The markets brought relief to investors this week with both equity and bond markets posting strong results. Giving investors optimism has been the hope that central banks have made their last rate hikes. More on that below.

| Index | Close Oct. 27th 2023 | Close Nov 3rd 2023 |

| S&P500 | 4,117 | 4,309 |

| TSX60 | 18,737 | 19,626 |

| Canada 10 yr. Bond Yield | 3.98 | 3.85 |

| US 10 yr. Treasury Yield | 4.85% | 4.66% |

| USD/CAD | $1.38690 | $1.37370 |

| Brent Crude | $89.20 | $86.92 |

| Gold | $2006 | $1,985 |

| Bitcoin | $33,920 | $34,779 |

Central Banks around the world are pausing rate hikes (for now). Last week the Bank of Canada left rates unchanged. This week it was the US Federal Reserve and the Bank of England. In his remarks after the rate announcement, Fed Chair Jay Powell said the Fed was in a wait and see phase. He acknowledged that high interest rates were still slowing the economy and inflation. He did not rule out more rate increases if inflation remained at or above current levels. The Bank of England kept rates unchanged at their current 15 yr. high. BOE Governor Andrew Bailey pointed to still high inflation (over 6%) while also saying the country was teetering on recession. While investors hope that we have seen the last hike(s) of this cycle, they should keep in mind Charlie Brown’s experience as a place-kicker.

Job growth in the US came in below expectations with 113,000 new jobs vs. expectations of 130,000. Wage growth was also less than expected. This report from ADP often differs from the government’s Non-Farm Payrolls report which comes out on Friday. Nevertheless, this is another sign of a cooling economy.

Staying with labour for a bit, the strike that had closed the St. Lawrence Seaway for 8 days has ended. The shutdown is estimated to have cost between $34 & $110 million per day, depending on who you ask. This week also saw the settlement (pending ratification) of the United Auto Workers strikes against the Big 3. It is estimated the rise in wages and benefits will cost each company $1 billion per year. How much of that gets passed on to the consumer remains to be seen.

We’ve mused in past editions of this newsletter about the lack of competition in the Canadian economy. Whether it is banks, phone companies, or grocery stores, we live in a land of oligopolies. Amendments introduced to the Competition Act were tabled in Parliament this fall that may make it harder for dominant players to continue to consolidate their sectors. Bill C-56 will eliminate some of the companies’ defenses in consummating their deals. This new-found enthusiasm for competition has infected the House of Commons Finance Committee which has recommended the government reject the proposed HSBC / RBC merger.

WeWork, the flexible workspace provider, is expected to file for bankruptcy next week. The company was lauded for its “cool” workspaces that came complete with lounges and beer while at the same time raising serious questions about its governance and finances. The pandemic didn’t help but the company was built on sand, and it is surprising to many that it took this long to fail.

Last spring the Federal Government established the “First Home Savings Account” (FHSA). Most institutions, including our custodians, are now able to offer these to clients. The accounts allow you to contribute up to $8,000 per year to a maximum of $40,000 cumulative. The contributions are tax deductible when made and withdrawals are tax-free when used to purchase a house. If you or your children / grandchildren are going to be buying a first home, then funneling the downpayment into an FHSA makes sense. The account needs to be in the name of the potential buyer who will also get the tax benefit. If you would like to discuss, give us call.

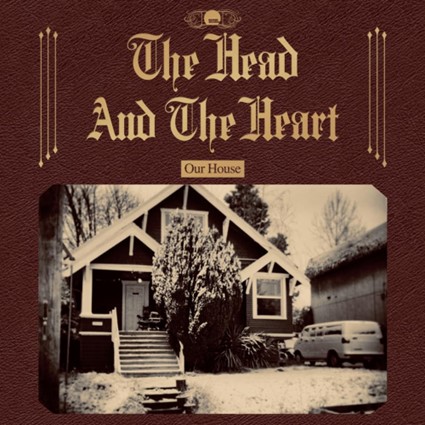

And since we’re talking about houses, we’ll close with this classic from Crosby, Stills, Nash, & Young… enjoy.

Russ Lazaruk, RIAC, CIWM, CIM, FCSI

Managing Director & Portfolio Manager

Tel 250.999.3329.

![]()

www.ncpdfo.com