It was a modestly negative week for most asset classes. The outlier was Bitcoin that hit a new all time high. Valuations had become stretched after a solid post “Liberation Day” rally. Also playing into the sentiment are concerns over the US budget (read on for more colour) showing up in the bond markets.

| Index | Close May 15th 2025 | Close May 22nd 2025 |

| S&P500 | 5,919 | 5,850 |

| TSX60 | 25,897 | 25,903 |

| Canada 10 yr. Bond Yield | 3.17% | 3.37% |

| US 10 yr. Treasury Yield | 4.44% | 4.53% |

| USD/CAD | $1.39625 | $1.38697 |

| Brent Crude | $63.03 | $64.05 |

| Gold | $3,240 | $3,294 |

| Bitcoin | $103,193 | $111,191 |

Source: Trading Economics & Factset

We’ll start in Canada where headline inflation fell to 1.7%. Before we get too excited, most of the fall in inflation (CPI) was due to the cancellation of the consumer carbon tax. Core inflation (CPI-trim), which strips out more volatile items such as energy, rose to 3.1%. This will complicate the Bank of Canada’s next rate decision with the labour market showing signs of weakness.

To some, it is a Big Beautiful Bill. To others it is a pathway to penury. We are talking about the US budget that just made it through the US Congressional House of Representatives. The Bill now needs to be passed by the Senate. According to the non-partisan Congressional Budget Office (CBO) it will add $2.3 Trillion to the deficit over the next 10 years. The bill extends tax cuts and raises spending for defense. There are spending cuts, but not enough to offset the tax cuts or spending increases.

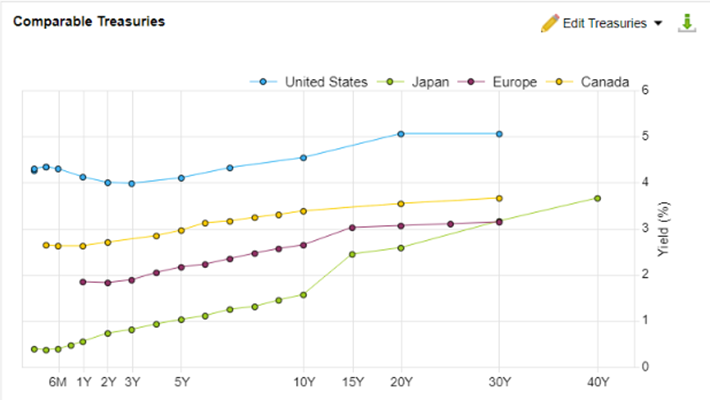

The budget comes after rating agency Moody’s downgraded US government debt by 1 notch. Moody’s had been the last credit rating agency to maintain a AAA rating on US bonds & bills. The outlook has also changed to negative from stable. The reaction of the bond market to both the budget and downgrade has been to increase the yields on US Treasuries (bonds). The yield on the US 30 yr. treasury is currently over 5% vs. under 4% in September of last year. The chart below shows the difference (spread) between various sovereign bonds.

Source: Factset

Consumer debt has also been rising in the US (and Canada) post the 2008/9 financial crisis and now stands at $18.2 trillion. Of that, $13.2 trillion is housing debt (mortgages & HELOCs) and $5 trillion in non-housing debt (car loans, credit cards, etc.) Delinquencies have also taken a sharp turn upwards. Neither of these issues will cause an immediate disruption in the markets but both are canaries in the coal mine that need to be watched.

Corporate debt issuers in the US are now turning to Euro markets to raise funds. Alphabet (Google) recently issues bonds in Euros and dollars. They will pay a coupon of 3.375% on the Euro debt and 4.5% on the dollar debt. That spread will narrow a bit with currency hedging costs, but on multi-billion loans, the savings are still significant.

All of this and more was on the table at the G7 finance minister’s meetings in Banff this week. Meeting in advance of the country heads meeting in Kananaskis in June, finance ministers worked on everything from Ukraine to tariffs. According to participants, the meetings were productive, and they managed to put together a joint communique.

Jamie Dimon, head of JP Morgan Chase, raised the angst level this week. In an interview for Bloomberg TV, he raised the spectre of stagflation. He didn’t make a prediction that we would get there but raised the level of probability significantly.

Hilary and I welcomed a new grandson into the world this week, Henry Waylon. So, we will close off with a piece from one of his namesakes, Waylon Jennings…. Have a great weekend.

Russ Lazaruk, RIAC, CIWM, CIM, FCSI

Managing Director & Portfolio Manager

![]()