It was a short but positive week on the markets as our American neighbours took a few days off to celebrate Thanksgiving. Despite threats of tariffs and trade wars, markets took it all in stride with both equities and bonds ending in the green. The Canadian dollar is holding in around the $1.40 ($0.714) mark. Oil is off marginally thanks to a ceasefire in Lebanon.

| Index | Close Nov. 21st 2024 | Close Nov. 28th 2024 |

| S&P500 | 5,948 | 6,015 |

| TSX60 | 25,391 | 25,544 |

| Canada 10 yr. Bond Yield | 3.50% | 3.25% |

| US 10 yr. Treasury Yield | 4.43% | 4.26% |

| USD/CAD | $1.39472 | $1.40120 |

| Brent Crude | $74.31 | $73.09 |

| Gold | $2,670 | $2,638 |

| Bitcoin | $98,252 | $95,172 |

Source: Trading Economics & Factset

GDP growth in the US came in at a healthy 2.8% for the third quarter with 8 of the last 9 quarters of having 2%+ growth. Both consumer spending (up 3.5%) and exports (up 7.5%) contributed to the growth. Business investment fell in housing and non-residential building but rose as spending on equipment surged.

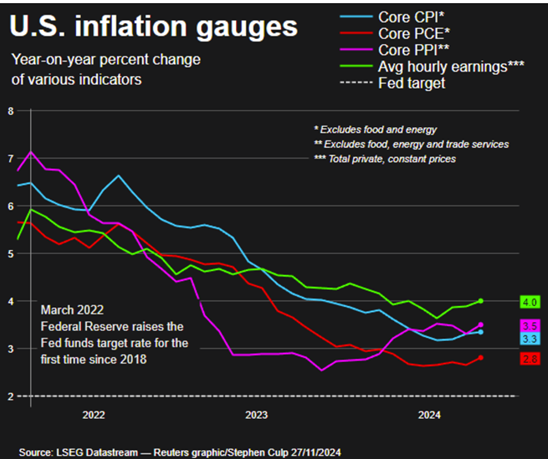

Meanwhile, inflation as measured by the US Fed’s favourite gauge, the PCE price index rose 2.3% in October compared to a year earlier. The core PCE rose 2.8%. Both numbers were slightly above expectations. What is worrisome is that the trend of falling inflation appears to have stalled. (See chart below) Markets are now pricing in a 25-bps rate cut in December, down from earlier expectations of 50-bps. Re-enforcing this view were the minutes from the last Fed (FOMC) meeting where the consensus was for “gradual” reduction in rates.

Doanld Trump’s pick for Treasury Secretary, Scott Bessent, has been met with a collective sigh of relief. Bessent, a Wall Street Financier who once worked for George Soros amongst others, is seen as a capable and steady hand.

In Canada the biggest financial headline has been the threat of 25% tariffs to be imposed by the Trump administration “on day 1”. Markets have been somewhat sanguine about the threat, seeing it as a negotiating tactic. Politicians, especially provincial premiers have been lighting their hair on fire about it. To be fair, the threat is serious and would affect all our exports to our largest market, including energy. The #1 demand is for tighter borders, to stop the flow of illegal immigrants and fentanyl. The empirical evidence shows those to be pretty minor as far as Canada is concerned, but facts don’t seem to count for much these days. And wouldn’t the security of the US’ northern border actually be their problem not ours??

While we are mixing finance and politics, the Federal government is proposing to cut the GST on select holiday items over the next 2 months AND give those earning less than $150,000 a tax rebate of $250. (I think they stole that last idea from Doug Ford in Ontario). So far, the NDP and Bloc want the rebates extended to retirees while the Tories have said they will vote against the measures. The GST proposal has been tabled in the House of Commons while the rebate sits on the backburner.

Independent Canadian mutual fund giant, CI Financial is being sold to U.A.E. sovereign wealth fund Mubadala Capital. CI has been on a major expansion campaign for the past few years, buying and consolidating US based advisory firms (RIAs). While the strategy has vastly increased the assets under management (AUM) for CI it has also greatly increased their debt load. Nonetheless, shareholders are receiving a premium price ($32) for their stock.

Spending too much time on social media? It can be addictive. This week Australia has moved to limit its influence on children and banned its use for those under 16 yrs. old. The ban is aimed at the most prevalent sites including Tik Tok, X (Twitter), Instagram, and Facebook. The onus will be on the companies to police the sites and show they have systems in place. There are serious teeth in the law with potential fines of up to $44 million. I suspect the new law has broad support amongst parents and teachers.

That morning cup of joe is getting more expensive. Coffee prices have reached a 27 year high as supplies dwindle. Poor conditions in Brazil and Vietnam have put a dent in crops for the past few years. Forecasts are for higher prices, though the end of the El Nino weather system could help crops over the next cycle.

We are almost there. December and all it entails is just around the corner, so we will leave you with this piece from Alison Krauss and Natalie MacMaster – just to help get you through the month…. Enjoy

Russ Lazaruk, RIAC, CIWM, CIM, FCSI

Managing Director & Portfolio Manager

![]()