It was a short week on the markets, as our US cousins celebrate Thanksgiving. With many traders taking an extended break volumes were down and prices (mostly) flat. Inflation continues to moderate along with yields. For now, the trend is our friend.

| Index | Close Nov. 17th 2023 | Close Nov. 23rd 2023 |

| S&P500 | 4,514 | 4,557 |

| TSX60 | 20,176 | 20,117 |

| Canada 10 yr. Bond Yield | 3.68 | 3.71 |

| US 10 yr. Treasury Yield | 4.44% | 4.42% |

| USD/CAD | $1.37180 | $1.36950 |

| Brent Crude | $80.61 | $80.21 |

| Gold | $1,980 | $1,993 |

| Bitcoin | $36,411 | $37,309 |

We’ll lead with Canada and its improving inflation picture. Headline inflation declined to 3.1% in October, well below September’s 3.8% reading. The biggest contributor was a drop in energy prices. Food and housing inflation is decelerating, but not as fast as the headline number. The Bank of Canada puts more emphasis on core inflation and both the “trim” and “median” decreased as well to 3.6%. The other key measure, the 3-month moving average also fell to 2.96% from 3.67%. All this gives the Bank ample reason to pause rate hikes. Even Tiff Macklem agrees.

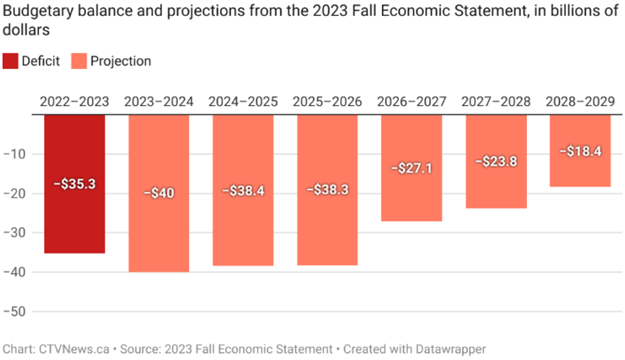

Finance Minister Chrystia Freeland delivered the government’s Fall Fiscal Update this week. The focus of this update was housing, with some new(ish) measures and more money to address housing affordability. There is $15.7 billion in new spending (almost all related to housing) and $2.5 billion in cost savings. Some things to note – short-term-rentals (STRs) such as Air BnB will not be able to deduct their operating expenses if they are in an area that has restricted them – up to $15 billion in low-cost loans to build more rental stock – and a new Canadian Mortgage Charter. While government projections show a decline in the deficit, government debt and the deficit remain stubbornly high. That said, Canada maintains the lowest deficit and net-debt to GDP ratios in the G7. And a AAA credit rating to top it off.

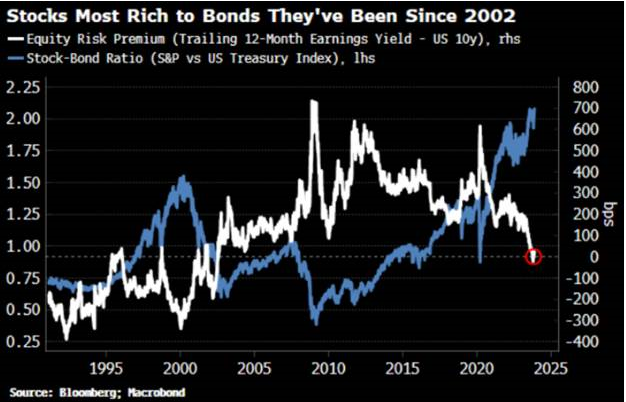

One of the key measures of market valuation is the “Equity Risk Premium”. This the spread between the earnings yield of the market over the yield of the 10 yr. US Treasury Bond. There are, of course, differing opinions on what this spread should be but 4% is a reasonable average. In that case, if the 10-year treasury yield is 4%, the earnings yield (earnings divided by price) should be 8%. This is a bit simplified but will serve our purpose for now. (A more detailed explanation can be found here.) All that makes the chart below a bit worrying as the risk premium is sitting at zero. 2 things can change the picture for the better, a continued drop in interest rates (possible) or a rise in earnings (doubtful in the short-term).

The tech world has been abuzz with the palace intrigue at OpenAI, developers of ChatGPT. Co-founder and CEO Sam Altman was fired by the Board of Directors last week. Since then, he has had (and accepted) an offer by Microsoft to continue his work there, been re-instated by OpenAI as CEO, and given a new Board of Directors to work with. We still don’t know exactly what precipitated this turmoil. It may have something to do with a letter from a research team to the Board citing their fears about a new AI breakthrough.

Shopping for a new car? Don’t want the hassle of visiting your local car dealership? No worries, now you can just go to your Amazon account and order one. This week Amazon and Hyundai announced a new partnership to sell Hyundai cars through Amazon Prime. We knew this was coming eventually.

This week saw the election of 2 populist firebrands to high office. Argentina elected Javier Milei as their new president. Argentina’s economy has been moribund for decades and is currently suffering an inflation rate of 143%. The polices being promoted by the new President include wholesale cuts to government services, eliminating the central bank and the Argentine peso, using the US dollar in their place. The Netherlands surprised the rest of us buy giving the most seats to the anti-Islam / anti-EU Freedom Party under Geert Wilder. The country uses a proportional representation electoral system, and the party will need to build a coalition to form government.

With Argentina in mind, we’ll close off with this from Madonna….. enjoy

Russ Lazaruk, RIAC, CIWM, CIM, FCSI

Managing Director & Portfolio Manager

Tel 250.999.3329.

![]()

www.ncpdfo.com