It was a mixed week, with markets feeling pretty good until the latest US GDP growth report was released on Wednesday. Growth for the first quarter was lower than expected as consumers curtailed their spending habits. At the same time, the Fed’s preferred inflation metric, personal consumption expenditures (PCE) rose 3.3 percent (annualized) in Q1. While below expectations it is still too high to give any credence to interest rate cuts. The bottom line is that there is a lot of uncertainty around the economy and traders are taking bets off the table.

| Index | Close May 24th 2024 | Close May 30th 2024 |

| S&P500 | 5,268 | 5,232 |

| TSX60 | 22,201 | 22,072 |

| Canada 10 yr. Bond Yield | 3.65% | 3.74% |

| US 10 yr. Treasury Yield | 4.48% | 4.55% |

| USD/CAD | $1.36949 | $1.36650 |

| Brent Crude | $81.31 | $81.90 |

| Gold | $2,328 | $2,342 |

| Bitcoin | $65,561 | $68,179 |

Source: Trading Economics & Factset

One of the many roles we play is that of risk manager. (Something Lehman Bros. wished they had taken seriously). It is critical to how we manage portfolios. This week our CEO, Grant Colby, thought it was time to publish something about it. In the spirit of efficiency, he decided that he could combine thoughts on risk management with a lesson on the increasing power of AI. The experiment was success, an engaging article on the travails of a risk manager, written by Microsoft’s AI engine, Co-pilot.

This week I attended the Responible Investment Association (RIA) conference in Vancouver. The conference covers a wide range of topics from ESG, to shareholder engagement & activism, to impact investing. The attendees are an interesting mix of advisors, institutional fund managers, and endowments. Here are some of the things I found interesting, dry though they may be to everyone else.

Data is the lifeblood of rational decision making. Technology makes our ability to collect and analyze infinitely easier. AI (more properly machine learning or ML) speeds up the process and allows us to get more granular. When applied to ESG issues, it can give us a much more accurate look into things such as carbon emissions including Scope 2 & 3. Presenting at the conference, Cindy Rose & Anders Knox of Oxford’s Commission on Sustainability Data gave us an insight on the future of data collection and verification. Essentially the project will collect and verify data from a company’s operations in a secure manner. The ability to use standardized and verifiable data is the holy grail for the RI world.

One of the most engaging speakers was Michael O’Leary who led the successful 2021 initiative to change the Board of Directors of Exxon. In his remarks he emphasized that ESG or responsible investing (RI) needs to be driven economic arguments and business fundamentals. Activist shareholders need to present a clear theory of change if they are to be successful. He also pointed out that although CEOs and company reports may have gone quiet on their sustainability initiatives, the work is still ongoing at the operational level and growing. He further argued that divestment does little to change things. It merely shifts a problem off your balance sheet onto someone else’s. His argument unsurprisingly is that shareholder activism is far more effective at fomenting change. You can read more on his thoughts around “citizen capitalism” in his book Accountable.

A session on the Energy Industry Transition covered another wide range of topics from insuring new ventures to the availability of capital. (It’s a problem in Canada for growth companies). One salient takeaway was the need for new technologies to be scalable. Scalability reduces unit costs which becomes a virtuous circle. The example given is solar which because of its scalability has reduced its costs by 99% since inception. Solutions that require large bespoke engineering solutions will not be viable. That includes large nuclear and carbon capture and storage, (CCSU). Small modular nuclear is scalable though and has a future.

I’ll leave it there, but if you want to discuss some of the other take-aways, do get in touch.

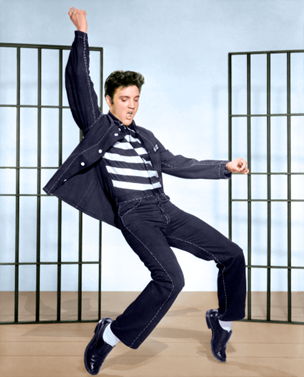

In breaking news as I finish off this week’s missive is that Donald Trump has been found guilty on all 34 charges in his criminal fraud trial. We’ll close off with this classic from Elvis Presley… enjoy and have a great weekend.

Russ Lazaruk, RIAC, CIWM, CIM, FCSI

Managing Director & Portfolio Manager

![]()