Equity markets are still positive for the week as I write this on Thursday afternoon. Bond markets have seen yields on the 10 yrs. climb a bit and both oil and gold are higher as well. Equity markets had rallied earlier in the week on speculation that the coming tariffs would be lighter and more targeted than earlier feared. That brief moment of optimism was squashed with the announcement of a 25% tariff on all autos being imported to the US.

| Index | Close Mar. 20th 2025 | Close Mar. 27th 2025 |

| S&P500 | 5,661 | 5,695 |

| TSX60 | 25,060 | 25,161 |

| Canada 10 yr. Bond Yield | 3.03% | 3.11% |

| US 10 yr. Treasury Yield | 4.24% | 4.37% |

| USD/CAD | $1.43151 | $1.43091 |

| Brent Crude | $72.23 | $73.94 |

| Gold | $3,044 | $3,057 |

| Bitcoin | $84,527 | $87,254 |

Source: Trading Economics & Factset

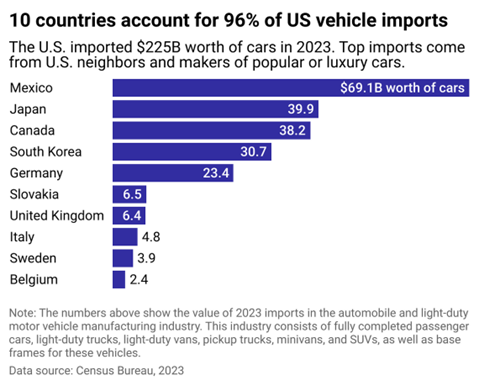

On Wednesday, Donald Trump signed an executive order putting a 25% import tariff on all automobiles being imported to the US. While this will be a major blow to Canada, with over 100,000 jobs at risk, the biggest loser will be Mexico which ships 2x the number of cars to the US as Canada. The tariffs still need to be fine-tuned to account for US content in cars built in Canada and Mexico.

Oil prices continued to rise this week. The immediate reasons are better production discipline amongst OPEC producers, tightening sanctions on Iran and Venezuela, and a draw-down in inventories. There is a new factor entering the mix. The US shale oil that supplied so much of the US’ energy needs over the past 2 decades is starting to decline. New technologies, such as injecting carbon-dioxide into the formations may extend the life of the fields but the easy money has been made.

As the US reduces its support of Ukraine, Europe is stepping up theirs. The US claims to have brokered a partial truce between Russia & Ukraine the stops the attacks on energy infrastructure and shipping in the Black Sea. So far it has had no effect. President Trump has already agreed to ease some sanctions on Russia before securing a meaningful agreement. (Art of the Deal???) To counter this, French President Emmanuel Macron has brought together a “Coalition of the Willing to support Ukraine. France, Britain and other countries have pledged “reassurance troops” if a peace treaty is signed.

These next two items epitomize the change in retailing in Canada. The Hudson Bay Co. is in partial liquidation after 355 years of fur trading and retailing. The company is trying to save 6 flagship stores. While this is going on, Canadian on-line shopping behemoth Shopify is moving its US listing from the New York Stock Exchange (NYSE) to the NASDAQ. The company may be eligible for inclusion in the NASDAQ100 index. That would make it the 25th largest company in the tech heavy index.

We are in Toronto and Montreal for the next 2 weeks visiting kids and grandkids. Sophie, who is now 2, has chosen this week’s song….. We get to hear it a lot, so we’ll share the joy

Russ Lazaruk, RIAC, CIWM, CIM, FCSI

Managing Director & Portfolio Manager

![]()