It was a mildly positive week on the markets with both equities and bonds advancing. The big news was Bitcoin breaking the USD $100,000 mark. Belief that the incoming Trump administration will be crypto-friendly along with the growing availability of Bitcoin ETFs in the US have combined to push the asset class higher. Personally, I find the steady fall in bond yields after the initial post-election panic to be of more consequence.

| Index | Close Nov. 28th 2024 | Close Dec. 5th 2024 |

| S&P500 | 6,015 | 6,074 |

| TSX60 | 25,544 | 25,680 |

| Canada 10 yr. Bond Yield | 3.25% | 3.10% |

| US 10 yr. Treasury Yield | 4.26% | 4.18% |

| USD/CAD | $1.40120 | $1.40235 |

| Brent Crude | $73.09 | $72.18 |

| Gold | $2,638 | $2,632 |

| Bitcoin | $95,172 | $99,215 |

Source: Trading Economics & Factset

The labour market in the US is stabilizing according to the latest Job Openings and Labour Turnover Survey (JOLTS) . October saw job openings rebound from to 7.7 million from 7.4 million in September. While the figure is down from 8.7 million a year ago, it does point to a healthy balance in the labour market. There are now 1.1 jobs available for each unemployed worker. Pre-pandemic there were fewer jobs than workers. The pandemic dramatically reversed the situation with a huge labour shortage.

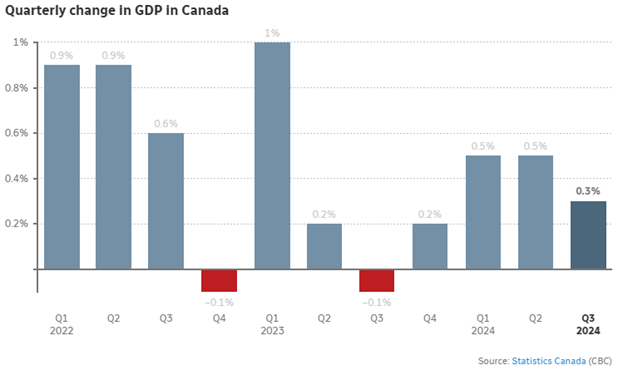

Canada’s GDP grew at an anemic 1% (annualized) in the third quarter. Most of the growth came from household and government spending. The rate was in line with economists’ expectation but below the Bank of Canada’s projection of 1.5%. Lower business investment, specifically spending on machinery, helped drag the number lower. I continue to make the argument that our chronically low productivity and GDP growth per capita is as much a problem of under investment by the private sector as it is government policy. (Though one can influence the other by varying degrees)

Elon Musk is in the news again still. This time a Delaware court has ruled that a massive $56 billion pay package from Tesla must be rescinded. Musk’s reaction was what you would expect with vitriol directed at the presiding judge. In all seriousness, Tesla is a publicly traded company with hundreds of thousands of shareholders. The pay package defies any sense of good governance.

The trade wars are heating up. This week China has banned the export of several critical minerals to the US. Included in the list are gallium & germanium (used in semi-conductors), antimony (used in bullets), and graphite (batteries). China has become a bi-partisan target of the US with other countries now joining the fray. With a 60% tariff being touted by the incoming administration, expect things to get a bit heated over the next 4 years.

Canada, so far, is trying to play nice in the sandbox. PM Trudeau travelled to Mar-a-Lago to break bread with Donald Trump over the US Thanksgiving Weekend. While the meetings were described as productive by both sides, there were no definitive results. Canada has said it will increase border security with the addition of personnel, helicopters, and drones. First steps in managing what will be a tumultuous 4 years. Oh, and DJT joked that everything could be solved if we became the 51st state…… I’ll leave that one there.

France’s government just collapsed on a parliamentary vote of non-confidence in Prime Minister Michel Barnier. While the PM is picked by the President (Emmanuel Macron) they can be ousted by non-confidence votes. Despite calls for his resignation by far-right politician Marie Le Pen, Macron is staying on. Le Pen is facing her own travails, with a court date coming up on charges of corruption that could have a 5-year jail sentence.

Not wanting to be left behind, the President of South Korea declared martial law only to rescind it a few hours later after a unanimous vote in the country’s parliament. The move took everyone by surprise. The President is now facing impeachment proceedings. South Korea has been a young but functioning democracy since 1979.

We’ve touched on this topic a few times over the past year. The market share of new electric vehicles in China has surpassed 50% for the past 4 months. So far sales have been supported with government subsidies (not unlike the west) and company discounts. There is range anxiety as well, but the infrastructure is being built to support the switch. Now if they could only retire the coal fired power plants.

We’ll close off a song that has some advice for those entering negotiations with the incoming Trump Administrations….. enjoy!

Russ Lazaruk, RIAC, CIWM, CIM, FCSI

Managing Director & Portfolio Manager

![]()