It has bee a modestly positive week on both equity and bond markets. The seemingly benign trend in the equity markets, is masking what could be a rotation as the high-flying tech/AI sector falls out of favour to be replaced by more “old economy” names. For bonds, improving US inflation numbers had yields retreating on the 10 yr. bond.

| Index | Close July 4th 2024 | Close June 11th 2024 |

| S&P500 | 5,532 | 5,588 |

| TSX60 | 22,244 | 22,544 |

| Canada 10 yr. Bond Yield | 3.63% | 3.46% |

| US 10 yr. Treasury Yield | 4.36% | 4.22% |

| USD/CAD | $1.36125 | $1.36330 |

| Brent Crude | $87.41 | $87.41 |

| Gold | $2,351 | $2,416 |

| Bitcoin | $58,190 | $57,426 |

Source: Trading Economics & Factset

The US Consumer Price Index (CPI) declined 0.1% in June from May’s readings. This brought the annualized inflation down to 3%. Core inflation also came in better than expected at an annualized 3.3%. While still noy at the Fed’s 2% target, the renewed downward trend in inflation increases the likelihood of a cut in rates by the Federal Reserve in September. Any cut in US rates will give the Bank of Canada (amongst others) more room to cut rates as well.

Fed Chair Jerome Powell testified before the Senate Finance Committee this week. His testimony was seen a s relatively dovish with particular emphasis on a more balanced labour market. The unemployment rate has ticked up and as we saw last week, the turnover in the labour markets has slowed.

Canada’s unemployment rate also ticked up in June to 6.4% after the economy shed 1,400 jobs. However, wages are still on the rise, up 5.4% from the same period last year. The toughest part of the labour market is in the 15 to 24 yr. old cohort. University students looking for a summer job are having a tough go this year.

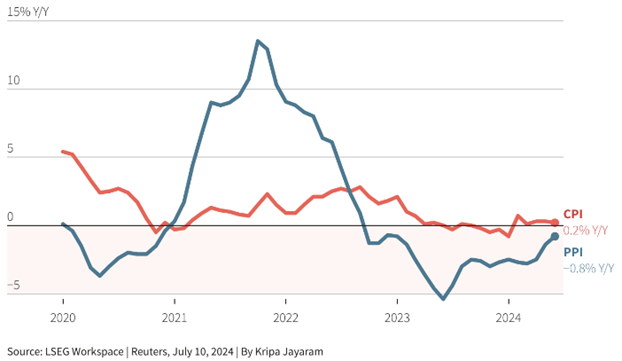

The risk of deflation persists in China with annualized CPI at 0.2% in June. The Producer Price Index (PPI) is in deflation now with prices falling 0.8% year over year. If China exports that deflation through lower prices on exported goods, it will make central banks jobs in the rest of the world much easier. Unless of course other countries decide to impose or raise tariffs.

In corporate news, the Hudson Bay Company (HBC) is buying Neiman Marcus for $2.65 billion. What makes this interesting is that Amazon and Salesforce are both taking minority positions in the transaction. Even closer to home, BC mining giant Teck Resources has received approval to sell its coal assets to Swiss mining conglomerate Glencore.

NATO held its 75th annual summit this week in Washington DC. Formed as a bulwark against the expansionist Soviet Union and Warsaw Pact it is back on centre stage in geo-politics. This week, the Alliance announced an “irreversible path” to NATO membership for Ukraine. That announcement came with new pledges of arms and cash to the beleaguered nation including an additional $500 million from Canada. Canada will also take over the training of F-16 pilots from France. Canada also announced that it has started the RFP process to acquire 12 new submarines capable of Artic patrols. We have long been a laggard in defence spending (under all governments) and the submarine announcement was part of a pledge by the Prime Minister to reach the 2% target by 2032.

One of the major focuses of the US election this year will be on immigration and especially illegal immigration. In his speeches and policy pronouncements (if you can call it that) Donald Trump has said he will deport millions of undocumented immigrants. Warwick McGibbin of the Peterson Institute for International Economics (PIIE) has modeled out what the effect would be on the US economy if the mass deportations were carried out. It is not pretty and would fuel inflation while shrinking GDP at the same time. Undocumented workers comprise 14.6% of the agricultural workforce and 5.7% of the manufacturing workforce.

We have a house full of grandchildren for the next couple of weeks. Charlotte (4) and Sophie (1) arrived from Toronto on Wednesday, so to say the least, our routines have been upended. Chaos reigns supreme but with a lot of fun and laughter mixed in. With that in mind we’ll sign of with this piece from Ace of Base….. have a great weekend

Russ Lazaruk, RIAC, CIWM, CIM, FCSI

Managing Director & Portfolio Manager

![]()