It was a relatively quiet week on equity and bond markets this week. The S&P500 was mildly positive while the TSX drifted a bit lower. Bond yields were mostly flat in the US awhile Canada saw slightly higher rates thanks to higher-than-expected inflation numbers. The big loser has been Bitcoin which is down about $10,000 from its recent highs.

| Index | Close June 20th 2024 | Close June 27th 2024 |

| S&P500 | 5,475 | 5,488 |

| TSX60 | 22,569 | 21,942 |

| Canada 10 yr. Bond Yield | 3.38% | 3.50% |

| US 10 yr. Treasury Yield | 4.27% | 4.29% |

| USD/CAD | $1.36985 | $1.36945 |

| Brent Crude | $85.59 | $86.28 |

| Gold | $2,360 | $2,328 |

| Bitcoin | $65,038 | $61,442 |

Source: Trading Economics & Factset

Inflation is not dead yet and to be honest, we shouldn’t expect it to be. In Canada, May’s annualized inflation rate ticked up to 2.9%, which was a shock to may observers. It makes the prospect of a July rate cut unlikely. We aren’t alone though. In Australia inflation hit 4% well above the 3.6% rate in April and market expectations of 3.8%. The conversation in Australia isn’t about delayed rate cuts, but if there will be rate hikes. Tomorrow the world will be focused on the US which releases its Personal Consumption Expenditures (PCE) numbers. Expectations are for a benign reading. A higher than anticipated reading will not be good for equity or bond markets.

Housing affordability is not just a Canadian issue. While some of the drivers are different, the US is also suffering from an affordability “crisis”. Economist at Bank of America predict that the market will not become unstuck until 2026. Somewhat counter-intuitively, the inventory of new houses is at its highest level since 2008 as buyers sit on the sidelines waiting for either prices or mortgage rates to come down. It is a similar story with existing home sales dropping 0.7% from May.

There was a lot of action in the automotive industry this week. Volkswagen and EV maker Rivian announced a partnership to collaborate on software development. The deal includes a $5 billion investment by VW into Rivian. VW has been struggling to make the transition to EVs while Rivian has just been struggling. The European Union and China are in talks over potential EU tariffs on Chinese made EVs. The spectre of a flood of cheap, subsidized Chinese EVs has countries moving to protect their domestic car makers.

The car industry in North America, suffered a major cyber security incident. CDK Global provides software and back-office systems to car dealerships across North America. A cyber attack has taken their systems off-line affecting ~15,000 car dealerships across the US and Canada. Some dealerships have even resorted to using pen and paper (!!!) to continue operating. In all seriousness, cyber security is an on-going issue that will continue to plague us, with real-world consequences.

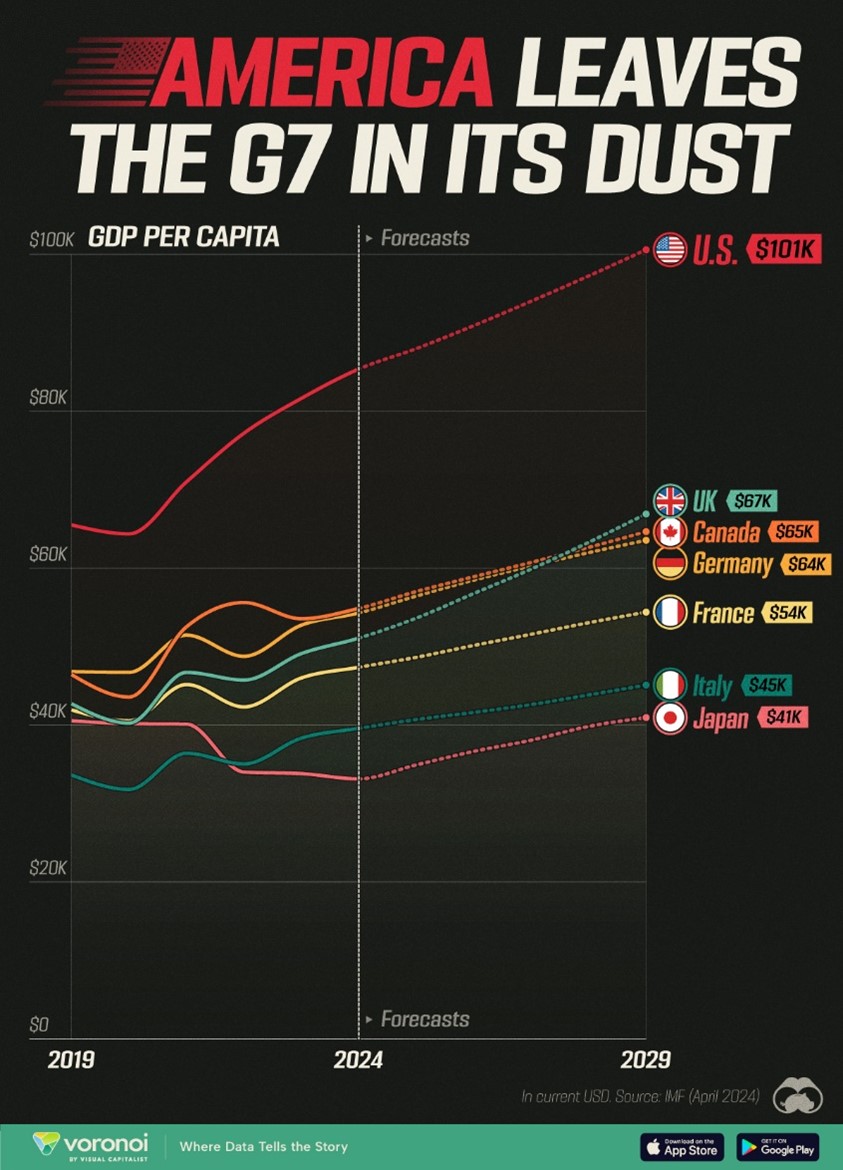

Bank of Canada Governor was on the speaking circuit again this week. In a speech to the Winnipeg Chamber of Commerce he echoed many of the thoughts of his Deputy, Carolyn Rogers, on Canada’s lack of productivity. He pointed to a lack of investment by businesses in worker productivity where Canadian businesses lag their US counterparts by a wide margin. Yes, we are better than many of our G7 peers as the chart below shows, but there is lots of room for improvement.

Chart Courtesy Visual Capitalist

Visual Capitalist, which is a treasure trove of fun charts, also posted a study of where the millionaires of the world are moving. This one will be a shock to those that claim everything is broken as Canada is a net recipient of wealthy emigres. Not surprisingly, the losers are those countries with either poor rule of law, or in the case of the UK a disastrous flirtation with populism that led to Brexit. As expected, warm sunny tax havens had their share of in-migration. I was surprised to see the US ranked not far ahead of Canada.

Chart Courtesy Visual Capitalist

This long-weekend our extended family will have 2 celebrations. One for Canada Day and the other for my wife’s sister Madeleine who was made a Member of the Order of Canada this week for her work as a teacher and Choral Director. Congrats Mads – an honour well deserved.

With a weekend of barbeques and assorted Canada Day festivities ahead, I’ll leave you with Canada’s first National Anthem….. Enjoy the Canada Day weekend!

Russ Lazaruk, RIAC, CIWM, CIM, FCSI

Managing Director & Portfolio Manager

![]()