It was a mixed week on the markets. The S&P500 declined while the TSX was up. In the US, it was the tech sector that led to the downside. We are coming into earnings season, so investors may be taking profits in advance of any potential earnings disappointments. Bond yields also rose, and investors are paring back their expectations of how much the Fed will cut rates. The change in outlook also had a negative effect on the Canadian dollar.

| Index | Close Sept 18th 2025 | Close Sept 25th 2025 |

| S&P500 | 6,643 | 6,615 |

| TSX60 | 29,454 | 29,734 |

| Canada 10 yr. Bond Yield | 3.19% | 3.24% |

| US 10 yr. Treasury Yield | 4.11% | 4.18% |

| USD/CAD | $1.37963 | $1.39231 |

| Brent Crude | $67.53 | $69.56 |

| Gold | $3,644 | $3,751 |

| Bitcoin | $117,675 | $109,096 |

Source: Trading Economics & Factset

The US economy (GDP) grew by 3.8% in the 2nd quarter of this year. The growth was powered by the consumer, who is proving to be very resilient. The number is also not quite as strong as it seems. GDP fell in the 1st quarter as companies rushed to import goods ahead of tariffs. Imports have a negative effect on GDP. The sale of those goods to the end consumer in Q2 added to GDP. So, a lot of noise. Bottom line, the US consumer is proving to be resilient, and the strength may moderate the Federal Reserve’s propensity to cut rates further.

Gold hit another all-time high of $3,764 this week before falling back. The precious metal has regained some of its status as a storehouse of value. Demand has been driven by central bank buying, investor purchases through exchange traded funds (ETFs), and increased industrial use by the tech sector.

Bank of Canada Governor Tiff Macklem gave a wide-ranging speech to in Saskatoon this week. In it he covered the fundamentally changed trading environment of the global economy, what Canada needs to do to adapt, and the risks facing the US dollar. For Canada it means lowering internal trade barriers, building the infrastructure to create more global export capacity, and diversifying our export markets. He went on to warn about the US Federal Reserve losing its independence and the effects that could have on the US dollar’s status as a reserve currency. In our view, there is currently no viable alternative to the USD. But that can or will change over time.

The World Intellectual Property Organization (WIPO) released its Global Innovation Index for 2025. The country ranking was interesting with the top 2 spots going to Switzerland and Sweden. The US came in at # 3 and Canada #17 out of 139 countries. The study also looked at the top 100 technology clusters with 3 Canadian cities in the list. Toronto at #33, Montreal at #62, and Vancouver at #66. I would add innovation, R&D, and venture capital funding to Tiff Macklem’s remedies for Canada.

This next story is tangentially connected to the last. The US has decided to put a $100,000 fee on the H1-B visas that have been a source of talent for much of Silicon Valley. The giants can probably (if reluctantly) absorb the fee, the start-up and mid-tier firms will struggle. That leaves an opening for Canada (and others) to attract the talent here to build out our own innovation sector. It won’t be straight forward as we are currently reducing our immigration levels with curtailments to the Temporary Foreign Worker Program and international student visas.

Sticking with the tech theme, France’s Mistral AI is setting up shop in Montreal. The company builds custom AI models for companies and sectors. Think of it as bespoke AI. The firm is hiring now, and its sales efforts will target financial services, energy, and the industrial sector. Montreal is a hub for AI and quantum computing with Meta, Microsoft, and Google already there.

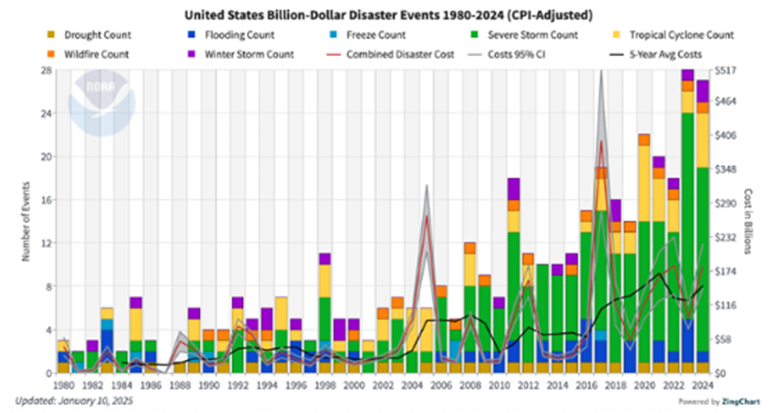

Here is some not so good news. Your cost of your house insurance is not going down. Insurance is shared risk, so losses in one area mean that everyone’s rates will go up. The chart below shows the rise in disaster events from 1980 to 2024.

Source NOAA

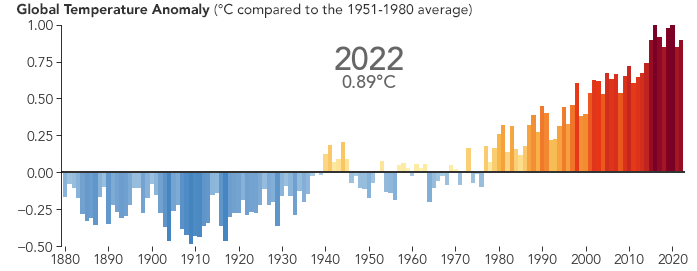

Despite Donald Trump’s utterances at the UN this week, the correlation between this chart and the next one are too close to dismiss.

Source NASA

I am told that having an MRI can be an intimidating experience. You are told to lie still and then put into a small, noisy tunnel. Now imagine you are a child and had to do this. (You thought bath time was a drama). Last month Camosun College delivered an MRI simulator to Victoria General Hospital’s pediatric clinic. It will give kids a chance to get used to the procedure in a safe, controlled, and supportive setting before having to have the actual procedure. Not only does it reduce stress for patients and parents, but it will also save the hospital time and money. Currently children under 8 need to be sedated, which has its own litany of risks and attendant costs. The simulator was built as part of the engineering student’s capstone project. Another example of Camosun’s leadership in applied learning AND applied innovation.

I will be working remotely for the next month. Thanks to the marvels of modern technology and a time difference that works in my favour, I will be able to enjoy the days away and put in a full shift. With that, I’ll leave you with a medley of French Medieval hits….. enjoy

Russ Lazaruk, RIAC, CIWM, CIM, FCSI

Managing Director & Portfolio Manager

![]()