It was a mixed week on the markets with the S&P500 getting a boost from improving inflation numbers while Toronto has been struggling with soft commodity prices and worries about loan delinquencies at the banks. Interest rates are trending down on the US CPI release earlier this week.

| Index | Close June 6th 2024 | Close June 13th 2024 |

| S&P500 | 5,353 | 5,431 |

| TSX60 | 22,229 | 21,698 |

| Canada 10 yr. Bond Yield | 3.42% | 3.35% |

| US 10 yr. Treasury Yield | 4.29% | 4.25% |

| USD/CAD | $1.36698 | $1.37374 |

| Brent Crude | $79.83 | $82.12 |

| Gold | $2,373 | $2,304 |

| Bitcoin | $70,957 | $66,836 |

Source: Trading Economics & Factset

The lead story this week (for us finance nerds) was the improving inflation picture in the US. The May Consumer Price Index (CPI) reading was flat month over month (MoM) and up 3.3% year over year (YoY). The story was the similar for core CPI with a 0.2% increase MoM and 3.5% YoY. All readings were below expectations. Thursday’s Producer Price Index (PPI) numbers were even more encouraging which saw a 0.2% decline MoM in prices. The PPI is up 2.2% YoY. It will take some time for the drop in producer prices to trickly through to consumers.

All of this, combined with today’s increase in unemployment claims, has investors salivating about coming interest rate cuts. The Fed is not about to get ahead of itself though. Its internal survey of FOMC members (the Dot Plot) shows one expected rate cut, while the market is starting to bet on (hope for) two cuts. In his post meeting news conference Jay Powell re-iterated they need to see a sustained path towards the Fed’s goal of 2% inflation.

All of this sets up a bit of a conundrum for investors. A softening labour market and falling prices will not be good for earnings. But a lower interest rate will make those earnings worth more today via the discount rate applied to them. It will also present a conundrum to the Bank of Canada (amongst others). If Canadian rates get too far ahead of the US, it will weaken our dollar. (Which has already shed a penny after our rate cut.) The weaker dollar may be good for exports but would also be inflationary as the price of imported goods or services goes up.

Elections seem to be all the rage these days. Europe just completed elections for the European Parliament which saw a shift to the right. The surge from populist far-right parties was not as great as feared but was meaningful. The governance structure of the EU is “complicated”. There are 3 governing bodies, each with its own areas of responsibility and authority. There is the European Parliament (elected by the citizens), the European Council (heads of government or state) and the European Commission (essentially the bureaucracy with a governing cabinet).

The strong showing of Marine Le Pen’s populist National Rally in France prompted Emmanuel Macron to call a snap parliamentary election. His job as President is not up for grabs and he will be able to finish out his second (and final) 6-year mandate. It is a high risk move on his part as further gains by the National Rally could impede his efforts at reform.

There is more consolidation coming in the Canadian banking sector. National Bank has announced a bid to buy Canadian Western Bank for C$5 billion. The deal was a win for CWB shareholders and will raise National’s presence in western Canada. It does reduce competition in an already concentrated sector of the economy. I understand the business case for the merger. I remain unconvinced it is good public policy. The deal still needs shareholder and regulatory approval.

There was a striking divergence in the treatment of shareholders in the automotive sector this week. GM increased their dividend AND their share buyback program. Both very shareholder friendly. Meanwhile, over at Tesla, shareholders, in a bewildering display of magnanimity, have voted a $56 Billion pay package for Elon Musk.

Here’s 2 bits of good news. The crime rate in the US has plummeted 15% in the first 3 months of this year. The crime rate had been in decline since the 1990’s until the pandemic. It looks like that trend is back in place. The next piece counts as good news in my books. The G7 group of nations will “lend” Ukraine $50 billion from seized Russian assets to aid the beleaguered nation in both its war efforts and rebuilding.

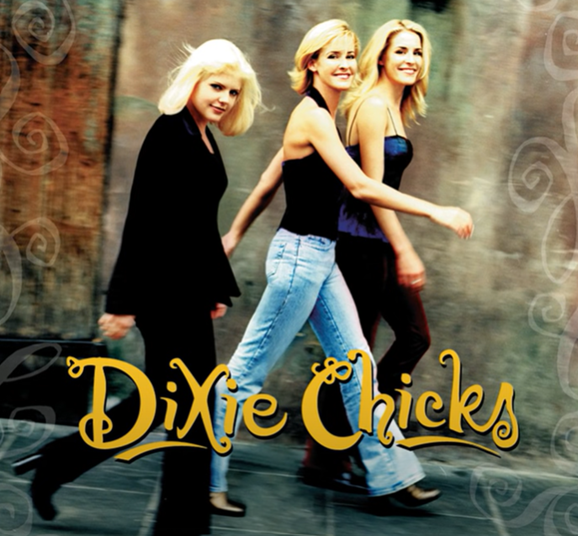

One of my writing (aka concentration) hacks is music. The theme while I’ve been writing this week’s edition has been The Chicks (Dixie Chicks). I’ll leave you with dreams of wide-open spaces… enjoy.

Russ Lazaruk, RIAC, CIWM, CIM, FCSI

Managing Director & Portfolio Manager

![]()