It was a mixed week on markets with the S&P500 down slightly while the bond market saw yields drop (prices up) marginally. We are now well into the summer doldrums, but traders appear to be rotating their exposure from some of the high-flying tech names to “the rest of the market”. There is one story that is stealing all the oxygen from the room, the is the attempted assassination of Donald Trump and his coronation this week as the Republican Presidential nominee. As that is well covered elsewhere, we’ll look for other interesting stories.

| Index | Close July 11th 2024 | Close June 18th 2024 |

| S&P500 | 5,588 | 5,551 |

| TSX60 | 22,544 | 22,674 |

| Canada 10 yr. Bond Yield | 3.46% | 3.41% |

| US 10 yr. Treasury Yield | 4.22% | 4.20% |

| USD/CAD | $1.36330 | $1.37119 |

| Brent Crude | $87.41 | $84.74 |

| Gold | $2,416 | $2,444 |

| Bitcoin | $57,426 | $63,655 |

Source: Trading Economics & Factset

Topping the list is the fall in Canada’s inflation rate (CPI) in June to 2.7%. This beat expectations of 2.8% reading. Core inflation (excluding food and energy) was pegged at 2.9%. This raises the probability of another 25bps rate cut by the Bank of Canada at their next meeting on July 24th. If the Bank does cut in July, it will put some pressure on the Loonie as the rate differential with the US widens out.

Overseas, the European Central Bank opted to hold rates steady. The ECB has cut rates once already and pundits expect another cut in September. However, in remarks after the announcement, ECB President Christine Lagarde pointed to continued wage pressures and services inflation that kept the Bank on the sidelines this week.

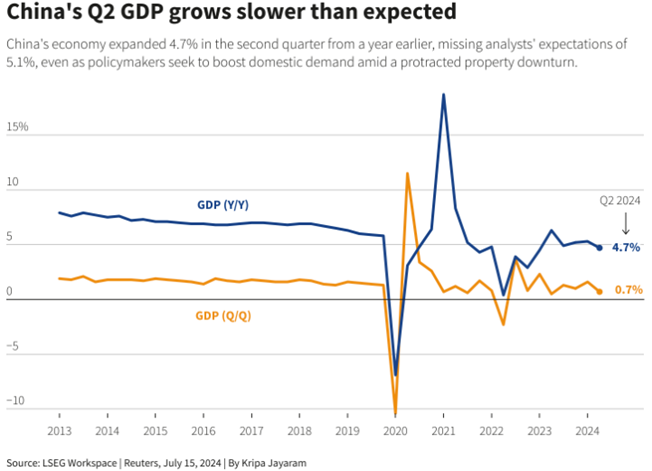

We’ve been keeping a wary eye on China’s economic prospects for some time. The latest GDP numbers don’t give us an sense of optimism, falling below expectations to an annualized 4.7% growth in the 2nd quarter. While the real estate sector is a continuing mess, retail sales are showing signs of outright deflation. It remains to be seen what stimulus measures the central government will put in place but with a shrinking workforce & population, high youth unemployment, and a retrenching consumer they have their work cut out for them.

Playing into both the China story and the rotation we seem to be experiencing in the equity markets is an announcement by the Biden administration of new restriction on the sale of semiconductor equipment to China. While there were hints of a rotation based on high valuations, the latest policy move has added some impetus. Not helping matters was Donald Trump saying that Taiwan, home the world’s largest semi-conductor manufacturers, could be on its own if China decided to invade.

Earlier this month Goldman Sachs (GS) produced a paper calling into question the hype around artificial intelligence (AI). The arguments are somewhat nuanced and there is some internal debate within GS. The Coles Notes for the more pessimistic view is that there will be $1 Trillion spent on developing the technology with little return on the investment for up to 25 years. In essence they see a very expensive piece of technology displacing already low-cost jobs or tasks. You can read more here. Food for thought.

Here on the home front, we are still entertaining Charlotte and Sophie with trips to the Children’s Zoo at Beacon Hill Park, time at Willows Beach (the water is still cold), and regular visits to the Beacon Drive-in for ice-cream. In between, I did manage to do another triathlon at Elk Lake, where the water (blue-green algae notwithstanding) was perfect for the swim. Summer is in full swing, so we’ll sign off with the Swimming Song from Loudon Wainwright III… Enjoy

Russ Lazaruk, RIAC, CIWM, CIM, FCSI

Managing Director & Portfolio Manager

![]()