This week, with Russ away visiting family in Central Canada, I (Sam Colby) am stepping in. Markets continued their upward climb, with both the S&P 500 and Nasdaq closing at record highs. Oil prices ticked up on renewed tensions between Israel and Iran, though not to levels that suggest immediate market alarm. Bitcoin held steady near $109,000, showing resilience amid global uncertainty and sustained institutional interest. Bond markets remained largely unchanged, with yields staying range-bound as investors await clearer direction from central banks. Despite the strong headline numbers, sentiment remains – cautious investors are keeping a close eye on the Federal Reserve’s next move and the looming expiration of Trump’s tariff pause.

| Index | Close June 26th 2025 | Close July 3rd 2025 |

| S&P500 | 6,141 | 6,226.78 |

| TSX60 | 26,752 | 26,889 |

| Canada 10 yr. Bond Yield | 3.34% | 3.36% |

| US 10 yr. Treasury Yield | 4.25% | 4.26% |

| USD/CAD | $1.36336 | $1.3634 |

| Brent Crude | $67.84 | $68.26 |

| Gold | $3,330 | $3,325 |

| Bitcoin | $107,906 | $109,445 |

Source: Trading Economics & Factset

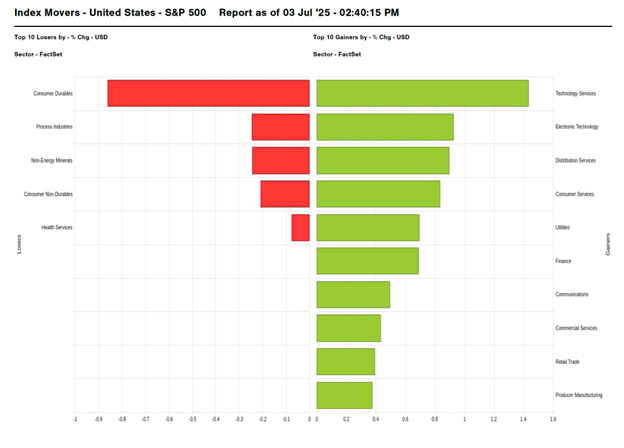

The S&P 500 and Nasdaq hit all-time highs this week, buoyed by strong gains in large-cap tech stocks, particularly Nvidia and Microsoft. Nvidia surged on continued AI momentum, while Microsoft benefited from robust cloud and enterprise demand. Apple, however, lagged behind its peers, weighed down by concerns over slowing iPhone sales and regulatory scrutiny. The Dow Jones Industrial Average underperformed slightly, held back by weakness in healthcare names like UnitedHealth and Merck, which have struggled amid policy uncertainty and earnings pressure. The divergence highlights a broader rotation underway, as investors weigh high-growth tech optimism against more defensive sectors.

Chart Source: FactSet

Meanwhile, tensions are rising as the July 9 tariff deadline approaches. Trump’s 90-day pause on new tariffs is set to expire, and while Vietnam has secured a partial deal, talks with India remain unresolved. If new tariffs are imposed—especially on key partners like India—analysts expect renewed market volatility, with potential ripple effects on inflation and global supply chains. The uncertainty alone is already weighing on global trade outlooks.

Prime Minister Mark Carney used his first Canada Day in office to double down on his “Build, Baby, Build” agenda. He touted Canada’s resilience and economic transformation while taking veiled shots at Trump’s trade policies. Behind the scenes, Ottawa quietly dropped its digital services tax to keep U.S. negotiations alive. Sentiment in Canada is improving—small business confidence is up, and consumer optimism is at its highest since early 2024. But growth remains tepid, and the threat of a modest recession still looms.

Trump’s “Big Beautiful Bill” Passes. After weeks of drama, the U.S. House passed Trump’s massive tax and spending bill on July 3. The bill includes $4.5 trillion in tax cuts—primarily benefiting high-income earners—alongside $150 billion in new funding for border enforcement. It also rolls back green energy incentives and imposes stricter work requirements for Medicaid and food stamp recipients. Electric vehicle subsidies are eliminated, and automakers will face reduced penalties for fuel efficiency violations. Despite internal GOP divisions, the bill passed with only two Republicans joining all Democrats in opposition. Trump is expected to sign the legislation on July 4, in a move he’s framing as a patriotic win—fireworks and all.

Sevilla Summit: A Global Reset? The UN’s Fourth International Conference on Financing for Development wrapped up in Sevilla this week with the adoption of the Sevilla Commitment—a sweeping agreement aimed at tackling global debt, climate financing, and inequality. The deal includes over 130 initiatives, such as a global hub for debt swaps, a “debt pause” alliance, and a solidarity levy on private jets to fund development goals. Notably, the United States declined to participate, citing sovereignty concerns—leaving the rest of the world to move forward without Washington.

AI is evolving at breakneck speed. This week, Meta launched its new “Superintelligence Labs” following a $14.3 billion investment in Scale AI, signaling its ambition to lead the next wave of artificial intelligence. Meanwhile, Microsoft made headlines with claims that its diagnostic AI now outperforms doctors by a factor of four in certain clinical settings. The four forces driving AI—compute, data, algorithms, and robotics—are converging faster than ever. But as innovation accelerates, so do concerns: regulators and ethicists warn that the pace of change may be outstripping society’s ability to keep up.

Summer seems to finally have arrived in British Columbia over the long weekend. Whether you spent it by the water, in the mountains, or simply soaking up the sun in your backyard, it feels like the season has truly begun. I’ll leave you with a classic to match the mood – a perfect soundtrack for the days ahead.

Sam Colby

Associate

![]()