Despite some volatility earlier in the week markets have put in a decent showing. Both bond and equity markets moved higher but the stars have been gold and crypto currencies. New crypto / Bitcoin ETFs in the US have added buying pressure to the space while gold is reacting to both the prospect of lower rates (cheaper carry) and a hedge against the madness in the world.

| Index | Close Feb. 29th 2024 | Close Mar. 7th 2024 |

| S&P500 | 5,096 | 5,148 |

| TSX60 | 21,364 | 21,762 |

| Canada 10 yr. Bond Yield | 3.49% | 3.37% |

| US 10 yr. Treasury Yield | 4.25% | 4.09% |

| USD/CAD | $1.35750 | $1.34581 |

| Brent Crude | $81.91 | $83.04 |

| Gold | $2,043 | $2,159 |

| Bitcoin | $61,445 | $67,399 |

Source: Trading Economics & S&P Cap IQ

The Bank of Canada held rates steady this week, saying it was too early for a cut despite inflation dropping to 2.9%. They need to see a sustained drop in inflation before cutting interest rates. They will also continue their quantitative tightening, reducing liquidity in the bond market. The European Central Bank (ECB) trod the same path while acknowledging that inflation was subsiding. Central Bankers are well aware of the dangers in cutting rates too early and having inflation rebound. We’ll hope they don’t wait too long and tip us into recession.

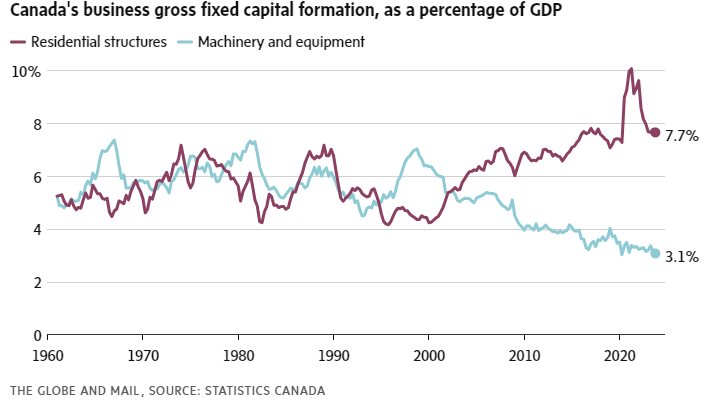

We’ve written a few times on Canada’s productivity decline. Globe and Mail columnist, Andrew Coyne, wrote a very good piece on the issue last Saturday. The problem is complex, and the fixes are not solely in the purview of government. (also, our federal system confuses which level of government has the levers, if any). The chart below illustrates that our capital investment is heavily skewed to real estate rather than new machinery & equipment that improves productivity.

The debate anguish over productivity has led to business leaders calling for pension funds to direct more of their capital to Canada. Foreign investment restrictions were lifted on pensions and registered accounts in 2005. Prior to this we were limited to 30% foreign content. The restriction was lifted in large part because Canada is less than 3% of the global economy and we were unable to optimize our retirement portfolios. While I can sympathize with the business community, our responsibility, whether as pension fund managers or portfolio managers is to the end client or beneficiary. Currently Canadian pension funds invest about 25% of their capital in Canada, which can be argued is already an over allocation. I’ll save the rest of my rant for another week.

South of the 49th if it wasn’t clear before it is now. The presidential election will be a Biden / Trump rematch as Republican contender Nikki Hayley has suspended her campaign after losing all but one state in this week’s primaries. In a break with usual protocol, she has not endorsed her party’s presumptive nominee. For those that are obsessed with US politics, Joe Biden will deliver the State of the Union address Thursday evening (I’m writing this Thursday afternoon).

The tax rules for Trusts are changing and you may be affected. The Canada Revenue Agency (CRA) has expanded the definition of what constitutes a Canadian Resident Trust and the reporting requirements. The most far-reaching change involves “bare trusts”. These are often informal arrangements where someone is holding or managing an asset for someone else, such as a joint account for a parent or an in-trust-for account for a minor child. The linked article is a good starting point. If you are not sure if this will apply to you, reach out to your tax professional. There are penalties for being offside.

The incorporation of a business or professional practice is done for a variety of reasons, limited liability often being the main motivator. Tax savings are of course a close second. The ability of the owner to take income in the form of dividends or receive all or part of the proceeds of the sale of the business tax-free are attractive. An often-overlooked benefit is the ability to increase your retirement savings by establishing an Individual Pension Plan (IPP) rather than using RRSPs.

An IPP is a defined benefit pension established for the benefit of induvial owners or key employees. They have significantly high contribution limits and provide a defined benefit upon retirement. The IPPs are funded by the corporation and are a deductible expense. This article from the National Post details some of the differences between using an IPP vs. RRSP. If you think this may be an option, we would be happy to provide more details.

I’ll be working from Toronto next week (along with visiting grandchildren) so I’ll leave you with this cheery number about Hogtown, where it is warmer than Victoria this week…. Enjoy

Russ Lazaruk, RIAC, CIWM, CIM, FCSI

Managing Director & Portfolio Manager

Tel 250.999.3329.

![]()

www.ncpdfo.com