It was a good week for US equities as the tariff war was dialled back. Bonds were a bit mixed with US yields up on the week but Canada essentially flat. Oil climbed earlier in the week before falling back on hopes for a US / Iran nuclear deal. Most investors are in a wait and see mode, not taking big bets in any one direction.

| Index | Close May 8th 2025 | Close May 15th 2025 |

| S&P500 | 5,666 | 5,919 |

| TSX60 | 25,254 | 25,897 |

| Canada 10 yr. Bond Yield | 3.19% | 3.17% |

| US 10 yr. Treasury Yield | 4.38% | 4.44% |

| USD/CAD | $1.39249 | $1.39625 |

| Brent Crude | $63.22 | $63.03 |

| Gold | $3,306 | $3,240 |

| Bitcoin | $103,514 | $103,193 |

Source: Trading Economics & Factset

Tariffs and rhetoric were both dialled back this week in the US / China trade dispute. Meetings in Switzerland brought some saner heads together. The US has dropped tariffs on imports from China to 30% from 145% while China has dropped their tariffs from 125% to 10%. This reduction is only for 90 days, allowing negotiations to continue. The announcement sparked an immediate rally in US equities. While markets were (are) euphoric about the change, it is only temporary, and we don’t know what the final (if any) deal will look like.

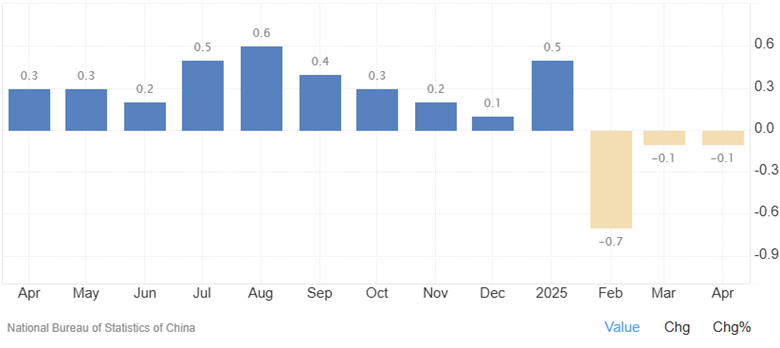

China has been in deflation for the past 3 months with April showing a 0.1% decline in consumer prices. China continues to struggle with weak domestic demand, persistent employment uncertainty and of course trade woes.

China CPI change YOY

In the US inflation was a somewhat benign 2.3% in April, the lowest since February 2021. Core CPI was 2.8% meeting expectations. All this before the impact of tariffs is felt. The cost of housing, which accounts for 1/3 of the index, continues to be problematic and accounted for more than half of the move. At the wholesale level, the Producer Price Index (PPI) was benign on the surface but showed some strains as you dug down deeper. Stripping out volatile food and energy prices, goods prices have been accelerating for the past few months.

US consumers will see the impact of tariffs in the next 4 weeks. Walmart has said that prices will be going up soon to pay for the tariffs. Retail margins are thin and there is only so much the stores (not just Walmart) can absorb. Will the cross-border shopping flows reverse as Americans look for cheaper, tariff free goods in Canada? Smuggling is an ancient, if not very honourable, profession.

The election is over, and PM Carney has been sworn in along with his new cabinet. The cabinet is a mix of old and new. Dominic Leblanc maintains the most urgent file on US / Canada trade file, Anita Anand is promoted to Foreign Affairs while Melanie Joly moves to Industry and Trade. Greater Victoria gets a junior cabinet member (Secretary of State) in rookie MP Stephanie McLean (Esquimalt-Saanich-Sooke). The new cabinet has a different structure with 2 tiers of ministers, which in theory will make it more agile.

Tax season is over (for individuals and trusts) and you will have now received your Notice of Assessment (NOA) from the CRA. If you haven’t, you can access it from the CRA portal here. If you haven’t registered for a CRA ID & password, don’t fret, the system allows you to access your account using a sign-in partner (on-line banking). On your NOA you will see what your available RRSP and TFSA room is for the coming year. For many clients, we make the contributions now, while it is top of mind. If this works for you, let us know.

With tariffs about to give the smuggling trade a boost, we’ll close with this piece from Cornwall (UK), famous for pirates, smugglers, and ship wreckers…. Have a great weekend,

Russ Lazaruk, RIAC, CIWM, CIM, FCSI

Managing Director & Portfolio Manager

![]()