Market volatility is starting to ramp up as we approach the US elections. In the long term, elections don’t matter that much to the financial markets, but they do raise angst levels in the short term. More on that below. Equity markets sold off a bit this week and bond yields were up (prices down). Meanwhile gold hit a new all time high before pulling back.

| Index | Close Oct. 17th 2024 | Close Oct. 24th 2024 |

| S&P500 | 5,851 | 5,814 |

| TSX60 | 24,690 | 24,552 |

| Canada 10 yr. Bond Yield | 3.18% | 3.27% |

| US 10 yr. Treasury Yield | 4.10% | 4.22% |

| USD/CAD | $1.37993 | $1.38534 |

| Brent Crude | $74.58 | $74.56 |

| Gold | $2,693 | $2,736 |

| Bitcoin | $67,370 | $68,444 |

Source: Trading Economics & Factset

We’ll start with the Bank of Canada today and its decision to cut the overnight rate by 50bps this week. After the latest inflation numbers, the cut was widely expected. Economists are now starting to call for another 50-bps cut in December. Private sector economists are more bearish on GDP growth than the Bank.

Running counter to Canada, and partly responsible for the recent market volatility, are muted expectations for rate cuts in the US. The US economy continues to outperform most around the globe and inflation is still above the Federal Reserve’s 2% target. The labour market is still strong, but any weakening may force the Fed to cut rates more aggressively.

The inter-play between interest rates in Canada and the US is not doing the Canadian dollar any favours. Considerations around the strength of the Loonie vs. the Greenback will have an impact on rate decision by the Bank of Canada.

Canada added 47,000 new jobs in September and brought the unemployment rate down to 6.5%. There is a lot of noise in that number including a reduction in hours worked (0.4%), a decrease in the participation rate, and a growth in the country’s population.

Canada’s rapid population growth has had a lot of unintended consequences from housing to disruptions in the labour market. This week the Federal Government reversed some of their polices and have reduced targets for permanent residents from 500,00 per year to 395,000 in 2025, 380,000 in 2026, and 365,000 in 2027. There will also be a reduction in temporary residents and the already announced reductions in international students. But make no mistake, with a birth rate of 1.26 per woman , Canada still needs robust immigration just to maintain our population levels. Somebody needs to be here to support us in our dotage.

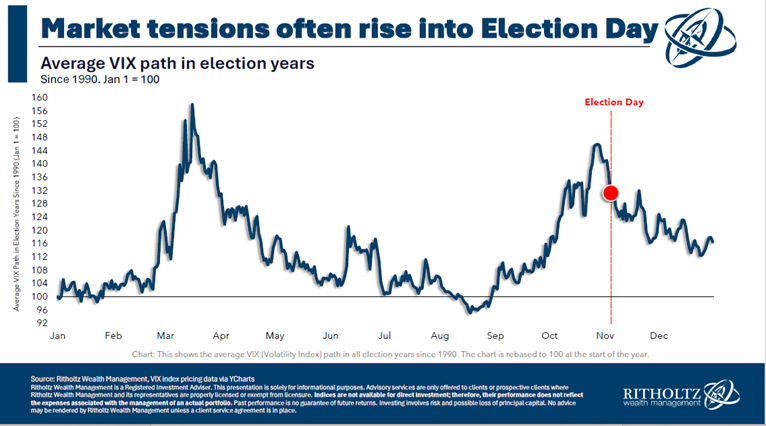

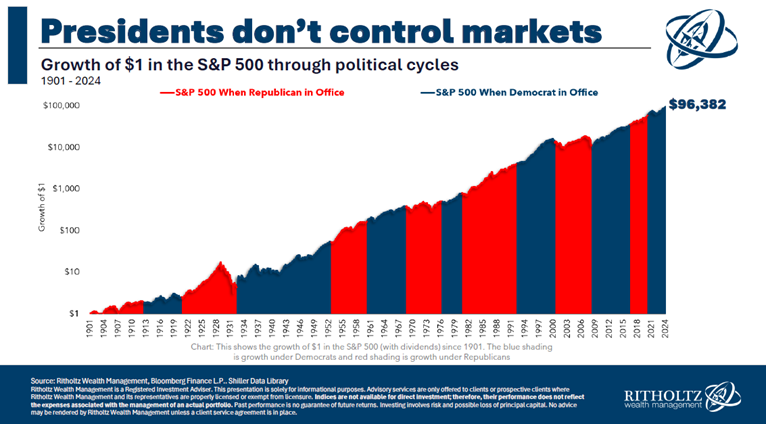

Do elections matter? For public policy, security, the health of democracy, and a myriad of reasons they absolutely do. For the markets though…. Not so much. US advisory firm Ritholtz Wealth Management recently published a look back at the markets (S&P500) and their reaction to various US Presidents. There is a rise in volatility leading up to the election, but the longer-term effect is negligible as the next two charts show. The lesson here is don’t take financial advice from car salesmen (that’s you Elon), political pundits, or social media.

One issue that has not been addressed in any recent election is the amount of debt that governments are piling up. According to the IMF, global public debt is probably worse than it looks. It currently stands at $100 trillion or 93% of global GDP and governments of every political stipe continue to pile on more. The solutions are simple, but not easy to implement. Do you want higher taxes or fewer government services? (In reality, it is not a binary choice). Now if only a brave politician would speak truth to the electorate.

Labour productivity is an issue here and in most economies. Here is one idea to help, fewer meetings. In a recent blog from software company Fellow, they pointed out that US workers spend at least 20% of their time in meetings. The higher up you are in the corporate hierarchy the more time you spend in meetings. It’s not just the quality of meetings that matters but the quality and purpose as well. Interestingly, the larger the organization, the more time spent in meetings.

We’ll close off here with this from Tennessee Ernie Ford, that reminds us to take fewer meetings and enjoy the day…..

Russ Lazaruk, RIAC, CIWM, CIM, FCSI

Managing Director & Portfolio Manager

![]()