t know it in Victoria today (11c with a bit of rain) it is winter, so we’ll close of with some Vivaldi for those east of the Rockies experiencing real winter… Enjoy

Russ Lazaruk, RIAC, CIWM, CIM, FCSI

Managing Director & Portfolio Manager

![]()