It was another positive week on both equity and bond markets as inflation continues to moderate. Investors are cheering on the prospects of an end to rate hikes and the possibility of cuts. I say, not so fast, if anything rates have normalized and there is still a lot of air to be let out of asset prices. But that is one opinion, and the future has a habit of humbling even the most ardently held opinions.

| Index | Close Nov. 10th 2023 | Close Nov. 16th 2023 |

| S&P500 | 4,415 | 4,513 |

| TSX60 | 19,654 | 20,053 |

| Canada 10 yr. Bond Yield | 3.84 | 3.68 |

| US 10 yr. Treasury Yield | 4.63% | 4.44% |

| USD/CAD | $1.37990 | $1.37516 |

| Brent Crude | $81.43 | $77.56 |

| Gold | $1,937 | $1,986 |

| Bitcoin | $37,290 | $36,487 |

Source: S&P Cap IQ and Trader Economics

Headline inflation in the US dropped to an annualized 3.2% vs. an expected 3.3% in October. This was down from September’s rate of 3.7%. Core inflation is still a bit higher at 4% but also trending down. The UK also celebrated falling inflation with October’s rate at 4.6%, down sharply from 6.7% in September. This is the lowest in 2 years. All good news.

Helping drive inflation lower now and going forward is a softening of the US labour market. Weekly new jobless claims rose by 13,000 to 231,000. Continuing claims rose as well by 32,000 to 1.865 million. The unemployment rate rose to a 2 year high of 3.9%, but there remain 1.5 job openings for every unemployed person. Part of this can be attributed to a skills mismatch. While this is not good news if you are unemployed, it is good news to central bankers and traders.

Staying on the cooling theme (it is almost winter after all), real estate in Canada is feeling the pinch of higher rates. Both sales and the number of listings are down across most of the country. Atlantic Canada is a bit of an exception, as a lower priced housing market has drawn buyers in. Calgary I also more buoyant thanks to a robust economy. The number of sales in Victoria declined by 13% in October vs. September.

The dysfunction in the US House of Representatives has not gone away, but newly elected Speaker of the House, Mike Johnson, cobbled together enough votes to pass an interim spending bill, preventing a shutdown. The Republican’s have a slim majority in the House, but internal divisions have prevented them advancing anything resembling an agenda. The Bill has passed the Senate and been signed into law by the President, but just kicks the can down the road to January.

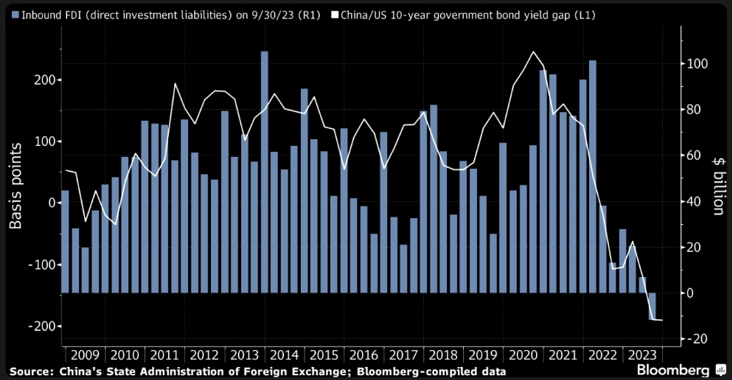

Presidents Biden and Xi Jinping met in San Francisco this week. The meeting was on the sidelines of the APEC conference being held there. While it was on the sidelines, it was not a sideshow and overshadowed the conference itself. There were no momentous breakthroughs to mend a relationship that is at a 50-year low but, there were positive developments. Military to military communications have been re-instated and a direct line between the 2 leaders established. This is probably the most important geo-political relationship in the world, so any effort to improve it should be applauded. Both sides have incentive to make it work with China needing it more than the US as this chart illustrates.

Ottawa, according to Alan Fotheringham, is the city that fun forgot. Tired of the moniker, the city is hiring a “nightlife commissioner” to spice things up a bit. Truly great cities don’t roll up the sidewalks at 6pm and a vibrant nightlife is an attractant to both tourists and workers. Now if the city could only fix the new light rail transit system that has been plagued with problems.

Will Miami overtake New York as the finance capital of the US? According to hedge fund mogul Ken Griffin, the answer is yes. Several major financial companies have made the move including Griffin’s Citadel. Climate is one reason, but the lack of state taxes is another. Even Jeff Bezos is making the move, though he claims it is to be closer to his parents.

With thoughts of golden beaches and balmy breezes, we’ll close off with this piece from Jimmy Buffett, and hardly shed a tear for those moving to Miami…. Enjoy

Russ Lazaruk, RIAC, CIWM, CIM, FCSI

Managing Director & Portfolio Manager

Tel 250.999.3329.

![]()

www.ncpdfo.com